Chicago Board of Trade Market News

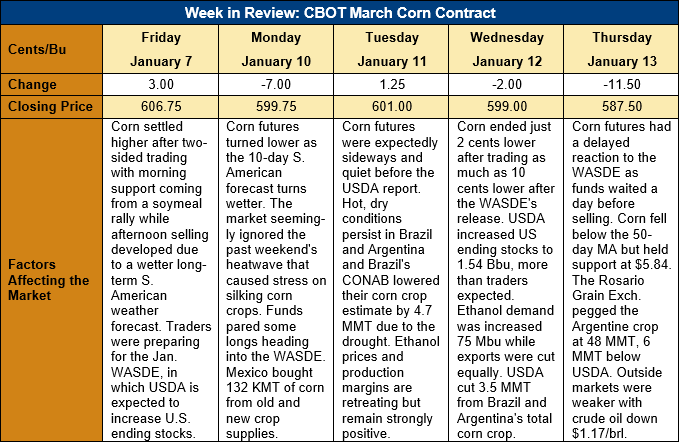

Outlook: March corn futures are 19 ¼ cents (3.2 percent) lower this week as funds pared bullish positions before the WASDE and intensified their selling following the USDA’s report. USDA increased the size of the U.S. crop and 2021/22 ending stocks by more than the market was expecting, which gave the WASDE a bearish interpretation. On Thursday, weather models shifted to expect up to 2 inches of rain over most of Argentina’s crop-growing region, which helped remove some of the “weather premium” that was bid into prices. Now, traders are reacting to the latest WASDE numbers while also trying to account for South American crop prospects and U.S. export demand.

The January WASDE was unique in that, for the first time in 20 years, USDA did not change its estimate of the U.S. corn yield from the November WASDE. Often, USDA will adjust the yield estimate based on improved harvested area data and December grain stocks information from NASS. This year, however, the agency left the 2021 corn yield at 11.116 MT/ha (177 BPA), but increased its harvested area estimate by 121,000 hectares (300,000 acres). The added harvested area put the 2021/22 U.S. corn crop at 383.94 MMT (15.115 billion bushels), the second largest crop on record.

On the demand side of the balance sheet, USDA increased the corn for ethanol use estimate by 1.905 MMT (75 million bushels) based on data from the grain crushings report and the U.S. Energy Information Agency’s 2022 outlook. USDA also increased the amount of corn used for dextrose and glucose by 127,000 MT (5 million bushels) while leaving feed and residual use unchanged. The U.S. corn export program was cut 1.91 MMT (75 million bushels) due to “expectations of increased competition”.

In total, USDA’s changes added 1.194 MMT (47 million bushels) to the 2021/22 U.S. carry-out estimate, now pegged at 39.118 MMT (1.54 billion bushels). The ending stocks-to-use ratio increased slightly and USDA left the average farm corn price unchanged at $214.56/MT ($5.45/bushel).

Outside the U.S., the ongoing drought in southern Brazil and Argentina prompted the USDA to cut production in both countries. USDA estimated the Brazilian crop at 115 MMT, down 3 MMT from its earlier forecast. Note that USDA left its estimate of the safrinha (e.g., second-crop) corn crop unchanged, so continued drought could impact that crop’s potential later this year. Argentina’s corn crop forecast was lowered 0.5 MMT to 54.0 MMT, which is above most private firms’ latest estimates and the Rosario Grain Exchange’s forecast of 48 MMT.

U.S. corn export sales and shipments increased last week, with net sales rising 79 percent to 0.457 MMT and exports totaling 1.01 MMT. The export figure was up 3 percent from the prior week and put YTD exports at 15.6 MMT (down 6 percent). YTD corn export bookings (exports plus unshipped sales) now total 41.45 MMT (down 9 percent) and account for 67.3 percent of USDA’s newest export forecast.

March corn futures were sticking close to the $6.00 mark before the January WASDE but have since started to pull away from that level. Thursday’s trade saw the market come within a half-cent of trading range support at the 3 January low ($5.84 ¾) but buying interest near that level prevented a breach of support. The contract did, however, trade and close below the 50-day moving average, which may be a bearish signal for some technical trading systems.

For now, the market seems to be carving out a sideways range with initial support at $5.84 ¾, followed by support at the 200-day moving average and the 30 November daily low ($5.62 ½). To the upside, resistance lies at $6.00 and then the 28 December daily high ($6.17 ¾). Markets are likely to be choppy and volatile as traders and analysts assess shifting weather forecasts and their implications for the South American corn crops.