Ocean Freight Markets and Spreads

Ocean Freight Comments

The confidence of the Panama Canal Authority is rising with the water levels of Gatun Lake. Now that the seasonal rains have arrived and look promising, the ACP increased the Neopanamax draft to 47 feet effective immediately. The draft will deepen to 48 feet on July 11. Daily vessel transits will increase to 35 after August 4. Under normal operating conditions daily transits total 36 to 38. Vessel drafts and the usually daily transits will be fully restored ahead of the U.S. grain export season that starts in October.

The Houthis terrorist organization continues to attack vessels transiting the Red Sea and around the Arabian Peninsula. They are ratcheting up the rhetoric claiming to have struck a vessel at berth at the Haifa Port in Israel. The attack has not been confirmed. Regardless, rhetoric becomes fear and further exacerbates ship owner and operators to consider sailing certain trade lanes or service various ports. The damage is appearing in container freight rates that have been rapidly rising on routes out of Asia to Europe and the Middle East and to the United States. However, container freight rates out of the United States to Asia remain flat or slightly lower.

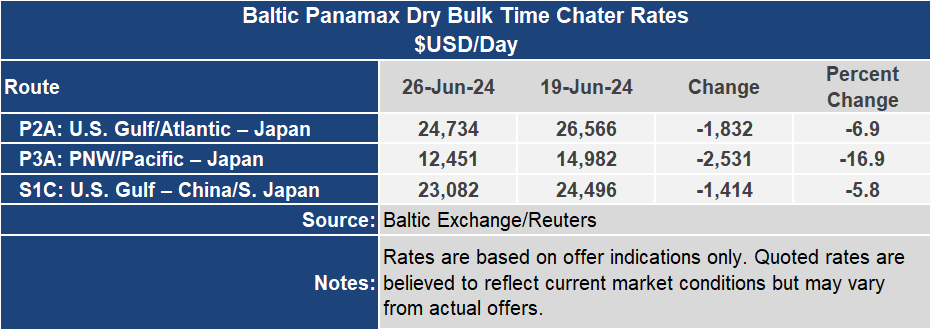

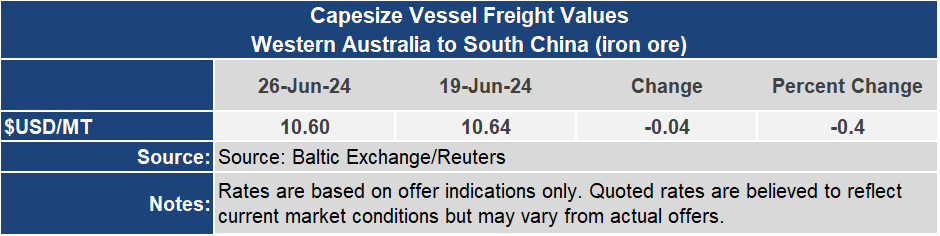

The yo-yo effect of dry bulk ocean freight rates up one week, down the next continues. This week they are mixed with the Capesize up 7% to an index of 3,145 while the Panamax index is down 12% to 1,683. The dry bulk sector is looking for its groove. The Baltic Dry Index ended the week 1% higher to 1,964. One year ago, the BDI and BCI were 73% higher, the BPI 59% higher and the Baltic Supramax Index was 88% higher.

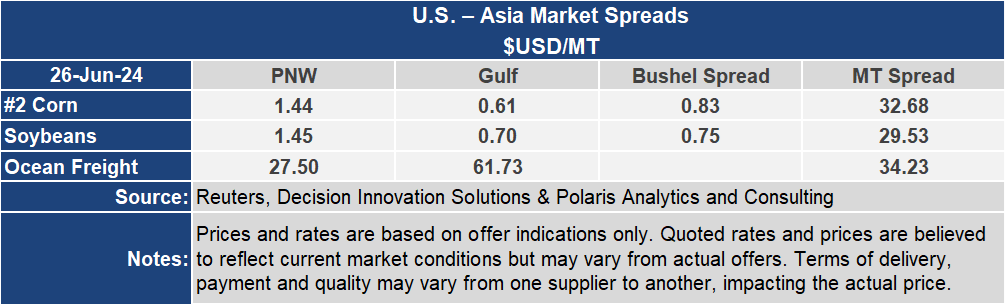

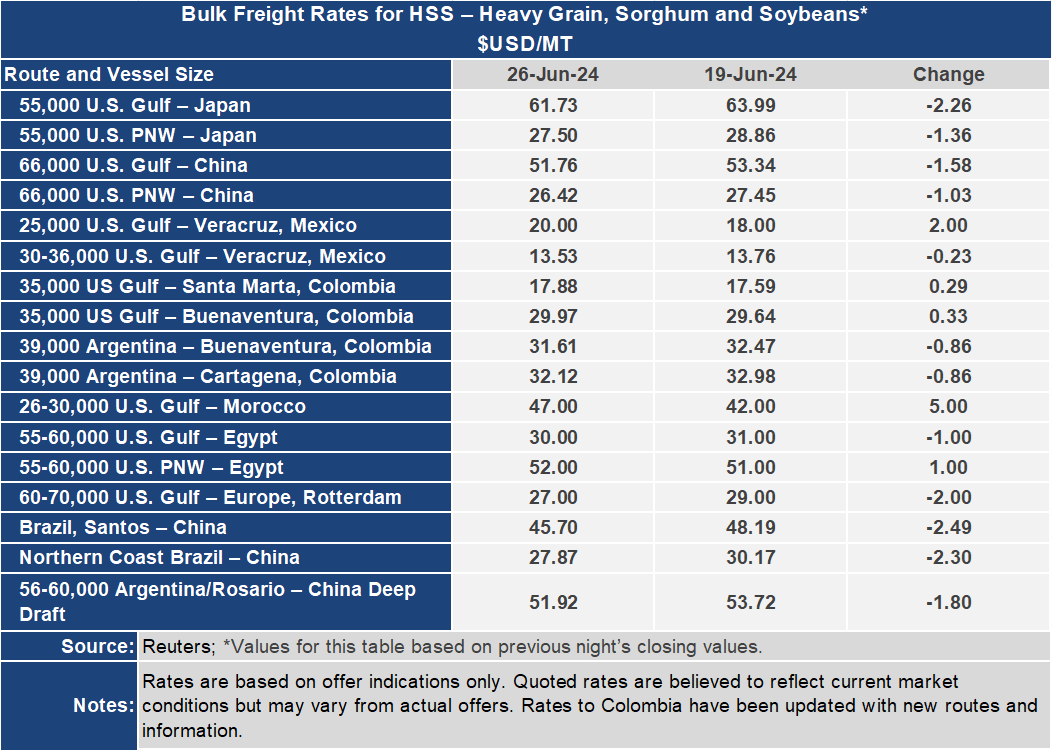

Grain freight rates to Japan from the U.S. Center Gulf ended the week down $2.26 per metric ton to $61.73 per metric ton. The rate out of the Pacific Northwest to Japan was down $1.36 per metric ton to $27.50. The spread between these routes narrowed $0.90 per metric ton to $34.23 for the week.