Chicago Board of Trade Market News

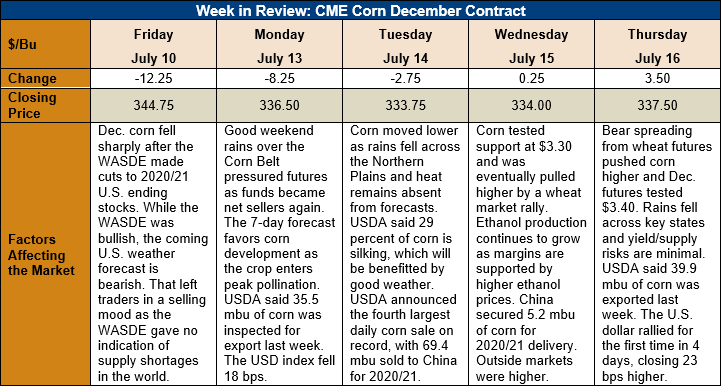

Outlook: December corn futures are 7 ¼ cents (2.1 percent) lower this week after a slightly bullish July WASDE was largely ignored in favor of focusing on favorable U.S. weather. Funds had been covering a large short position heading into the report, but favorable U.S. weather forecasts and a lack of global supply threats sparked additional selling. The market found some support Wednesday and Thursday, however, thanks to a rally in wheat futures that helped the entire CBOT move higher.

The July WASDE offered a bullish surprise as USDA lowered its 2020/21 U.S. ending stocks forecast from 84.409 MMT (3.323 billion bushels) to 67.263 MMT (2.648 billion bushels). The ending stocks figure was on the low end of analysts’ pre-report estimates and was thus interpreted as mildly bullish. USDA lefts its yield forecast unchanged at 11.2 MT/ha (178.5 bushels/acre), which when combined with the agencies June acreage forecast, put 2020 production at 381.02 MMT (15.0 billion bushels). The latest figures suggest the 2020 U.S. corn crop will not break records but will still provide ample supplies.

Regarding U.S. old crop corn, USDA cut feed and residual use by 2.54 MMT (100 million bushels) and ethanol consumption of corn by 1.27 MMT (50 million bushels). Both were expected after the June Grain Stocks report that surprised the market with larger stocks. The consumption cuts prompted USDA to increase its estimate of 2019/20 U.S. ending stocks, which are now pegged at 57.102 MMT (2.248 billion bushels). The larger carry-out figure from the current crop year helps create a large-supply scenario heading into the 2020/21 crop year.

Outside the U.S., USDA’s cut 2020/21 world ending stocks by 22.8 MMT to 315.04 MMT, which was below market expectations. The biggest reductions in foreign 2020/21 ending stocks came from China, Argentina, the EU, Mexico, and Canada. USDA cut Canadian corn production forecast while increasing the crop estimates for Russia and Bolivia. USDA increased China’s feed and residual corn use for 2019/20 and 2020/21 due to low corn prices and a faster-than-expected rebound in livestock consumption rates. USDA increased Argentina’s 2019/20 corn export forecast but cut Brazil’s due to a slower than expected pace so far in the year.

U.S. weather patterns remain broadly favorable for corn and summer crop development, with warm, wet conditions expected for the coming 7-10 days. Any drought/dryness concerns are limited to the Southern Plains, while the Corn Belt will see favorable rains. U.S. corn conditions ratings slipped 2 percent from the prior week, with 69 percent rated good/excellent. The U.S. corn crop is approaching peak pollination this week and next and significant weather threats reman few. Sorghum conditions slipped an equal amount as hot/dry weather in the Southern Plains took its toll. Overall, however, U.S. crops are in excellent shape and offer good potential for trendline or better yields this fall.

The weekly Export Sales report featured net corn sales of 981,100 MT (up 64 percent week over week) and exports of 1.014 MMT (down 6 percent from the prior week). Recent shipments put YTD exports at 35.9 MMT (down 20 percent) while YTD bookings (exports plus unshipped sales) stand at 43.4 MMT (down 12 percent). The report also featured 70,600 MT of sorghum exports. YTD sorghum exports are up 160 percent.

From a technical standpoint, December corn futures formed a double top at $3.65 last week and have since broken sharply lower. The market tested key support at $3.30 on Wednesday but a strong wheat market subsequently pulled prices higher. On Thursday, bear wheat/corn spreading helped propel December corn futures higher and to key resistance at $3.40. The contract has an open chart gap at $3.43 that bulls will likely try to fill. Recent export sales business has helped support cash markets and if the trend continues, will push CBOT prices higher as well. On the bearish side, without significant weather threats for the major U.S. corn-growing regions, there seems little risk of supply shortages this year. The market is apt to trade mostly sideways between support at $3.30 and resistance at $3.48 (the 100-day moving average) amid these competing supply/demand drivers.