Ocean Freight Markets and Spreads

Ocean Freight Comments

The m/v Tutor that was attacked by the Houthis terrorist group in the Red Sea last week sunk this week. One crew member died following the attack. War risk premiums are rising, reportedly about 0.7% of the value of a ship, up most recently from around 1% earlier this year. Ship values have been increasing so these war risk premiums are compounding and become more expensive. Attacks on vessels have totaled 10 for June compared to five during May. Seafarers are opting to avoid working for vessel owners and operators using the Red Sea out of fear for their safety and lives. Those owners and operators still using the Red Sea may avoid the higher costs of sailing greater distances to avoid the conflict zone but pay higher war risk premiums and higher crew costs, if they can find enough crew members.

The United States Navy claims to have destroyed one ground control station and one command and control node in a Houthi-controlled area of Yemen. Despite these efforts by the unified command to protect merchant trade, the Houthis continue to find ways to attack. This conflict is far from over and many vessel owners and operators are planning on avoiding the Arabian Peninsula indefinitely. The negative impact is higher operating costs using more fuel, longer voyages, and tightened vessel capacity, which lead to higher freight rates and disrupted supply chains.

The Panama Canal is getting closer to being fully operational following last year’s El Nino drought induced impact on available water supplied for the canal. With the rainy season underway, the water level in Gatun Lake is improving. The draft through the Neopanamax locks will increase to 46 feet from 45 feet this month to 48 feet in August. Daily vessel transits will increase to 34 from 32 in July. Under normal operating conditions daily transits total 36 to 38. Based on the forthcoming changes and rain expectations, the usual draft and number of daily transits will be available ahead of the U.S. grain export season that starts in October.

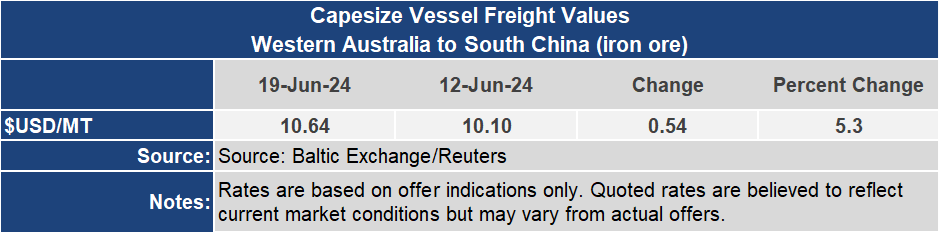

Dry bulk Baltic freight rates made positive ground for the week ending June 19, but lost steam as the week wore on. The Baltic indices for all dry bulk vessel sizes improved this past week, moving the Baltic Dry Index 5.8% higher to 1,943. BDI is a measure of all dry bulk vessel sectors and is greatly influenced by the Capesize sector.

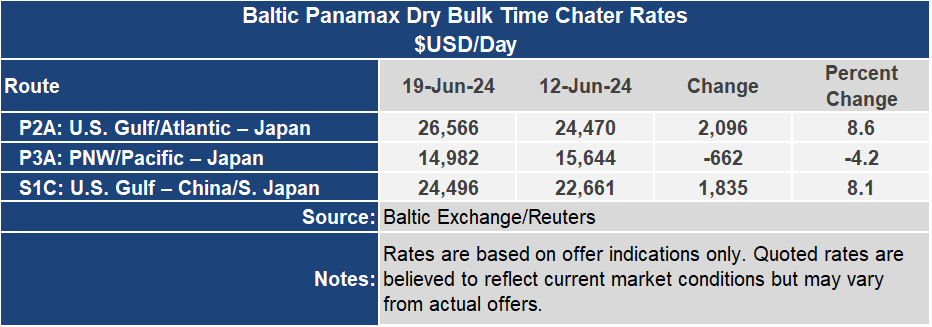

The Baltic Capesize Index jumped 1,197 points or 7.4% for the week to 2,927. The Baltic Panamax Index ended the week 3% higher at 1,919 while the Baltic Supramax Index gained 5.9% to 1,374. However, despite the gains of this past week, the BDI peaked at 1,961 on June 18 and was dragged lower by the Capesize and Panamax sectors. The Supramax and Handysize sectors kept a firm tone all week. The dry bulk sector is not finding a sustained direction higher or lower, rather maintaining a sideways trading range on weakened demand and a comfortable amount of available capacity.

China may be using less coal now that its hydroelectric power system has more water available to generate electricity, offsetting the need for coal. If coal usage slows or is unchanged imports will weaken. With weakened coal imports by China vessel capacity utilization eases and should lead to flat to lower freight rates in the dry bulk sector.

