Chicago Board of Trade Market News

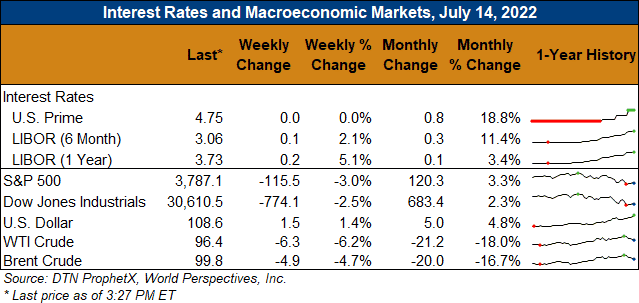

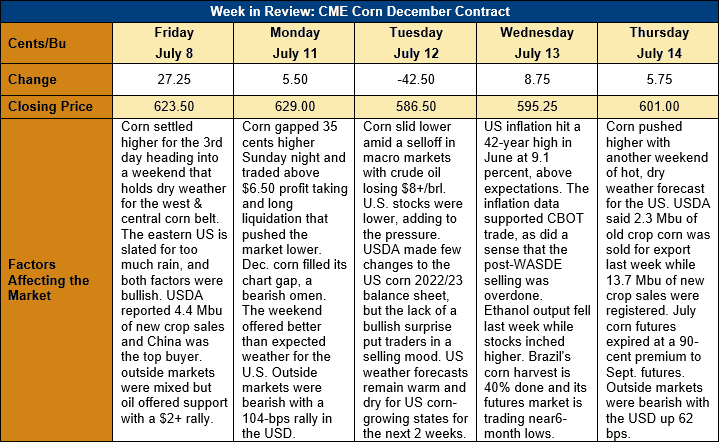

Outlook: December corn futures are down 22 ½ cents (3.6 percent) this week after early-week strength found profit taking and long liquidation selling pressure. The market sold off sharply following what was a relatively neutral WASDE report and rebounded slightly on Wednesday and Thursday. The market’s attention is now turning to the U.S. weather forecast and how predictions for heat and dryness over the Corn Belt might affect yields.

Overall, the July WASDE was largely neutral U.S. and global corn markets, though the lack of any bullish surprise created a subsequent selloff at the CBOT. USDA made relatively few changes to the 2022/23 U.S. corn balance sheet in its July WASDE. The agency, as expected, increased corn acres 0.5 percent due to the findings of the June acreage report, which helped boost production by1.14 MMT (45 Mbu), which is now pegged at 368.45 MMT (14,505 Mbu). On the demand side, USDA made no changes, which when combined with an extra 0.64 MMT (25 Mbu) of carry-in stocks from the old crop marketing year, pushed 2022/23 ending stocks to 37.34 MMT (1,470 Mbu). That leaves a 10.1 percent ending stocks-to-use ratio, which is up from the agency’s June forecast and in-line with 2021/22 levels. USDA lowered its forecast of the average farm price slightly to $261.80/MT ($6.65/bushel).

On the world balance sheet, USDA increased global production by 0.93 MMT due to the larger U.S. crop and an increase in Paraguay’s output. USDA did, however, cut production for Russia, the EU, and Kenya. USDA made modest reductions to global feed use and exports, which pushed global 2022/23 ending stocks 2.49 MMT higher to 312.9. The world ending stocks to use ratio is in-line with 2021/22 at 23 percent.

The U.S. corn crop remains near average condition and USDA reported Sunday that the share of the crop rated good/excellent was steady with the prior week at 64 percent. That is down slightly from the five-year average of 66 percent and favorable, late week rains prevented week-over-week declines in the ratings. USDA also noted 15 percent of the crop is silking currently, which is 10 percent behind normal due to the impacts of this year’s delayed planting. While conditions for the major corn growing states remain favorable, USDA reported a 2 percent decline in sorghum ratings last week as well as a 1 percent decrease in barley ratings. Long-term weather forecasts continue to call for heat and expanding dryness across the western and central Corn Belt into early August, which could crimp yield potential as the crop will enter peak pollination in the next few weeks.

From a technical standpoint, December corn futures seem to be forging a sideways trading range after forming a bullish reversal last week but failing to continue early week strength this week. Monday’s gap-higher opening was bullish until the market filled it completely and sold off sharply following the July WASDE. Funds are still net long but have pared that position substantially and commercial and export buying has picked up on the recent price break. USDA’s latest report seemed to offer little justification for sub-$6 new crop futures, so it is likely the market will chop sideways/higher from last week’s lows. Note that the U.S. weather forecast will – as it always does – have an outsized impact on corn futures through mid-August, which creates greater probability of choppy, volatile trade.