Chicago Board of Trade Market News

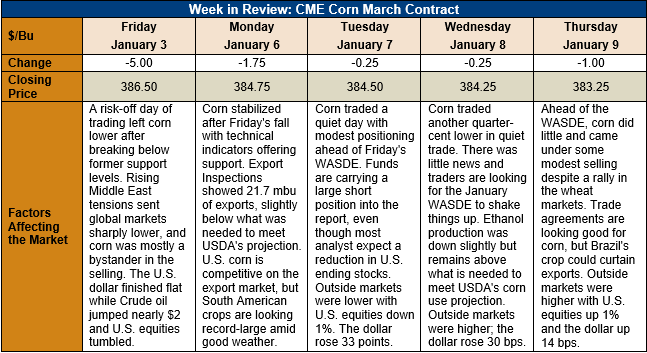

Market Outlook: March corn futures are 3.25 cents (0.8 percent) lower this week after last Friday’s breech of technical support points. The market has been trading steadily sideways since then, with support at the 40-day moving average as traders position for the January WASDE. Friday’s report is expected to bring a modest reduction in U.S. yields and ending stocks, but trade is cautious on that front since USDA has surprised the market several time this year.

Market analysts are expecting a decline in U.S. corn yield and production in tomorrow’s WASDE. The average estimate from Dow Jones’ survey pegs U.S. yields at 10.419 MT/ha (165.9 BPA), down from 10.448 MT/ha (167 BPA) in the December WASDE. Analysts are also anticipating slightly lower harvested acres, due to the wet weather that delayed much of the U.S. corn harvest this year. The yield and harvested acres expectations combine for an average 2019 production estimate of 342.776 MMT (13.494 billion bushels). U.S. ending stocks are expected to hit 44.529 MMT (1.753 billion bushels) for 2019/20, based on the lower production figure.

The weekly Export Sales report is delayed until Friday, January 10 due to a winter storm that impacted federal agencies in Washington D.C. earlier this week. Last week’s report (which contained data for the week ending December 26) saw net corn sales of 531,000 MT and weekly exports of 447,000 MT, up 35 percent from the prior week. YTD corn bookings (exports plus unshipped sales) stand at 18.35 MMT, down 42 percent from the prior year. The report also showed 23,900 MT of sorghum exports and 1,300 MT of barley shipments, bringing YTD bookings for those commodities up 134 percent and 1 percent, respectively.

This past Monday, USDA released its weekly Export Inspections report for the week ending January 2, 2020. That report showed 550,000 MT of corn was inspected for export, up 35 percent from the prior week. Sorghum exports jumped to 67,388 MT due to a large purchase from China.

Cash corn prices are slightly lower this week with the national average price reaching $145.57/MT. Basis has strengthened slightly under growing commercial demand and now averages 13 cents under March futures. Barge CIF NOLA prices are down 1 percent this week while FOB NOLA offers are slightly lower at $174.50/MT.

From a technical standpoint, March corn has been range-bound for much of the past few weeks as traders look for supply/demand clarity in the coming USDA report. Funds still hold a sizeable net short position in corn, which could create a sizeable move higher if the WASDE is anything but bearish. Additionally, a continued trend higher in wheat futures could create spillover support for the corn market too. However, the fundamentals will always rule the day, and the market will get an excellent look at those tomorrow.