Chicago Board of Trade Market News

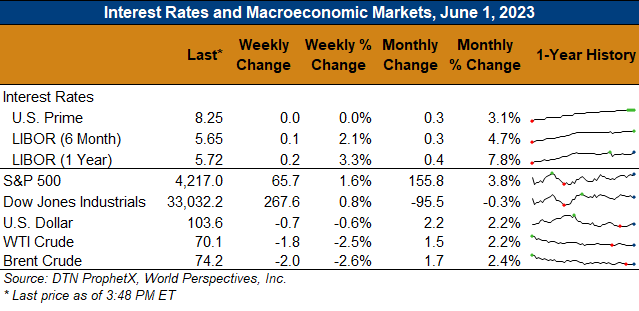

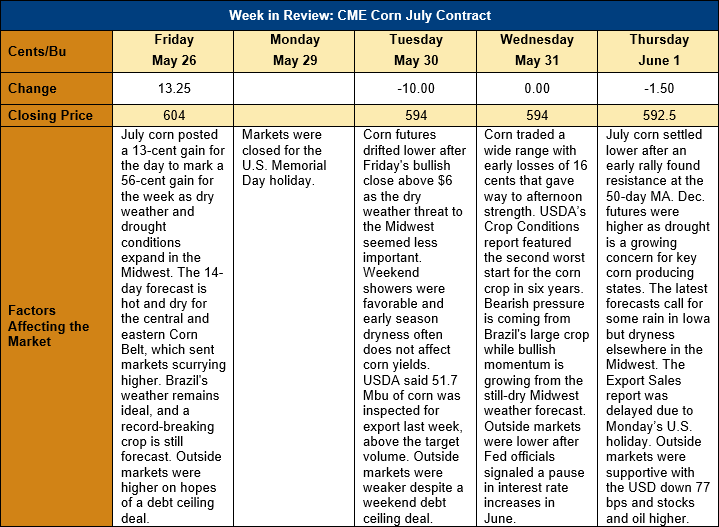

Outlook: July corn futures fell 11 ½ cents (1.9 percent) from last Friday to Thursday’s market close after volatile trade developed in the holiday-shortened week. Last week’s trade was dominated by a hot, dry 14-day weather outlook for the Midwest that prompted some “weather risk” trading and sent July futures above $6.00. This week’s trade has featured a retreat from that trend with traders acknowledging that some early-season dryness will not hurt yields and can even help encourage deeper root development. Wednesday and Thursday’s trade was volatile as traders tried to ascertain the impacts of the still-dry weather forecast and growing Midwest drought against steady exports and record-breaking new crop production forecasts. Going forward, trade is likely to remain volatile amid the changing 2023/24 supply and demand outlook.

The 2023 U.S. corn planting effort is all but finished with 92 percent of fields seeded as of 28 May. That pace is up from last year and the five-year average of 84 percent. The report showed strong progress in the Northern Plains where early season cool, wet weather initially hampered seeding. The corn crop is 72 percent emerged (ahead of the five-year average of 63 percent) and 69 percent was rated in good/excellent condition. The conditions rating – the first so far this year – was slightly below pre-report expectations and the second lowest first-week rating of the past six years.

The weekly Export Sales report is delayed until Friday due to this week’s holiday in the U.S., but the Export Inspections report featured 1.313 MMT of shipments. That figure was down just 1 percent from the prior week and above the pace needed to meet USDA’s May WASDE export forecast. YTD inspections total 28.691 MMT, down 32 percent from the prior year.

Ethanol production rose 2.1 percent last week and topped 1.0 million barrels per day as the industry faces strong production margins heading into the seasonal summer peak in U.S. gasoline demand. The weekly corn grind was estimated at 2.578 MMT (101.49 million bushels), which was just 1 percent below the volume needed to keep pace with USDA’s latest 2021/22 corn use forecast. Corn demand from the ethanol industry and ethanol production margins are expected to remain strong this year with E15 fuel now permitted for summer sale in the U.S.

The monthly Grain Crushings report from USDA showed that the ethanol industry used 10.56 MMT (415.7 million bushels) of corn for fuel ethanol in April, down 4.7 percent from March and down 0.1 percent from the same month in 2022. Corn used for industrial ethanol totaled 0.15 MMT (5.9 million bushels) and was down 1.2 percent from March and down 30.9 percent from 2022 while corn for beverage ethanol rose 11.4 percent from March and 60 percent from April 2022 to 0.161 MMT (6.4 million bushels). April DDGS production hit 1.47 MMT (1.62 million short tons), down 5 percent from March and down 5 percent from the same time in 2022.

From a technical standpoint, July futures continue to find resistance above $6.00 with the 50-day moving average forming the high end of the current trading range. Short-term support lies at Wednesday’s lows $5.77 ½ with the 18 May low ($5.47) offering support below that. One key factor is the fact that funds are heavily short corn heading into summer when “weather rallies” typically develop. This positioning could accelerate upside moves if changes in weather or old crop demand dictate that managed money traders must cover their shorts.