Chicago Board of Trade Market News

Outlook

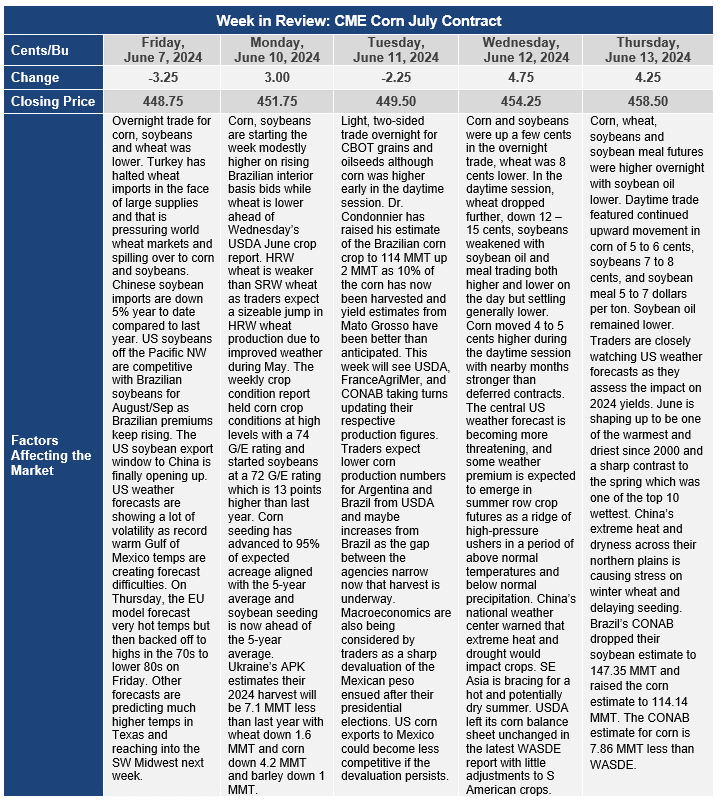

Corn futures found support at the developing uptrend line last Friday and bounced more than 10 cents. Prices this week have traded on both sides of Friday’s close as markets digest updated estimates of Russian, Ukrainian, French and South American crops even as U.S. crop ratings begin the year at relatively high levels. Corn prices ended the week on a stronger note as the market puts some weather premium back in as above average temperatures become more common both in the U.S. and in other major production areas.

Searing heat and ongoing dry weather are reducing estimates of Ukraine and Russian wheat production while excessive rainfall is pushing the seeding of the spring wheat crop in Russia beyond the optimal dates in both northcentral and northeastern Russia. Lower planted acreage for Ukrainian corn is also being factored in to updated crop estimates. Besides the Black Sea drought conditions, weather issues abound around the world. Mexico continues to be in the grips of the worst drought that country has seen in 50 years. China’s dryness is rising as a concern expressed by traders as more heat is developing in those growing regions. A lack of rainfall and relatively high temperatures in the upper 80s, 90s and low 100s is expected to cover about 60% of China’s winter wheat area and up to 25% of China’s cornbelt. China’s national weather center warns that a hot, dry summer is expected to impact crops across much of China, Southeast Asia and northern India.

U.S. ethanol exports and DDG exports were strong in April with more than 214 million gallons of ethanol exported and 970,164 metric tons of DDGs. Both quantities were higher than year ago levels and are supportive of the increased domestic use of corn for ethanol in recent weeks. The U.S. exported DDGs to more than 30 countries in April with Mexico being the top destination with 233,715 mt, Indonesia at 126,042 mt, and South Korea at 123,042 mt.

Net corn sales of 1.056 MMT for 2023/24 were down 11% from the previous week but up 16% from the prior 4-week average and aligned with trade expectations. Increases primarily came from Japan, Colombia, Mexico, China, and unknown destinations. Export shipments of 1.249 MMT were down 16% from the previous week but up 1% from the prior 4-week average. Top destinations were Mexico, Japan, Colombia, Taiwan, and China.

Some mild price fluctuations were seen immediately following the release of USDA’s Crop Production and Supply & Demand Reports, but corn, soybean and wheat futures ended the day at roughly the same levels as where they were trading ahead of the data. There were no major surprises in the data, which will likely keep near-term market focus on U.S. and global weather as traders await acreage and grain stocks data at the end of June.

USDA made no changes to U.S. corn or soybean 2024/25 projected ending stocks and lowered U.S. wheat ending stocks for 2024/25 by 8 million bushels. USDA lowered the 2023/24 world corn ending stocks to 312.39 MMT, down from 313.08 MMT in the May report and lowered 2024/25 world corn ending stocks to 310.77 MMT, down from 312.27 MMT in the May report. World soybean ending stocks for 2023/24 were lowered to 111.07 MMT from 111.78 MMT in the May report and lowered 2024/25 world soybean ending stocks to 127.90 MMT from 128.50 MMT in the May report. CONAB raised their estimate of the Brazilian corn crop to 114.14 MMT while USDA left their estimate of the Brazilian corn crop at 122.00 MMT. The gap between CONAB and USDA is narrowing, with USDA still 7.86 MMT higher than CONAB.