Chicago Board of Trade Market News

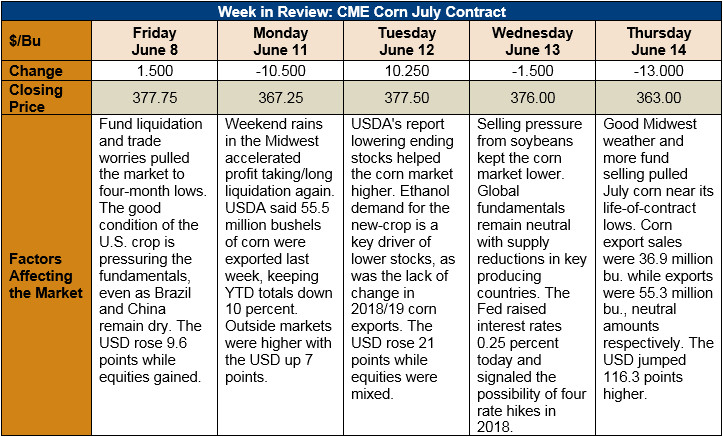

Outlook: July corn is 4 percent lower from last week as the market adjusts to continued fund liquidation, good crop conditions, and political uncertainties. USDA issued a modestly supportive WASDE report on Tuesday but trade uncertainties and deteriorating technical conditions have undone any bullishness the USDA offered.

Tuesday’s WASDE report raised the 2017/18 U.S. corn export forecast 1.9 MMT on the back of reduced availabilities from South America. USDA also lowered corn import projections for the current marketing year by 0.127 MMT, leaving ending stocks 1.778 MMT lower. 2017/18 ending stocks/use levels were estimated at 14.2 percent. The ending stocks reduction was initially perceived as bullish, but subsequent trade concerns pushed the market lower Wednesday and Thursday.

For the 2018/19 U.S. corn crop, USDA increased the corn for ethanol use figure by 0.635 MMT to a record high 146.44 MMT. USDA left 2018/19 corn exports unchanged, though the tightened South American supplies would seem relevant for both the 2017/18 and 2018/19 crop years. USDA’s estimate of 2018/19 ending stocks/use ratio dropped to 10.6 percent.

The U.S. corn crop is currently in excellent condition, with 77 percent of fields rated good/excellent (above the 5-year average of 72 percent). The crop will be tested this week, however, with hot and dry weather building across the Corn Belt. The Black Sea region is dry as well, as is Australia, so the weather may offer some long-term support. However, current long-run weather forecasts for the U.S. Midwest through August suggest equal chances of above or below normal temperatures and precipitation.

From a technical standpoint, July corn is targeting its life-of-contract low at $3.62/bushel. If the market finds reasons to close below this point, it will usher in another round of selling. Seasonally, December corn futures trend lower from June/July into harvest, and 2018 looks to be no exception.