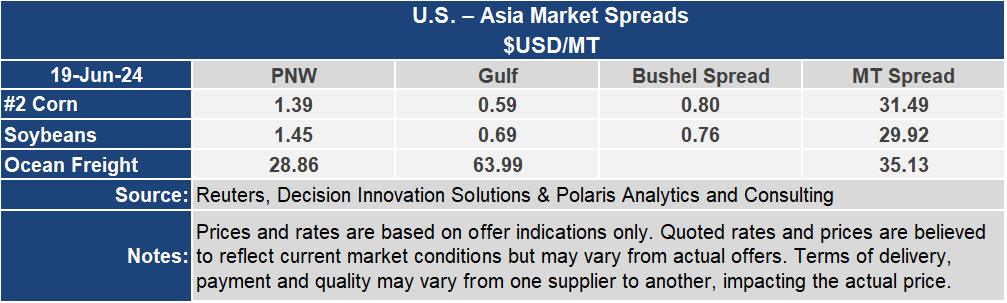

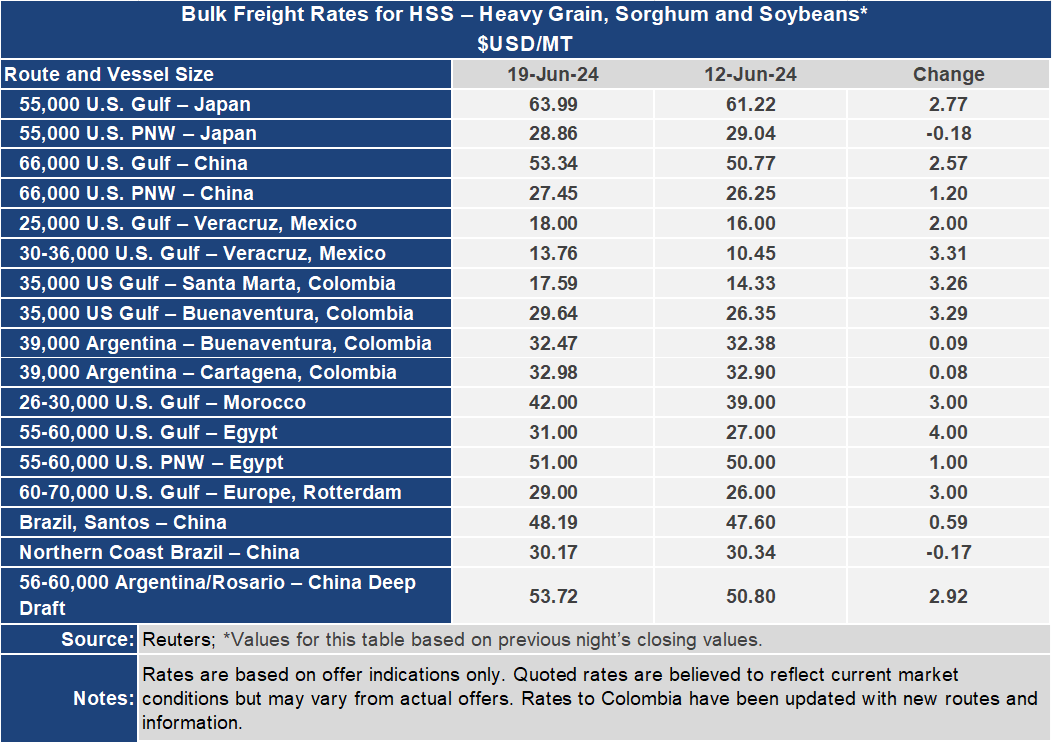

Grain freight rates to Japan from the U.S. Center Gulf ended the week at $63.99 per metric ton, up $2.77 per metric ton for the week and its highest level in more than one month. From the Pacific Northwest to Japan the rate was slightly lower at $28.86 per metric ton or $0.18 per metric lower. The spread between these routes widened nearly $3 per metric ton or 9.2% to $35.13 for the week.

Container freight rates are surging from the Far East to the U.S. West Coast, up nearly 200% since January 1 to an index of 6,740 for a forty-foot container this week. The record high for this index was 8,900 in March 2022. Rates are rising on tightened vessel capacity utilization related to the Red Sea diversions, slower speeds, congestion mounting in Asia and higher demand.

For U.S. exporters, container freight rates from the United States to the Far East are flat to lower. From the East Coast the rate index has been relatively flat for about one year, hovering around 475 for a forty-foot container. From the West Coast the rate index is off a recent peak of 787 in early May and ended the week at 690 for a forty-foot container.