Chicago Board of Trade Market News

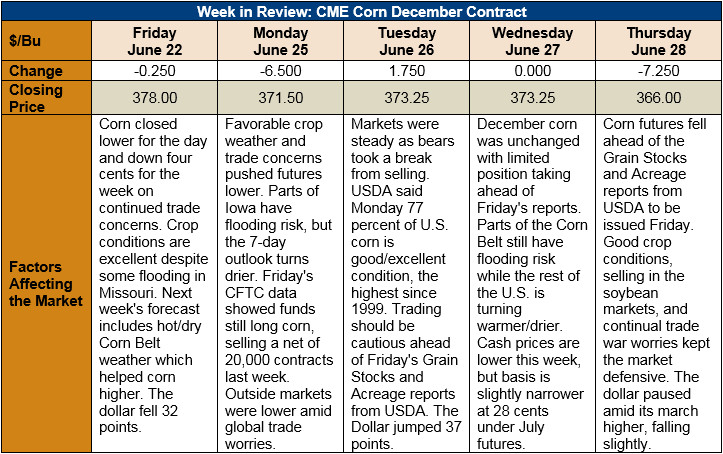

Outlook: The corn market remains on the defensive amid selling pressure from soybeans, excellent crop conditions and global trade tensions. December corn futures are down 3 percent (12 ¼ cents) this week amid broader pressure from agricultural markets.

Tomorrow (Friday, 29 June) holds two potentially market-moving reports: USDA’s Grain Stocks and Acreage statistics. Most traders expect modest increases in corn area, with an extra 200,000 acres being allocated to the feed grain for a total of 88.372 million. Similarly, traders expect June 1 corn stocks to be near 133.81 MMT (5.268 billion bushels). With aggressive corn exports this spring and higher ethanol production, the stocks figure could surprise the market by being beneath expectations.

The U.S. crop continues to be one of the best in history, with 77 percent of the crop rated good/excellent condition, above the five-year average of 70 percent and the highest rating since 1999. Some parts of northern Iowa and parts of Missouri are experiencing flooding, but most of the crop is in near perfect condition. Unless drought develops in the next few weeks (not currently forecast by the National Weather Service), the crop will enter and exit the pollination period in excellent condition and with good weather. The probability of above-trendline yields is growing.

Corn exports reached 1.479 MMT last week with an additional 849,000 MT in old-crop sales. For the 2017/18 marketing year, U.S. corn export bookings (exports plus unshipped sales) are up 3 percent YTD while YTD exports are down 6 percent. After revisions to the 2017/18 export forecast in the June WASDE, USDA now anticipates current marketing year exports to nearly equal those in 2016/17 at 58.423 MMT (2,300 million bushels).

From a technical perspective, December corn is trying to find support amid a medium-term downtrend. The 10-day moving average has proven significant resistance this week while the 19 June low ($3.60/bushel) remains major support for the contract. Noncommercial traders are still net long corn futures (having sold roughly 20,000 contracts last week), either hoping or bracing for some summer weather scare. Choppy trading should be expected until bullish fundamentals are uncovered, or the market deepens its bearish lean by closing below major support.