Ocean Freight Markets and Spreads

Ocean Freight Comments

The Houthis terrorist attacks on vessels using the Red Sea to access the Suez Canal have no let up. In fact, the attacks are increasingly focused on vessels that have ties to Israel, the United States or United Kingdom. For example, vessel owners whose companies are listed on trade exchanges in the U.S. are being attacked, even though a vessel of theirs might be delivering cargo to Iran. It is believed that Iran is funding the Houthis and that vessels serving Iran are protected. But this last week at least one vessel destined for Iran was attacked, most likely because the parent company is listed on a U.S. trade exchange. Now additional dry bulk owners and operators are diverting vessels away from the Red Sea, and the Suez Canal, and opting for longer routes around South Africa’s Cape of Good Hope. The longer route nearly doubles the transit time and increases costs and freight rates as a result.

The number of daily vessel transits across the Panama Canal is limited to 24 to conserve the amount of water used to flush vessels through the network of locks. If water levels in Gatun Lake hold steady during the dry season that started in January and typically runs into the month of May then vessel transits will hold firm. However, water levels are slowly falling, with a reading of 81.0 feet for February 15, 2024, and are expected to fall 79.6 feet by mid-April. Water levels during April average 82.9 feet. Normally the number of daily vessel transits is about 36. The freshwater surcharge is 2.31% this week, up from 2.21% last week. Very few dry bulk vessels handling grain and soybeans from the United States are transiting the Panama Canal during this lower water event.

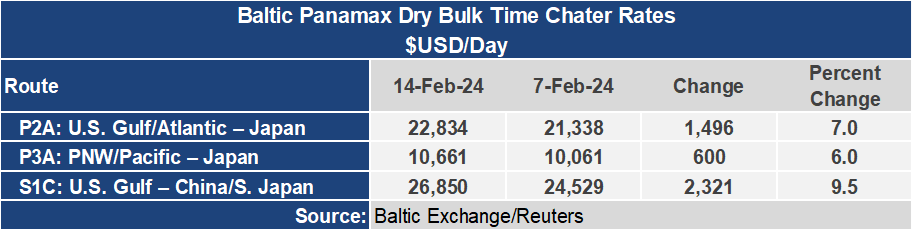

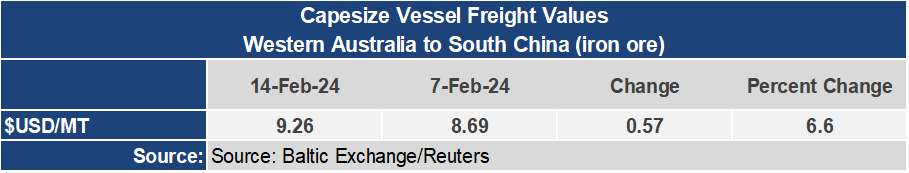

The Baltic Dry Index rebounded this last week, gaining 95 points or 6.4% to an index of 1,582. The Panamax sector was the star of the show during the week, gaining 173 points or 7.6% to 1,582. The Supramax market was mostly unchanged, ending the week at 1,052 while the Handysize was down fractionally to 566. Despite China celebrating its Lunar New Year that runs through February 24, and its economy rather dour, the dry bulk markets have some support from iron ore and grain loadings out of Brazil. And with more carriers opting to divert away from the Red Sea, the dry bulk sector is seeing a trickle down affect where vessel capacity utilization is rising as a result.

The Forward Freight Agreements (FFAs) for Panamax and Supramax vessels for March and April sailings were firmer this week, pointing to higher freight rates on the horizon. Panamax timecharters for March were up $600 per day for the week to $16,100, the highest this FFA for March has been. For April the Panamax timecharters settled at $17,000 per day for the week, up $900 during the week.

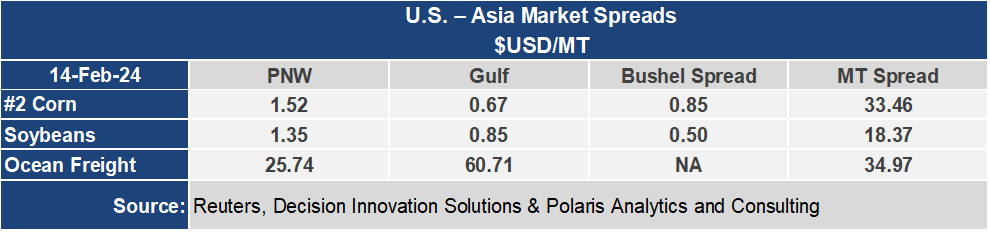

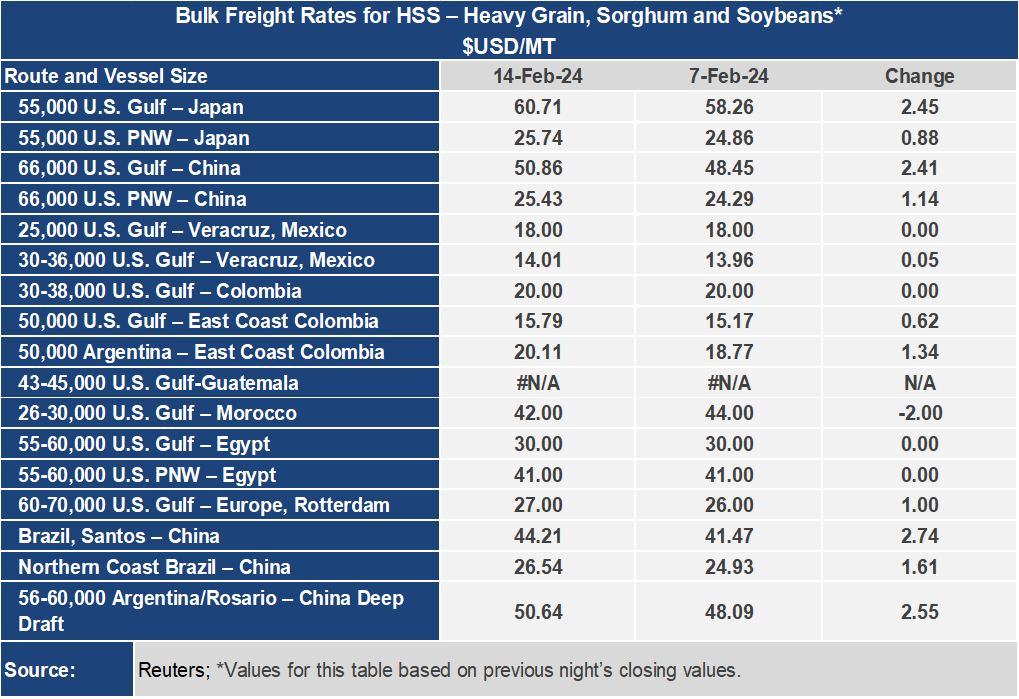

Dry bulk voyage rates on most grain routes were firmer this week. Out of the U.S. Gulf to Asia route the rate to China was up 5% to $50.86 per metric ton while the rate from the Pacific Northwest was up similarly to $25.43. The spread between these venerable routes widened more than 5% to $25.43 per metric ton.

Container freight rates reflect bifurcated patterns. For shipments in forty-foot equivalent containers from China to the West Coast United States the rates have nearly tripled since the Houthis started attacking vessels in the Red Sea from last November, with index currently sitting at 4,659. Meanwhile, for freight in the same containers from the U.S. West Coast back to China, freight rates are essentially unchanged to an index of 701. The westbound rate is supportive for U.S. exports.