Chicago Board of Trade Market News

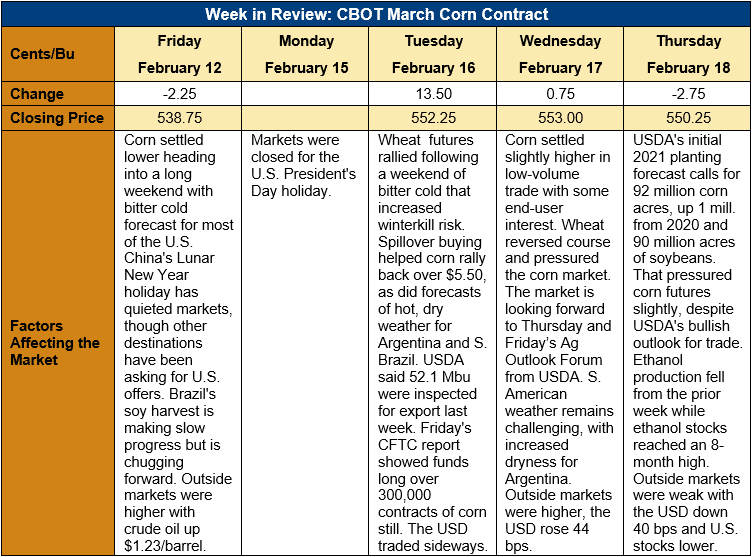

Outlook: March corn futures are 11 ½ cents (2.1 percent) higher this week as a resurgence of Argentine drought concerns and steady end-user buying have supported values. The market has steadily ground higher in mostly low-volume trade during the U.S. holiday-shortened week. Much of the trade’s attention on Thursday was dedicated to the USDA’s annual Ag Outlook Forum, which offered the agency’s first full look at the 2021/22 crop year.

USDA’s annual Ag Outlook Forum issued a favorable/bullish outlook for U.S. ag commodities in the coming year. Total agricultural exports for 2021/22 were forecast at a record high of $157 billion, of which China expected to take $31.5 billion. U.S. 2021/22 corn exports are expected to increase from the current year based on China’s recovering hog inventories, though USDA has not yet quantified its 2021/22 corn export forecast. The agency also issued a 2021/22 corn price forecast of $165.35/MT ($4.20/bushel), down just 10 cents/bushel from the projected 2020/21 average price.

The USDA said it expects 73.653 million hectares (182 million acres) to be planted to corn and soybeans combined in the U.S. in 2021. Of that, corn is currently expected to be planted on 37.2 million hectares (92 million acre) and soybeans to 36.42 million hectares (90 million acres). The corn acreage forecast is up 0.405 million hectares (1 million acres) from 2020 while the soybean acreage reflects a 2.79-million-hectare (6.9-million-acre) increase.

The latest weather forecasts show the La Nina event in the Pacific Ocean strengthening, meaning it is likely to persist into mid- to late-spring. That will continue to threaten Argentina and Brazil with below-average precipitation, and the U.S. Plains and Southwest are likely to see similar dryness. This week’s forecast for Argentina features below-average rainfall and above-normal temperatures, which may create modest yield reductions. The current two-week forecast offers slightly better chances of precipitation, but confidence in models is low.

The weekly Export Sales report is delayed until Friday due to this week’s U.S. President’s Day holiday, but Tuesday’s Export Inspections report was supportive for corn. The report featured 1.3 MMT of inspections, down from the prior week but above pre-report expectations. YTD inspections total 22.7 MMT, up 84 percent. The USDA also reported 70,000 MT of sorghum inspections, all destined for China, which puts YTD inspections up 154 percent at 3.3 MMT.

U.S. cash prices and basis remain firm with bitter cold and snow across the Midwest creating logistical challenges and supporting bids. The average cash price in the U.S. is $211.07/MT ($5.36/bushel), up 3 percent from last week. Basis has narrowed to 17 cents under March futures (-17H), up slightly from -18H last week. Barge CIF NOLA offers are up 2 percent as of Thursday afternoon’s trade, following a volatile week. FOB NOLA offers for March are up slightly at $252/MT.

From a technical standpoint, March and May corn futures have entered a sideways trading pattern with support at last Thursday’s lows and various moving averages. Despite the bearish key reversal following the February WASDE, follow-through selling and position liquidation has been limited. Indeed, the latest CFTC Commitments of Traders’ report showed managed money funds still holding a near-record large long position of over 300,000 contracts. The market seems to be waiting for signs of Chinese demand following that country’s week-long Lunar New Year holiday as well as the outlook for the Brazilian safrinha corn crop. End-user demand remains steady and evident on breaks, which will likely keep the corn market trading sideways heading into March.