Ocean Freight Markets and Spreads

Ocean Freight Comments

The navigation channel to and from the Port of Baltimore was fully restored to a 700-foot channel width and a depth of 50 feet this week. The channel had been restricted since the Francis Scott Key Bridge collapsed after the m/v Dali lost power and allided into it on March 26.

The Panama Canal Authority confidently increased the draft capability through the Neopanamax locks to 46 feet from 45 feet and will go into effect in late June. The maximum designed draft is 50 feet. The number of daily vessel transits will increase to 34 from 32 in July. Under normal navigation conditions daily transits average about 34 to 36. Recent rains and the prospect of a normal rainy season are leading to improved water levels in Gatun Lake.

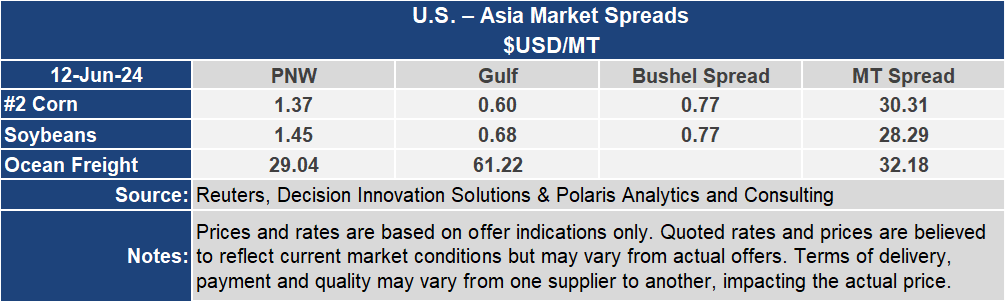

The improving conditions at the Panama Canal together with adequate water levels of the Lower Mississippi River allows for more favorable U.S. grain exports to Asia through the U.S. Center Gulf.

The efforts of the Houthis terrorist group to disrupt trade continues. This week they used small watercraft for the first time to attack vessels navigating the Red Sea and around the Arabian Peninsula. A Greek-owned ship m/v Tutor was attacked and taking on water requiring it to be rescued. Tutor was loaded with coal at a Russian port and sailed to an Egyptian port where the cargo was discharged. From there it was destined for Jordan when it was attacked. The Houthis attacks are in solidarity with Hamas, who attacked Israel, and will continue its attacks until Israel has a ceasefire in Gaza. These types of attacks further the resolve of vessel owners and operators to avoid the Arabian Peninsula and use alternative and more expensive routings connecting markets while tightening vessel capacity utilization.

