Chicago Board of Trade Market News

Outlook

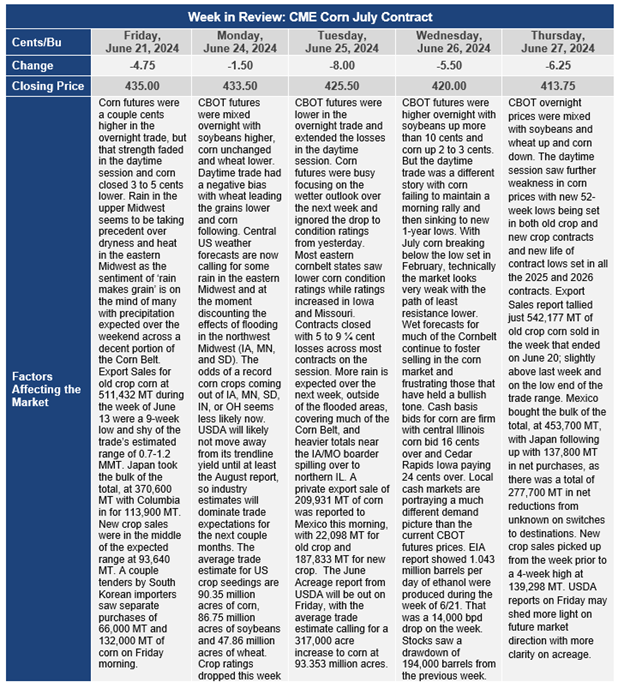

Considerable choppiness in the corn market this week but with a definite downward bias. From last Thursday to this Thursday, July corn futures dropped 26 cents per bushel (a 5.9% price decline); in one month July futures have dropped 56 cents per bushel (a 11.9% price decline); July futures declined 86 cents per bushel in the past 6 months (a 17.2% price decline); and July futures have declined $1.72 per bushel since the peak in July 2023 (a 29.4% price decline). The corn futures market appears to be fully embracing the notion that “rain makes grain” and that recent precipitation in the Cornbelt has been more than sufficient to take any weather risk premium out of the market.

This downward push in corn futures prices is at odds with rising U.S. cash corn basis bids. Central Illinois cash corn bids are now 16 cents over the July futures and Cedar Rapids, Iowa cash corn bids are 24 cents over the futures market and cash corn bids in Northwest Iowa are up to 28 cents over the July contract. To keep corn supplies flowing to end users like feed mills and ethanol plants that need corn every day of the year, cash basis bids are having to counteract the downward movement of the futures market.

Looking forward, with the USDA grain stocks report and planted acreage reports set to be released on June 28th, strengthening interior, Midwest cash basis bids, oversold technical conditions, and erratic world weather conditions, one wonders when the market bears may bank profits and buyers of corn emerge to lock in corn that is “on sale” compared to prices of the past several years.

“Rain makes grain” but there likely has been a loss of 2 to 3 percent of the Iowa corn crop due to field flooding, probably 3 to 5 percent of the Minnesota corn crop, and likely 5 to 7 percent of the South Dakota corn crop. Down-stream river levels (Missouri River and several interior rivers in Iowa, Minnesota, and South Dakota) are rising and at several places on these rivers, new record high flood levels are being reached. It is quite likely that about 1 million acres of corn is under water in these three states and at 190 bushels per acre would represent a loss of 201 million bushels of potential supply. Keep in mind that the planted acreage numbers released later this week will not adjust for this event and, in fact, it is likely that harvested acreage estimates for corn will not be officially revised until at least the September crop report.

In other areas of the world, the Black Sea drought is forecast to worsen over the next 10 days amid warm and dry weather trends. A few showers did help crops in that area in mid-June but the heat and dryness has returned. Like the central U.S., corn pollination for Ukraine and Russia corn crops starts in early July and extends into late July. Faltering Black Sea corn production, if it occurs, would be happening on the back of Argentina’s lost corn production due to corn stunt disease and while Brazil’s corn production is down at least 20 MMT from last year. All the foreign corn losses make the U.S. 2024 harvest even more important.

Trade expectations for the June U.S. planted acreage report are for 90.353 million acres of corn, up from the March estimate of 90.036 million acres, but down 4.288 million acres from 2023 plantings. Soybean planted acres are expected to be 86.753 million acres, up 0.243 million acres from the March estimate and up 3.153 million acres from 2023 plantings.

Expectations for grain stocks as of June 1, 2024 are 4.873 billion bushels for corn, up 770 million bushels from a year ago. Soybean stocks are expected to be 0.962 billion bushels, up 166 million bushels from a year ago.