Ocean Freight Markets and Spreads

Ocean Freight Comments

Recent rains have across Panama have been beneficial, greatly improving water conditions in Gatun Lake that are about normal for July. The Panama Canal Authority is scheduled to increase the Neopanamax draft to 48 feet on July 11 from 47 feet. Daily vessel transits will increase to 35 after August 4. Under normal operating conditions daily transits total 36 to 38. News of improving conditions is traveling fast with vessel delays starting to mount, and that is a good thing as shipper and vessel operators and owners are gaining confidence to use the Panama Canal as a quicker alternative between the U.S. and Asia in particular.

The Houthis terrorist organization kept up their attacks on vessels transiting the Red Sea and around the Arabian Peninsula this week. However, the U.S. military command did announce success destroying Houthi radar sites. Vessel owners and operators are maintaining their positions to avoid the Red Sea for the foreseeable future. As global demand has picked up for container service, vessel utilization is being challenged even more by avoiding the Red Sea.

Hurricane Beryl is the strongest storm this early in the hurricane season. Its course is impacting Mexico and the Port of Brownsville, Tex. The Port of Brownsville is limiting vessel traffic through Tuesday next week. Vessels that can finish loading on Friday night or Saturday morning will be allowed access. Normal operations are expected to resume Tuesday. Other Texas ports along the Gulf Coast are monitoring the situation closely.

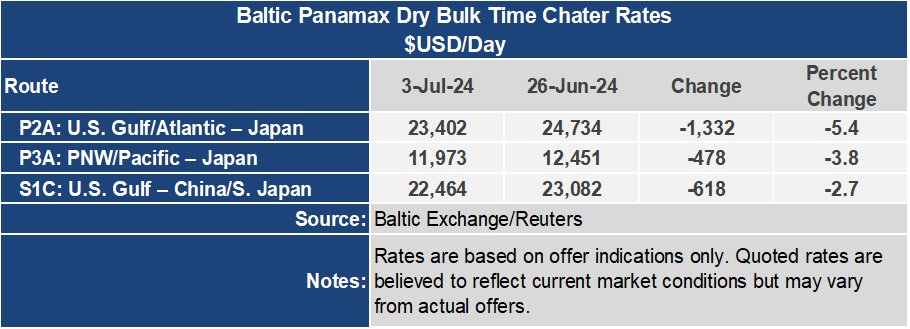

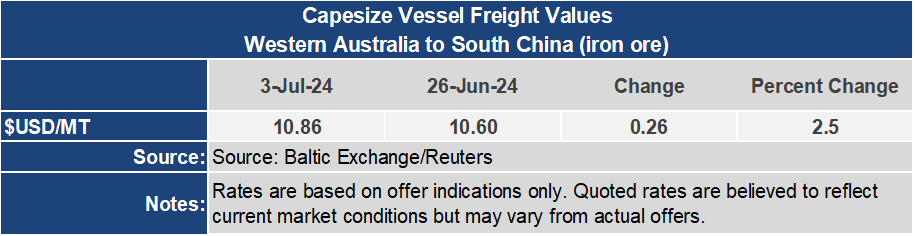

The Baltic Dry Index ended the week stronger on the strength of the Capesize sector finding improved demand, at least for this week. The BDI gained 100 points or 5% for the week to 2,064. The Capesize sector, a major influence on the BDI, gained 435 points or ended the week 14% higher to 3,580. The BDI could have been firmer still had the Panamax and Supramax found momentum. Instead, both were lower with the Panamax sector down 4.5% to 1,607 and the Supramax down 5% to 1,340.

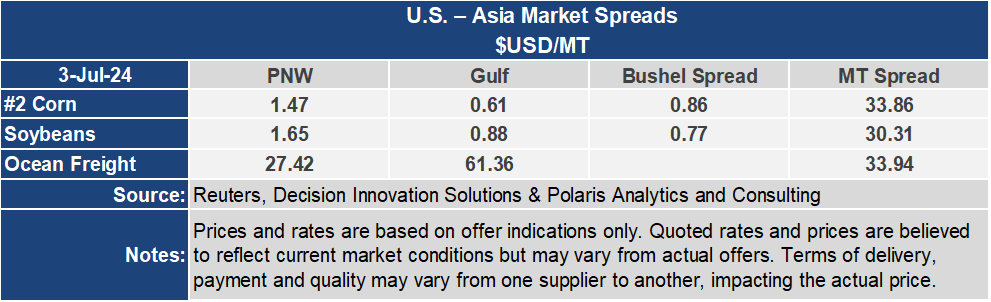

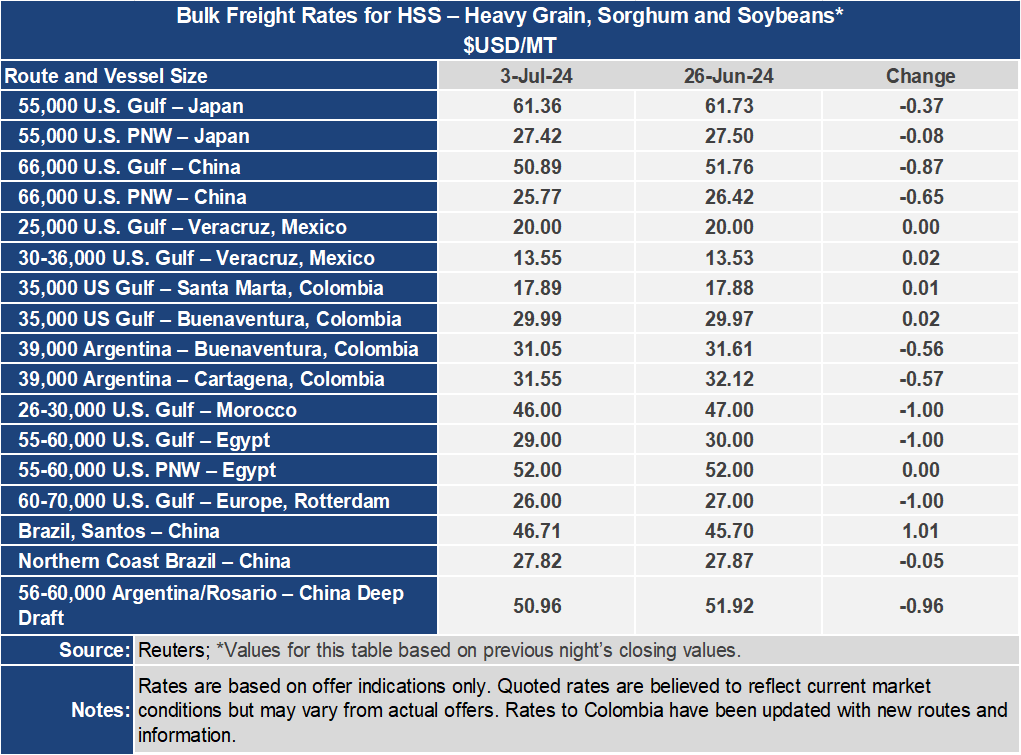

Grain freight rates on the venerable routes to Japan ended the week down with the Gulf route down $0.37 per metric ton to $61.36. The rate out of the Pacific Northwest was down nominally to $27.42. The spread between these routes narrowed $0.29 per metric ton to $33.94 for the week.