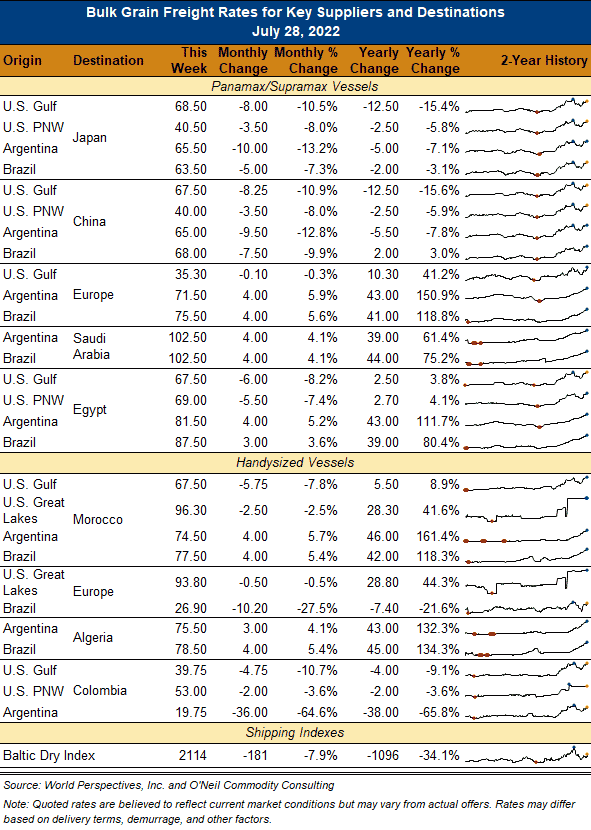

Ocean Freight Comments

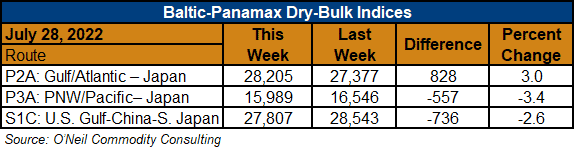

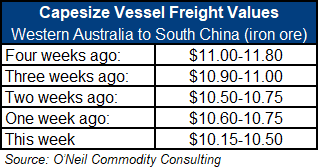

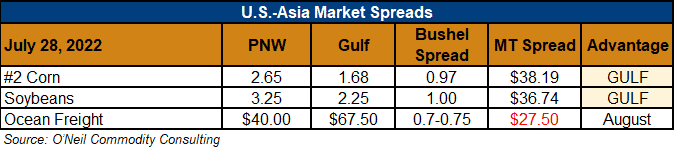

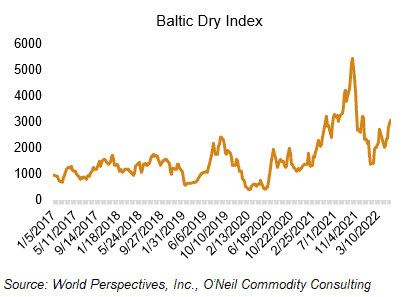

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk freight markets were little changed this week; but it was a struggle to keep values from sliding further down the slope. Fear of reduced Chinese coal imports and a lack of global cargo growth is stunting traders’ optimism as it now looks like a 2.8 percent fleet growth may be sufficient to cover global needs. For the moment, markets will be happy to sail in quite waters and hope values will climb back in Q4 2022. But since Q4 is historically a soft market, vessel owners may have to wait until Q1 of 2023 to see any significant rate improvement.

In container markets, the trucker protest that shut down the port of Oakland, CA for four days has ended. But the fight over California Gig-worker Assembly Bill AB5 has not been resolved and will continue to be a serious issue for all industries in the state. The ILWU-West Coast Port labor contract negotiations continue as the big issue of port automation remains to be resolved.