Ocean Freight Markets and Spreads

Ocean Freight Comments

Attacks on maritime vessels using the Red Sea are on-going, though to a lesser degree now that owners and operators of container, bulk and other vessel types are bypassing the Red Sea. The vessel owners and operators are choosing the longer and more expensive route around the Cape of Good Hope, while shippers are evaluating sourcing options. Vessel owners are warning that the Houthis attacks will likely extend into the second half of 2024. The Houthis indicate they will cease their attacks once attacks in Gaza end and humanitarian aid can freely be administered. Meanwhile, the United States and United Kingdom navies continue to counterattack Houthis.

Water levels in Panama’s Gatun Lake were nearly unchanged for the week at 80.8 feet as of February 29, 2024. The water stored in Gatun Lake is used to assist vessels through the canal zone lock system, and for municipal water requirements. By the end of April, the water level is expected to fall more than one foot to 79.6 feet.

The number of daily vessel transits through the Panama Canal is unchanged and limited to 24, down from the normal 36. The vessel draft is also unchanged with the Neopanamax locks at 44 feet, down from 50 feet. Vessel draft at the Panamax locks has not been impacted, standing at 39.5 feet. The freshwater surcharge is now 2.54%, up from last week’s 2.42%. For reference purposes, a water level of 79.5 feet equates to a freshwater surcharge of 4.11% and does not change draft requirements through the Neopanamax locks or the Panamax locks. In April the Panama Canal is expected to give an update on the number of transits and draft restrictions.

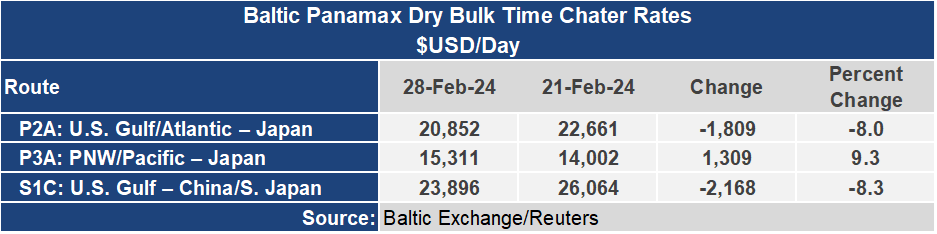

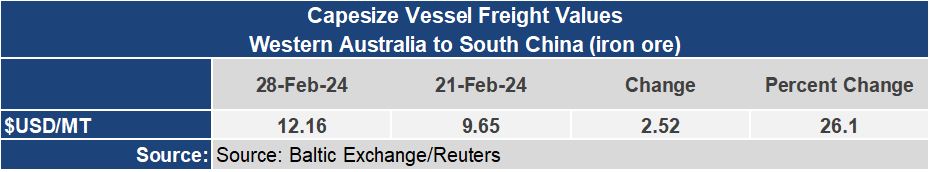

With the Chinese New Year celebrations in the rearview mirror, attention is given to the strength of the Chinese economy. Rumblings of improved iron ore shipments for China are emerging and that has been supportive to the Baltic Dry Index. The Baltic Dry Index jumped nearly 22% or 365 points to an index of 2,041 this week, making gains nine consecutive days, and a level last seen in early January this year. The Capesize market was the star of the index gaining more than 41% for the week or 1,053 points to an index of 3,596. Demand for iron ore is giving optimism to the Capesize sector. The Panamax sector, however, lost 46 points or nearly 3% this week to an index of 1,627. The Supramax market is maintaining a firmer tone, up 12% on the week to 1,239.

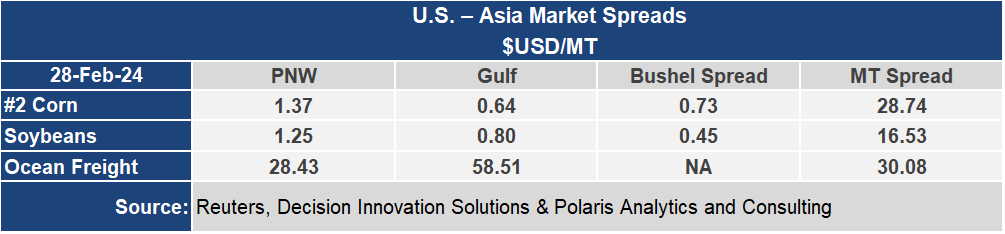

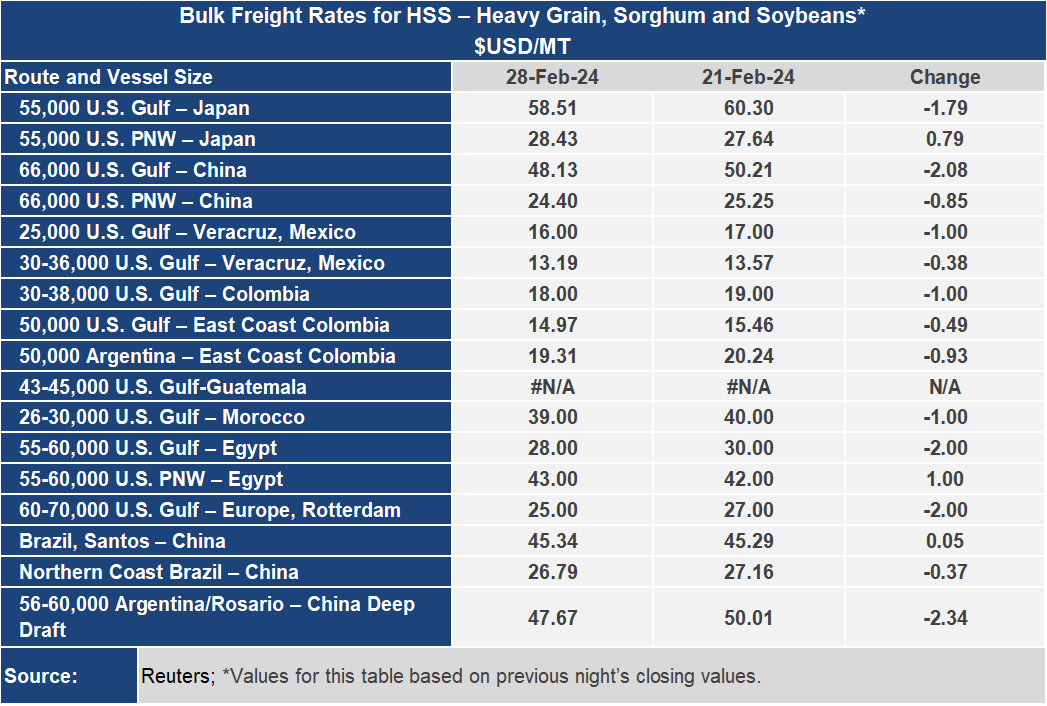

Dry bulk voyage rates were mixed on the key grain routes this week, with most routes lower. Out of the U.S. Gulf to Japan the rate was 3% lower to $58.51 per metric ton for a 55,000 metric ton shipment, while out of the Pacific Northwest the rate was up nearly 3% to $28.43 per metric ton. The spread between these key routes narrowed nearly 8% or about $2.60 per metric ton to $30.08 per metric ton.

Confidence in the Forward Freight Agreements (FFAs) for Panamax and Supramax vessels for March and April sailings is ensuing with strengthening daily values. Panamax timecharters for March were up $1,000 per day for the week to $16,200, and for April ended the week at $18,200 per day, gaining $1,800 per day for the week, the highest level since FFAs first started being posted for April. The Supramax FFA for April gained $850 per day for the week to $16,800 per day.