Chicago Board of Trade Market News

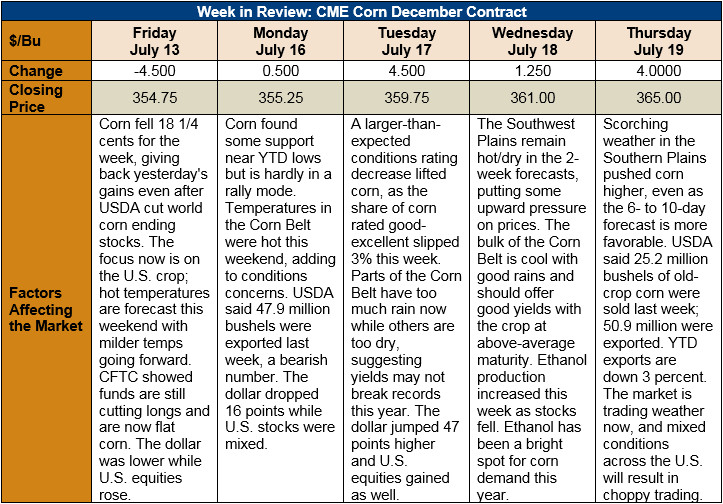

Outlook: It’s mid-July and the corn market is trading its favorite July fundamental factor: weather. Variable weather conditions across the U.S. pushed December corn futures up 2 percent week-over-week, having added 5 ¾ cents since last Thursday. Last week’s WASDE offered some bullish fundamentals (reductions in world corn ending stocks, for example), but these merely stopped corn futures’ downward slide rather than induce a serious rally. With the market having digested the WASDE numbers, its biggest focus is now the Corn Belt weather.

U.S. weather conditions have been mixed so far this year. Early season conditions were nearly ideal and crop condition ratings reflected that dynamic. Now, the Southern Plains are increasingly hot/dry with temperatures that may pare back yield potential in that region. Conversely, parts of the northeastern Corn Belt are cool and too wet with farmers reporting spots of drowned-out corn.

The weather forecasts for the next 6-10 days include cool temperatures for the northern Corn Belt but below-average chances of precipitation. Conversely, the southern Corn Belt will feature hot temperatures but above-average chances of precipitation. The net effect of this is that localized areas are experiencing adverse conditions, but the bulk of U.S. corn-producing areas should receive favorable weather.

On Monday USDA said 72 percent of U.S. corn is rated good/excellent, down 3 percent from the prior week but above the five-year average of 70 percent. More impressively, the crop is advanced in its maturity despite a late planting, with 63 percent of corn silking – well above the five-year average pace of 37 percent. The early silking suggests the crop may enter the bulk of its key reproductive stage under cooler temperatures, which should aid in pollination. At this stage, there seems little threat to U.S. corn yields, but record-breaking yields, which typically take consistently excellent conditions across nearly all growing areas, may be unattainable given present conditions.

Corn exports totaled 1.293 MMT last week, with 641,000 MT of net sales. YTD bookings (exports plus unshipped sales) are up 4 percent presently.

From a technical standpoint, December corn has likely made its seasonal lows and is attempting a modest rally. The contract has closed higher each of the past four days and is now testing resistance at the 20-day moving average. A close above this point will likely bring additional buying support, including, perhaps, funds adding long positions. Even so, corn futures do not seem ready to jump back to $4/bushel given their present lack of a significant fundamental “story.” Rather, price appreciation in this market is likely to be a slow, steady march higher with traders watching the weather all the way.