Chicago Board of Trade Market News

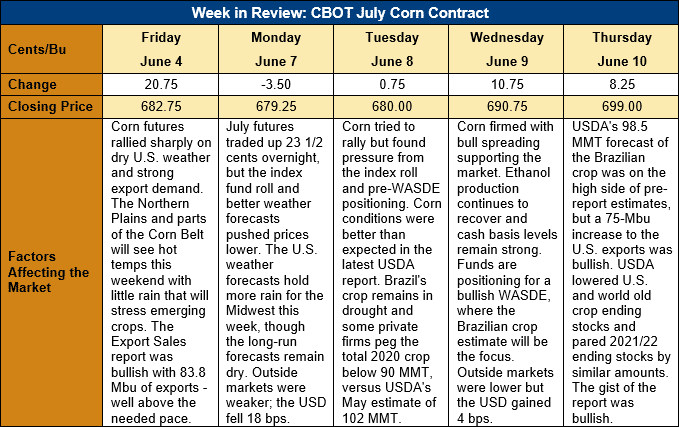

Outlook: July corn futures are 16 ¼ cents (2.4 percent) higher this week after USDA cut its estimate of the Brazilian corn crop and lowered U.S. and world 2020/21 ending stocks. Earlier in the week, index funds were rolling positions from July futures into deferred contracts, which created weakness and bear spreading. With the roll mostly completed and a supportive WASDE, however, old crop futures look poised to trade steady/higher going forward.

Perhaps the most anticipated number from Thursday’s June WASDE was the Brazilian corn production estimate. USDA lowered its assessment of the Brazilian crop 3.5 MMT from its May estimate to 98.5 MMT. That figure was within the range of pre-report estimates but above the average. Some private firms have pegged the Brazilian 2020/21 crop at less than 92 MMT based on the ongoing drought, meaning USDA’s forecast could fall again next month.

Regarding the U.S. corn balance sheet, USDA increased the 2020/21 U.S. export forecast by 1.905 MMT (75 million bushels) to 72.394 (2.85 billion bushels) – a new record high. USDA also increased its estimate of ethanol corn use by 1.905 MMT (75 million bushels) based on higher ethanol production this spring. In total, USDA increased old crop use by 3.8 MMT (150 million bushels) and reduced 2020/21 ending stocks by the same amount. The resulting 28.119 MMT (1.107 billion bushel) carry-out figure is the smallest since 2013/14 and the fourth smallest in the past 20 years.

As expected, USDA made few changes to the 2021/22 U.S. corn balance sheet, except to lower beginning stocks based on changes to the old crop carry-out. With no other changes to the balance sheet, the 2021/22 U.S. ending stock forecast fell 3.8 MMT (150 million bushels) to 34.47 MMT (1.357 billion bushels). The expected ending stocks-to-use ratio is 9.2 percent, down 1 percent from USDA’s May forecast. The agency left its average market price forecast unchanged at $5.70/bushel for the coming crop year.

Outside the U.S. and Brazil, USDA made no changes to its 2020/21 or 2021/22 global corn production forecasts. The agency lowered 2020/21 world feed use 1.6 MMT but increased the world total use and trade estimates slightly. World 2020/21 corn ending stocks were cut 2.9 MMT to 280.6 MMT, which was in-line with pre-report expectations. USDA made no significant adjustments to the 2021/22 world corn balance sheet, other than lowering beginning and ending stocks in accordance with the smaller old crop carryout. World ending stocks for 2021/22 are forecast at 289.4 MMT, up 8.8 MMT from the current marketing year.

The Export Sales report showed 189,600 MT of net 2020/21 corn sales with 1.647 MMT of exports last week. Both figures were down from the prior week and reflect a holiday-shortened trading week. YTD exports are up 75 percent at 52.9 MMT while YTD bookings are up 68 percent at 69.297 MMT.

From a technical standpoint, July corn futures are trending higher in a wide trading range between the 26 May daily low ($6.02 ¾) and the contract high ($7.35 ¼). A short-term trendline has developed in the past 2 weeks with support at $6.73 ¾ and 14-day stochastics are trending higher, indicating upside momentum. Thursday’s push above $7.00 and to a new 4-week high was a bullish development, even if the market could not sustain a close above the $7.00 mark. A settlement above that point will be bullish and could create another test of the contract highs. Notably, December futures have traded above the psychologically important $6.00 level all week and are threatening their contract high as well. The strong export pace and ongoing drought issues for the U.S. suggest the CBOT will have a hard time sustaining breaks and the general market direction is still higher.