Chicago Board of Trade Market News

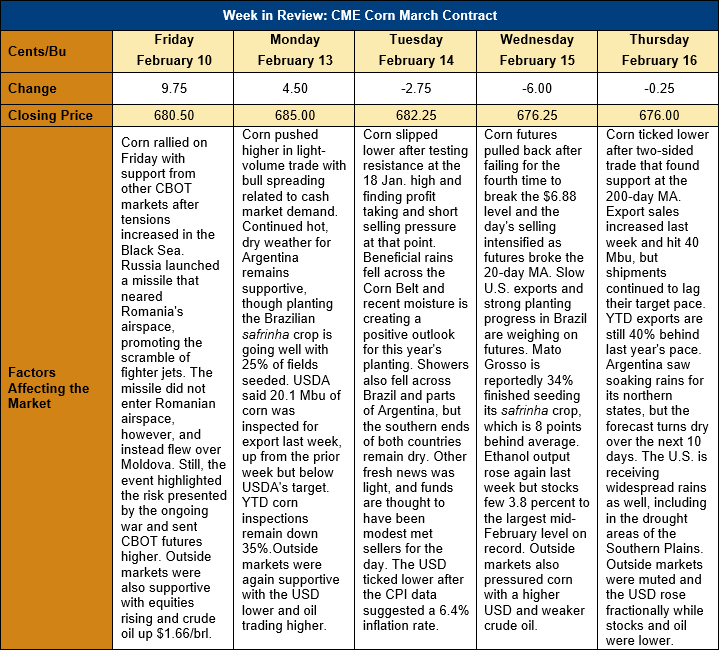

Outlook: March corn futures are down 4 ½ cents (0.7 percent) this week as the market falls away from technical resistance near $6.90. Last Friday saw a quick rally in corn and other CBOT markets after Russia launched a missile that threatened Romania’s airspace. The missile instead flew over Moldova and avoided impacting a NATO nation (Moldova is not part of the organization), but the event put traders on alert over the ever-present risks from the war in Ukraine. After a brief rally Friday and Monday, however, futures turned sideways with little fresh news to drive market direction. Amid the lack of news and with the February WASDE report come and gone, corn futures are largely trading U.S. export trends, the South American weather, and developments in basis and cash prices.

U.S. corn gross export sales increased from last week and totaled 1.094 MMT while exports rose 70 percent to 0.670 MMT. That volume is still below what was needed to keep pace with the USDA’s February WASDE projection of 48.897 MMT (1.925 Mbu) of 2022/23 exports. YTD exports total 13.676 MMT (down 39 percent) while YTD bookings total 27.8 MMT (down 40 percent) and account for 56.9 percent of USDA’s projected 2022/23 export program.

The South American weather continues to hold mixed implications for the U.S. and global corn markets. Despite recent rains in northern Argentina, most of the country continues to suffer from drought and forecasts for the next 7-10 days offer more heat and dry conditions. The late-planted corn crop has so far avoided the worst of the drought that hurt the early corn crop and soybean yields but the upcoming weather forecasts are not encouraging. Conversely, the Brazilian safrinha crop is being seeded under nearly ideal conditions in the central part of the country, though planting is slightly delayed to due wet weather hampering the soybean harvest. The extent to which the Brazilian crop can offset any production shortfall in Argentina will play a major role determining the market’s direction until the Northern Hemisphere crops arrive.

U.S. cash prices remain historically strong with basis averaging 8H (8 cents over March futures) across the Midwest. Basis has fallen slightly in recent weeks but remains near 20-year highs in parts of the country and the average basis is well above the -12H recorded this time last year. U.S. Midwest corn prices average $269.49/MT ($6.76 ¼/bushel) this week.

Technically, March corn futures have turned sideways after they failed to break above major technical resistance at $6.88 ¾ for the fourth time. Futures pulled back in quiet volume in late-week trade but managed to find support a the 20-day moving average on Thursday. The light trading volume present in this week’s pullback indicates it may be short-lived (major market moves usually develop with heavy and growing trading volume). March corn has trendline support at $6.64 ½.