Chicago Board of Trade Market News

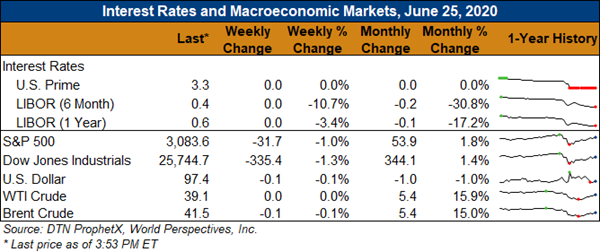

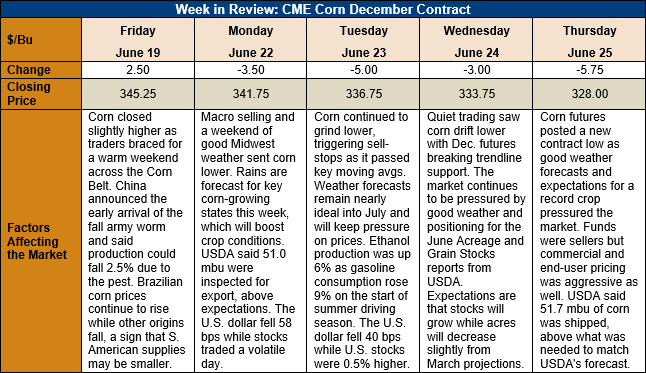

Outlook: December corn futures are 17 ¼ cents (5.0 percent) lower this week as Thursday’s trade saw heavy selling that forged a new contract low. Favorable weather forecasts through mid-July and rising expectations for a potential record corn crop this fall were the fundamental triggers for the day’s selling. A poor technical close on Wednesday afternoon also contributed to long liquidation.

The U.S. corn crop is nearing its seasonal peak pollination period in early to mid-July. USDA reported that 2 percent of the crop was silking as of June 21, in-line with the average development pace. U.S. crop conditions improved last week, with 72 percent of corn in good/excellent condition – up 1 percent from the prior week. Current weather forecasts through mid-July offer above-average heat for the Plains, Corn Belt, and Upper Midwest, but precipitation should be average or better for all but the western Plains. As long as rains come as currently forecast, the heat will likely have minimal impact on corn pollination.

The weekly Export Sales report featured net corn sales of 461,700 MT and exports of 1.313 MMT. Both figures were up from the prior week but below market expectations. The recent shipments put YTD exports at 32.442 MMT (down 24 percent) while YTD bookings (exports plus unshipped sales) stand at 41.952 MMT (down 14 percent). The report also featured 110,000 MT of sorghum exports. YTD sorghum exports are up 157 percent as international demand has remained exceptionally strong.

From a technical standpoint, December corn futures have broken trendline resistance and forged a new contract low, which tend to indicate further price weakness ahead. This year, however, funds are already holding a massive short position heading into July when any hot/dry weather forecast can spark a CBOT rally. That calls into question how much additional downside is actually present in the market. Additionally, farmers have been slow sellers of old crop stocks, leading to a firmer-than-average basis. Firmer basis/cash prices will likely offer support to the futures market. Finally, commercial pricing activity and international demand have been active on price breaks, and buyers are likely to be aggressive with futures at contract lows.