Chicago Board of Trade Market News

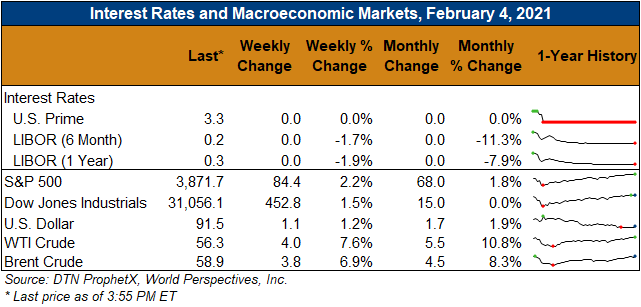

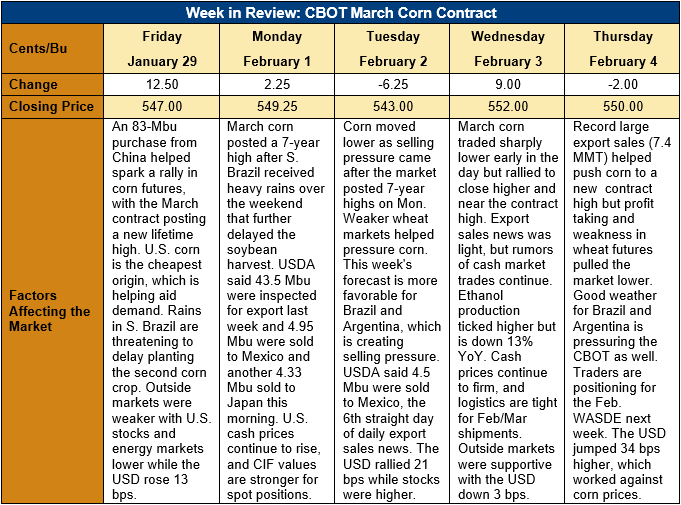

Outlook: March corn futures are 3 cents (0.5 percent) higher this week and posted a new contract high on Thursday as export demand remains supportive. The market has traded a tight range this week from $5.36-5.58, sticking close to its former contract highs or posting new highs as traders are reluctant to be short amid strong export buying. Traders are looking forward to the February WASDE and pre-report positioning is starting to develop and dictate a portion of the daily price action.

U.S. exporters booked a record amount of corn sales last week. UDSA reported 7.436 MMT of net export sales recorded for the week ending 28 January 2021, up 302 percent from the prior week and an all-time record. China was the primary buyer, securing 5.8 MMT, with Japan emerging as the next largest buyer, purchasing 0.5 MMT. Weekly exports were down slightly from the prior week at 0.995 MMT but YTD exports are still up 80 percent at 20.016 MMT. YTD bookings (exports plus unshipped sales) total 56.106 MMT, up 146 percent YTD and accounting for 87 percent of USDA’s 2020/21 export forecast.

Sorghum exports were higher last week at 0.309 MMT, putting YTD exports up 236 percent at 2.7 MMT. YTD sorghum bookings are up 404 percent at 5.8 MMT. Barley exports reached 1,500 MT last week and YTD bookings stand at 30,500 MT, down 37 percent.

U.S. cash prices continue to rally amid the strong export program and light farmer selling U.S. farmers are thought to have sold some 85 percent of the 2020 crop, meaning cash market rallies are seeing little selling pressure. The average cash price across the U.S. is 210.28/MT ($5.34/bushel) this week, up 1 percent from last week and 44 percent above this time last year. CIF NOLA prices are up 2 percent at $247.258/MT and tight logistics are creating even more support for nearby positions. FOB Gulf offers are up 1 percent this week at $255.25/MT for February/March shipment and are among the lowest FOB offers in the world.

The market is primarily focused on demand-side factors, sbut the South American weather continues to exert at least minor influence on prices. The weather forecast for Brazil has turned more favorable for crop development this week, though recent rains in the southern end of the country have delayed the soybean harvest. In turn, that is creating concern for planting the safrinha corn crop (i.e., second-crop corn). While any impacts on corn plantings are at least a month away, the trend is supportive for CBOT futures. This week’s forecast calls for beneficial rains for central and northern Brazil while southern Brazil and Argentina remain drier than average. The dryness remains a concern for Argentina’s crops where drought stress is already evident, but cooler temperatures will help minimize soil moisture draws. Overall, this week’s forecast is largely non-threatening for South America, but the persistence of the La Nina weather event means forecasts are highly variable and more unreliable than usual.

From a technical standpoint, March and May corn futures are trending higher and the March contract continues to post new contract highs. Bull spreading, a hallmark of bull markets, is a feature of the markets and long corn/short wheat spreads have become increasingly popular as well. Neither the March nor May contract is overbought yet, but momentum indicators are approaching overbought levels. Open interest continues to grow in corn futures and options, which helps offset the cautionary sign of lower trading volume occurring with this week’s grind higher. Overall, the market is likely to continue its steady/slightly higher path heading into next week’s WASDE report when the trade will get a fresh look at U.S. and South American fundamentals.