Chicago Board of Trade Market News

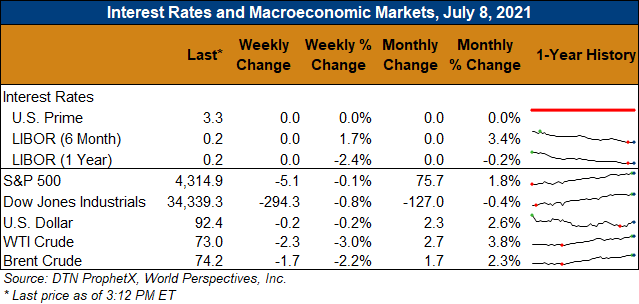

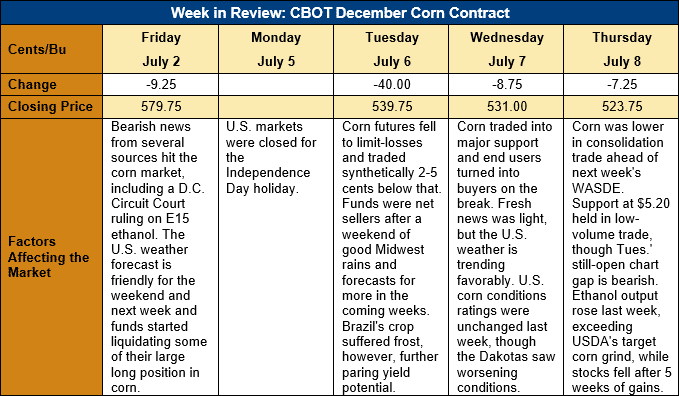

Outlook: December corn futures are 56 cents (9.7 percent) lower this week as traders and funds have been aggressive in liquidating long positions on improving Midwest weather forecasts. The market has erased the gains created by last week’s Grain Stocks and Acreage reports with traders’ focus increasingly turning to Monday’s WASDE report and the U.S. late July weather outlook.

The U.S. weather has turned more favorable for corn production across the U.S. this week. While significant concern still exists for crops in the western U.S. and northern Plains, parts of the Dakotas, Iowa, and northern Minnesota received meaningful precipitation this week. The 7-day outlook suggests showers will continue across the region into mid-July, with some moderation in temperatures as well. The ongoing drought has certainly damaged yield potential for crops in the region, but the wetter outlook has allowed the CBOT to remove some of the weather risk that was priced into futures.

In contrast to the dry northern Plains outlook, the central and eastern Corn Belt will continue to see cooler-than-normal temperatures and above-average rainfall that will boost corn and soybean yield potential. This fact has been the market’s primary focus this week with expectations for 4-5 inches of rainfall across Iowa, Illinois, and Indiana this week pressuring futures markets. The 6-14-day forecast offers good odds of above-average temperatures in mid-July, but rainfall should be normal or better, according to the latest model runs. Moderately hot temperatures combined with adequate precipitation can benefit corn yields and there are currently few weather threats to the Corn Belt crops.

While the major U.S. corn-producing states are under favorable weather conditions, Brazil’s safrinha corn crop remains under duress. Initially plagued by drought, the crop suffered frost/freeze damage earlier this week. The states of Parana and Mato Grosso do Sul were most heavily impacted and private firms have once again cut their expectations of the crop’s size. Analysts are expecting USDA to make a significant downward adjustment to its forecast of the Brazilian crop in Monday’s WASDE, a change that is likely to boost the agency’s outlook for 2021/22 U.S. corn exports.

The weekly Export Sales report is delayed due to Monday’s U.S. holiday, but the weekly Export Inspections report was neutral/bullish corn markets. Inspections totaled 1.23 MMT, up 20 percent from the prior week, and brought YTD inspections to 58.15 MMT, up 69 percent.

From a technical standpoint, December corn futures are bouncing sideways in a wide range from major support at $5.00 to last Thursday’s high ($6.11 ¼). Within that range, support has developed at $5.20 with the contract testing that level Wednesday and Thursday this week. End users, both domestically and internationally, were active buyers as prices reached that level following Tuesday’s limit-down trade. Thursday’s trade formed an inside day on the charts, a sign of steady, congestive trade as traders position for Monday’s USDA report. Heading into the report, the unfilled chart gap from $5.52 ¼ to $5.73 ½ is a bearish sign and a break below $5.20 could spark a selloff to $5.00. Trade below that level, however, is unlikely as few will want to be overly bearish with USDA likely to cut the Brazilian corn crop and possibly lower production estimates for the western U.S. states.