Ocean Freight Comments

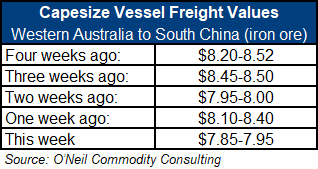

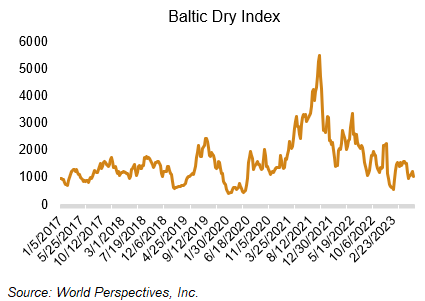

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: I feel a bit like the traffic policeman who tells the crowd “Move along, nothing to see here.” Dry-bulk markets are very much in the same situation as there has been no increase in Chinese cargo demand and, therefore, no excitement in dry-bulk freight markets. Every attempt to rally continues to be met by selling pressure. This week was no exception and markets set back on a lack of buying support. July FFA Panamax markets dropped from $9,000/day to $7,750/day while Q3 is now at $8,750/day and Q4 at $10,400/day. It may look like a carry market, but this is mostly optimism and pure hope on the part of vessel owners, with desperation showing in the spot and 30-day markets. There is nothing bullish visible on the horizon and container markets are not looking any more exciting or optimistic.

ILWU Canada did instigate a West Coast Canada port work stoppage on July 1.

The Associated Branch Bar Pilots advised they will resume their 50-foot Draft Recommendation for NOLA- Southwest Pass effective 1000 hours 6 July 2023.