Ocean Freight Comments

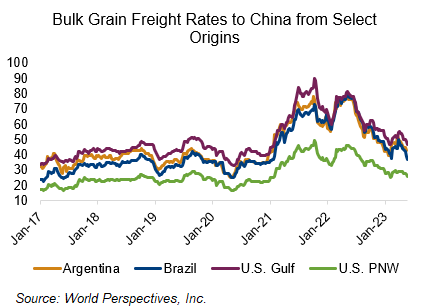

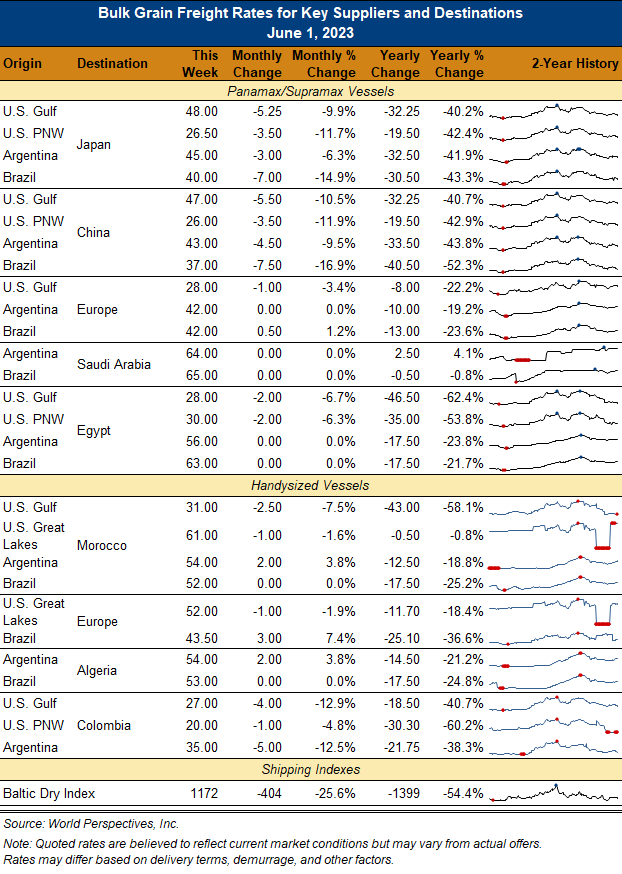

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was yet another disappointing and unexpected week for dry bulk vessel owners and shipping news magazines. Most every industry ocean freight article and freight blog has been touting the reasons why ocean freight markets have bottomed out and are positioned for a big rally. As stated previously, the logic for such is simple and it stands on the belief that the Chinese economic recovery is forthcoming, and the new vessel order book is small. To date, the flaw in this logic has been the slow rate of cargo growth from China. With Chinese housing construction declining, so is the demand for imported raw materials.

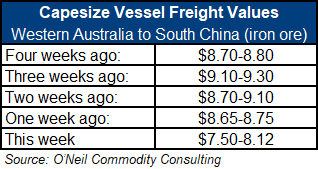

Vessel rates are moving below some owners’ operating costs and new CO2 emissions regulations are adding extra financial pain to owners’ returns. Panamax FFA July paper dropped to $9,200/day and Q3 traded down to $10,700/day with Q4 trading down to $11,600/day. It was an ugly week for vessel owners.