Chicago Board of Trade Market News

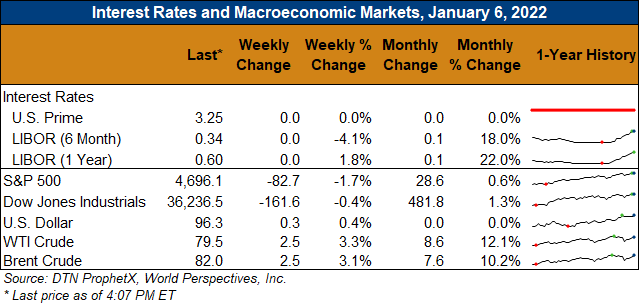

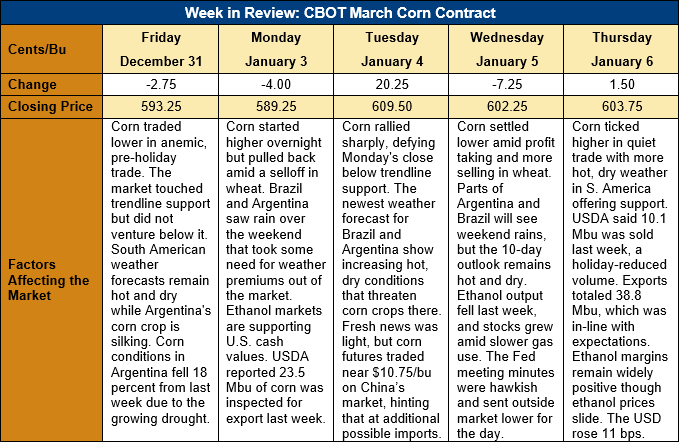

Outlook: March corn futures are 10 ½ cents (1.8 percent) higher this week and have fully erased last week’s declines amid choppy, weather-driven trade. Dry conditions in parts of South America have pushed futures higher even amid a holiday-week slowdown in export trade. The market is increasingly focused on next week’s WASDE report from USDA and futures are starting to enter a sideways pattern as traders position for the new commodity outlooks.

Much of the market’s focus in the past two weeks has been on the hot, dry weather forecast for Argentina and southern Brazil. The weather pattern has perhaps the most immediate effect on the region’s soybean crop, but traders and analysts are evaluating potential impacts on corn too. In Argentina, where 31 percent of the crop (and 55 percent of the early-planted corn) is currently silking, hot temperatures (exceeding 32° Celsius or 90° Fahrenheit) and below-normal rainfall have depressed crop conditions. This week, the Buenos Aires Grain Exchange estimated 40 percent of the crop was rated good/excellent, down 18 percent from the prior week. Notably, however, just 12 percent of the crop was rated good/excellent this time last year. The forecast for the coming 10 days offers little relief, with continued hot temperatures and scattered showers across central Argentina.

The threatening weather forecast for Argentina and southern Brazil has prompted traders to add a “weather premium” to soybean and, to a lesser extent, corn futures. Funds are also positioning for the 12 January WASDE report and are expanding long positions in corn and soybeans. Most analysts expect USDA to leave the South American production outlook unchanged or to make minor cuts, as is the agency’s typical approach in the January WASDE. If USDA maintains that pattern this year, it will lean bearish corn futures in the short-run while the weather forecast will dictate long-run price trends.

The weekly Export Sales report reflected the low-volume trade that occurred between the Christmas and New Years holidays. Net sales totaled 0.256 MMT, down 79 percent from the prior week, while weekly exports were up 7 percent at 0.985 MMT. The export volume pushed YTD exports to 14.65 MMT (down 4 percent) and YTD bookings (exports plus unshipped sales) to 40.996 MMT (down 7 percent). YTD bookings account for 58.6 percent of USDA’s December WASDE export forecast while shipments, due largely to U.S. Gulf shutdowns after Hurricane Ida, total 21 percent of USDA’s projection.

March corn futures have been volatile this week with Monday’s bearish outside day finding no follow through selling and sparking a 20-cent rally on Tuesday. The contract has drifted lower since then but has found support on breaks below $6.00. Technically, trendline support was broken on Monday but trading range support was established at $5.84 ½. Until the WASDE is released, it seems March corn will stick to a $5.84 to $6.16 trading range.