Chicago Board of Trade Market News

Outlook

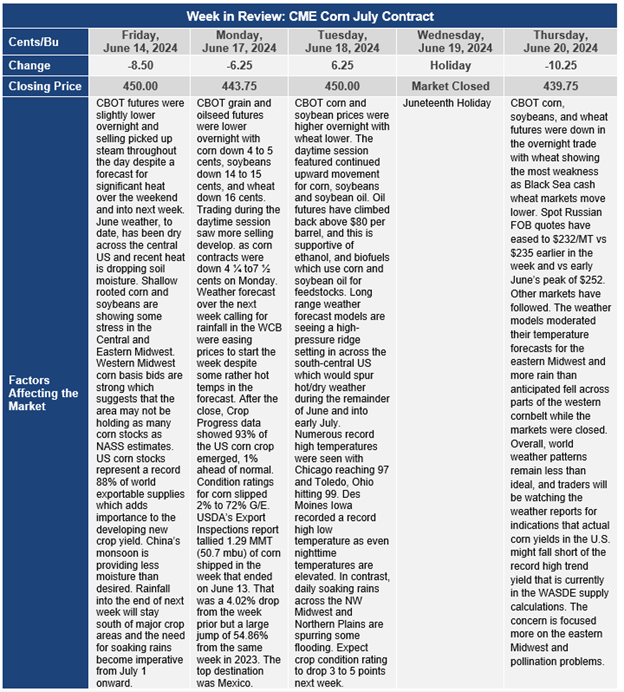

Significant choppiness in the corn market this week with prices dropping sharply early in the week, then rebounding prior to the Juneteeth holiday in the U.S., but then moving lower again once trading resumed after the short holiday break. Weakness in Russian FOB wheat prices is weighing on wheat and grain markets around the world. From their peak in early June, Russian FOB wheat prices have dropped $20/MT (54.4 cents per bushel). During that same time, Chicago July wheat futures have dropped from a high of $7.20 to a recent low of $5.65 per bushel, a drop of $1.55 per bushel. The movement in corn prices has been more muted. Chicago July corn peaked at $4.71 when wheat peaked at $7.20 and the recent low for corn has been $4.38, just 33 cents off of the peak. New crop, December corn futures have had a move similar to July corn, with a high on May 28th of $4.93 and a recent low of $4.58, a 35-cent range.

To date, the market has digested two major supply shocks since early March (drought and frost on the Russian wheat crop, and reduced production out of the primary growing areas of Brazil) and after short-lived rallies the wheat market is back to within 30 cents of where it was in March and corn futures are within 10 cents of March prices. So, is demand slipping and mostly offsetting the supply shocks?

For coarse grains, world production is projected to be 8.8 MMT greater in 2024/25 than it was in 2023/24 and trade in coarse grains is expected to be 8.7 MMT less than 2023/24. For wheat, world production is now expected to be 3.2 MMT greater than 2023/24 but world trade is expected to be down 6.2 MMT from 2023/24 levels. For oilseeds, despite the production problems in South America, oilseed production is expected to be 29 MMT greater in 2024/25 than in 2023/24 and trade only 7.5 MMT greater. The potential build-up in ending stocks is overwhelming the near-term uncertainties that have accompanied the supply shocks.

If one considers just the conditions outside the U.S. coarse grain production is projected to be 20 MMT greater in 2024/25 than in 2023/24 with trade down 10.2 MMT. Wheat production outside the U.S. is projected to be up 1.5 MMT this year and trade down 8.3 MMT. Oilseed production outside the U.S. is still projected to be up 30 MMT despite production problems, and trade only up 7.5 MMT. The net result is that relative to supply changes, trade demand is slipping and is being reflected in the current weakness in prices.

Potential weather shocks are still a very viable reality for U.S. corn and soybean production this year. A flash drought appears to be developing in the eastern Midwest (Illinois, Indiana and Ohio) and in parts of the Middle-Atlantic area and, southeastern U.S. The timing of this flash drought is just ahead of prime pollination time. The amount of precipitation received during the first two weeks of July will have significant impacts on the yield potential of this year’s U.S. corn crop. Drought indications had almost disappeared from the cornbelt during May and into early June, but now abnormal dryness is emerging on the drought monitor map in parts of Iowa, Illinois, Indiana, Ohio, and along the Mid-Atlantic states of Delaware, Maryland, Virginia, and the Carolinas.