Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values are lower again this week amid the heightened volatility in corn and soybean meal futures. Ethanol run rates remain strong and product supply is ample, which is also pressuring offers. The increased DDGS supply has producers with access to river markets pushing product there and making competitive offers.

The DDGS/cash corn ratio is steady with last week at 1.11 and above the three-year average of 1.02 while the DDGS/Kansas City soymeal ratio is also steady with last week at 0.47 and below the three-year average of 0.50.

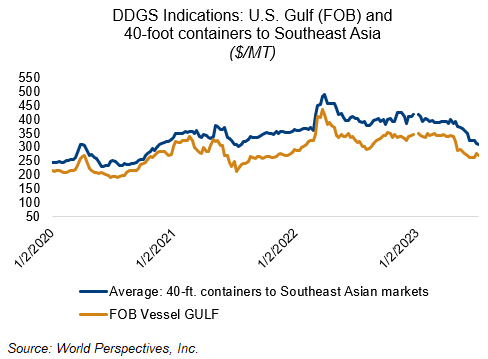

Barge CIF NOLA DDGS offers are $14/MT lower this week as barge freight weakens and offers for product destined for the river system continue to ease lower. FOB NOLA offers are $6-9/MT lower while U.S. rail rates are steady/$2 lower. Offers for 40-foot containers to Southeast Asia are down $5/MT at $310 for July shipment and are down just $2-3/MT for August-October positions.