Chicago Board of Trade Market News

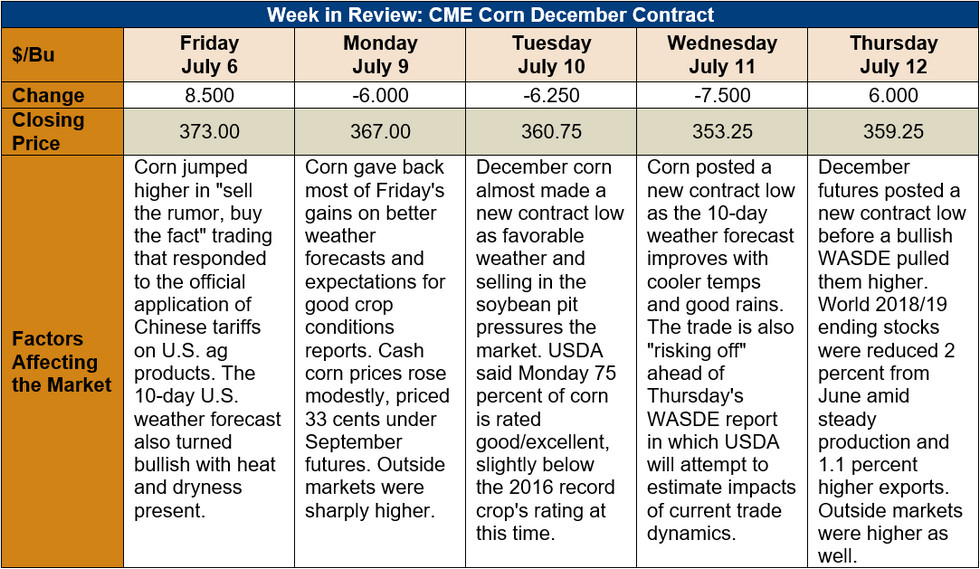

Outlook: The corn market posted two new contract lows this week before the USDA issued a bullish WASDE report. World corn production was unchanged from the June report while ending stocks fell 1.8 percent from the same report. Citing poor weather in Russia, USDA lowered Russian production expectations and did the same for Canada’s corn crop as well. European corn production was increased 1 percent while balance sheets for Brazil, Argentina, and China were largely unchanged from the June report.

In the U.S., planted acreage increased 1.2 percent according to USDA NASS’ latest Acreage report. 2018/19 corn yields were unchanged at 175 bushels per acre and production increased 4.8 MMT (190 million bushels). Feed and residual use increased 1.9 MMT (75 million bushels) from the last report while ethanol use of corn was lowered (50 million bushels). USDA increased 2018/19 corn exports 6 percent (3.2 MMT or 125 million bushels) given rising global corn demand. In total, U.S. 2018/19 ending stocks were pegged at 39.423 MMT (1.552 billion bushels), down 0.64 MMT (25 million bushels) from June and equating to a 10.5 percent ending stocks/use ratio. That figure, being 3 and 4 percent lower than the previous two marketing years, is bullish corn going forward.

Beyond the corn market, USDA increased barley production 0.174 MMT (8 million bushels) based on the added acreage from the June Acreage report. Similarly, sorghum production increased to 9.042 MMT (356 million bushels) on higher acreage figures. Lower export forecasts for sorghum, however, led USDA to lower the farm-gate price forecast 10 cents/bushel. USDA left 2018/19 oat production unchanged but increased feed and residual use 0.077 MMT (5 million bushels).

The U.S. corn crop remains in excellent condition with 75 percent of the crop rated good/excellent. The rating is above the 5-year average condition of 70 percent good/excellent and is just slightly below the record 2016/17 crop’s condition at this time. The U.S. weather forecast looks favorable for the coming two weeks with cooler temperatures and adequate moisture for much of the Corn Belt. USDA reported 37 percent of the corn crop is silking (above the 5-year average pace of 18 percent) and the cooler temperatures will aid the crop’s reproductive development.

From a technical perspective, December corn futures are deeply lodged in a downtrend but are attempting a reversal. Thursday’s price action, which composed a “key reversal” on the charts complete with a new contract low, higher close, and an “outside day” trading range, could be considered bullish corn. With USDA confirming a tighter world ending stocks situation and increasing its expectations of U.S. corn exports, the market now has fundamental reasons to move higher.