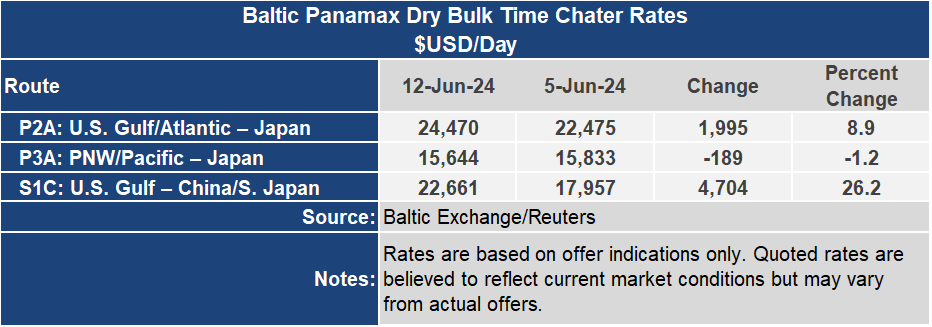

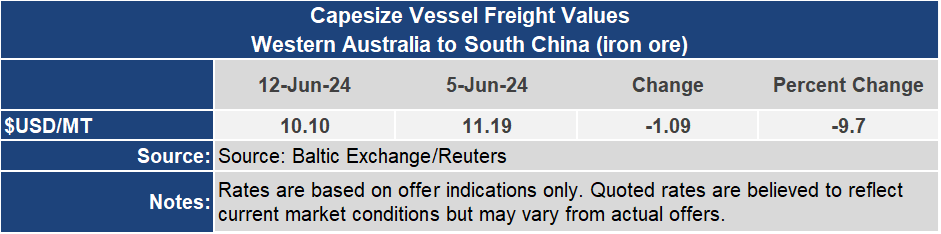

Baltic indices were mixed this week with the Panamax and Supramax sectors showing firmness. The Baltic Panamax Index was up 10% during the week to an index of 1,864, its highest level in nearly a month. The Supramax index was 3% higher at an index of 1,297. Despite the strength in the smaller vessels, the Capesize index shed 7% to 2,726. Because the Capesize market weighs heavily on the Baltic Dry Index it finished the week 1% lower at 1,836. Vessel demand is lacking any consistent pattern, keeping freight rates rangebound.

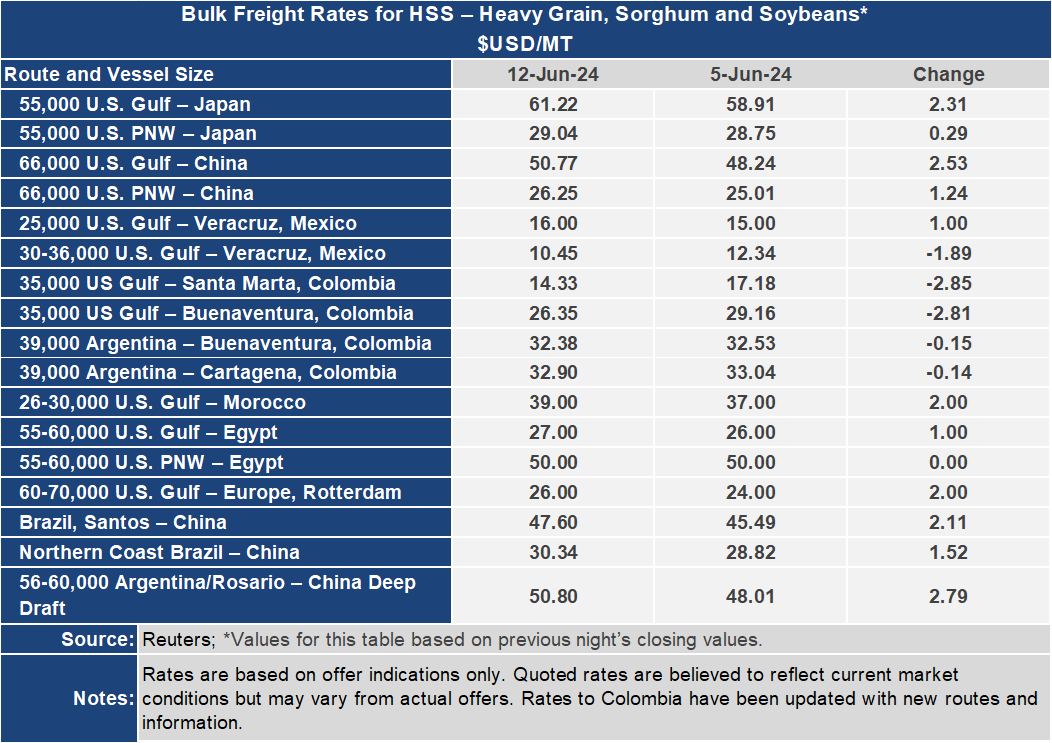

Grain freight rates to Asia, Europe and the Middle East were firmer on all routes this week. To Central America rates were lower, but these routes tend to swing more from one week to the next unlike the longer haul routes. The Gulf to Japan rate gained 4% this week to $61.22 per metric ton, while the rate from the Pacific Northwest gained 1% to $29.04 per metric ton. The freight spread between these routes widened 73% or about $2 per metric ton to $32.18 per metric ton.