Chicago Board of Trade Market News

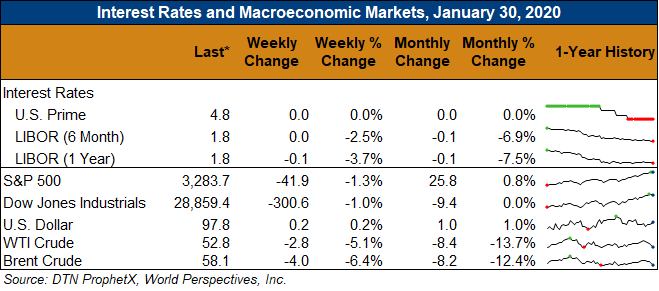

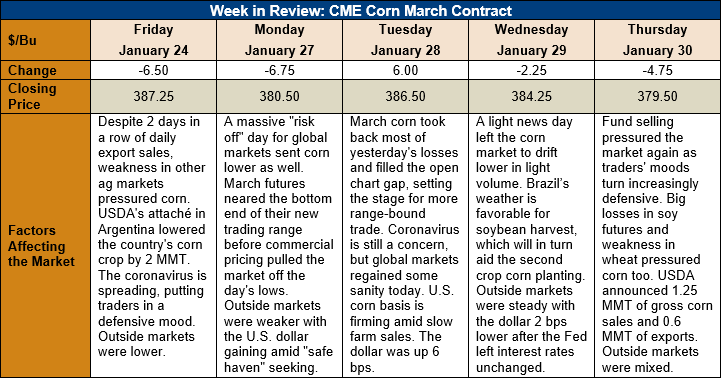

Outlook: March corn futures are 7 ¾ cents (2.0 percent) lower this week after global markets sold off sharply on Monday in response to the coronavirus outbreak. While ag commodities will be relatively immune from demand shocks due to the virus, other industries could be more greatly impacted. That dynamic set into motion widespread “risk off” trade early this week. Corn futures attempted to rally from Monday’s losses, but aggressive fund selling pulled the market back near where it started the week.

The weekly Export Sales report reflected positive developments for the U.S. corn market. Gross sales hit 1.277 MMT for the current marketing year while exports jumped to 681,000 MT, a 74 percent increase from the prior week. YTD exports now stand at 10.5 MMT, down 45 percent from the prior year. Other report highlights include 147,000 MT of sorghum exports and 900 MT of barley shipments. YTD exports for sorghum and barley are up 118 and 12 percent, respectively.

Cash corn prices are mostly steady this week with the national average price reaching $145.95/MT. Basis has strengthened slightly and now averages 9 cents under March futures. Basis in parts of the country remains abnormally high due to solid commercial demand and slow farmer selling. Barge CIF NOLA prices are down 3 percent this week while FOB NOLA offers slightly lower at $176.50/MT. U.S. corn is enjoying a period of significant competitiveness on the world market, which should help exports strengthen in the near term.

From a technical standpoint, March corn has established a new and very wide trading range from $3.75 – 3.94 and is currently working towards the bottom end of that range. Funds are short and are adding to that position, but commercial buying is active on breaks and strong basis levels suggest that will remain the case for some time. With U.S. corn competitive globally and exports starting to pick up, there are good odds the corn market will move higher heading into the spring. However, traders may need to see consistent shipments before moving to the long side of the markets.