Ocean Freight Comments

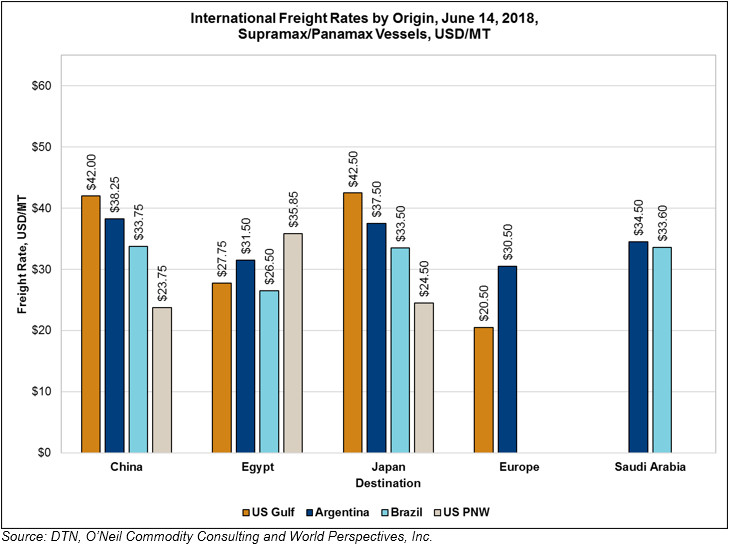

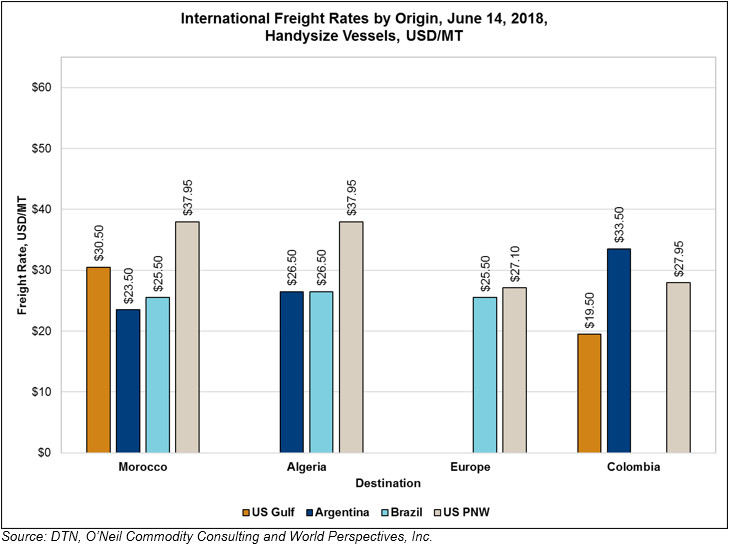

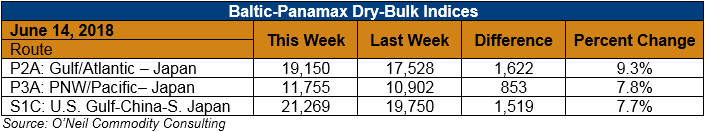

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It has been a bumpy ride – or in the seaman’s terms moderately rough seas – in dry-bulk freight markets over the past six months. Physical rates have moved up and down in a two dollar per-ton range but always circled back to about where the year started off. Overall 2018 dry-bulk rates have been fairly steady while trading in a narrow range but have not improved much over Q4 of 2017.

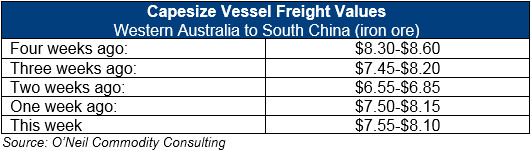

Market sentiment remains bullish (or at least hopeful) but it has been difficult to carve out any meaningful improvements in vessel rates or profitability. The increase in bunker fuel costs has cut into operating profitability. This week the paper traders pushed markets up again, so we are now into a two-week uptick in values. The Capesize vessel market has not followed the Panamax market higher so we will have to see if this week’s rally can be sustained. The S&D picture remains unchanged and international trade/tariff disputes are not helping the demand outlook.

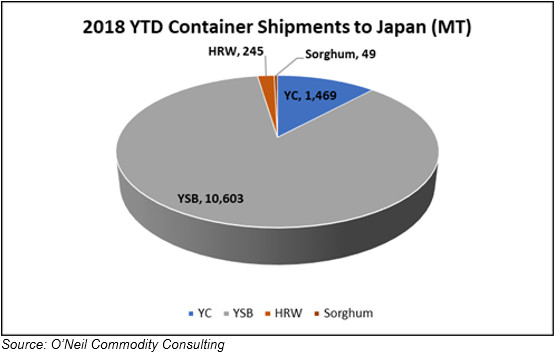

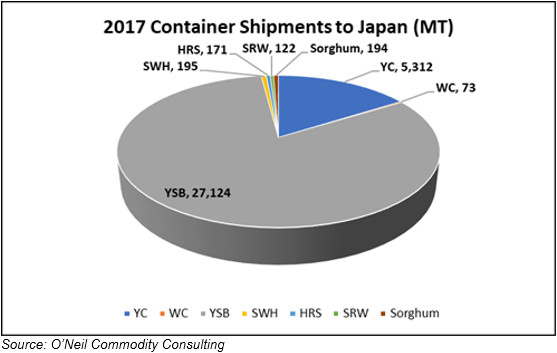

The charts below represent 2018 YTD totals versus 2017 annual totals for container shipments to Japan.