Chicago Board of Trade Market News

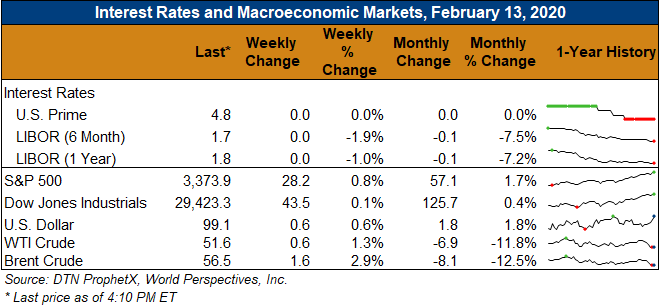

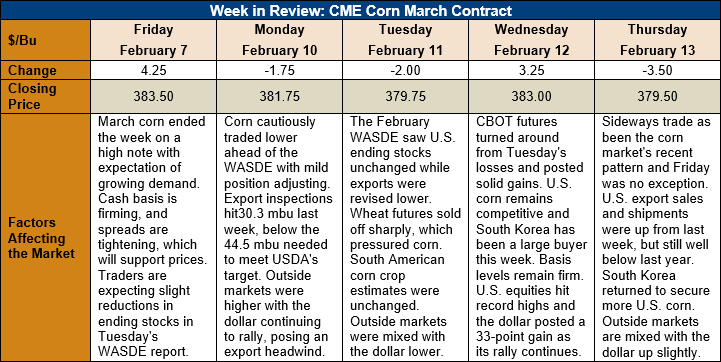

Outlook: March corn futures are 4 cents (1 percent) lower this week as trading has been decidedly range-bound and sideways. The February WASDE, as expected, offered few surprises but also failed to lower U.S. ending stocks like the trade had anticipated. That slightly bearish event was offset by attitudes that the worst of China’s coronavirus outbreak has passed and that demand/U.S. exports might pick up again soon.

The February WASDE left U.S. 2019/20 ending stocks unchanged after making equal increased to the ethanol use forecast and reductions to the export outlook. Ethanol use of corn for 2019/20 was increased by 1.27 MMT (50 million bushels) and exports were reduced by an equal amount. Traders were expecting a slight reduction in ending stocks, so the report came with a slightly bearish interpretation.

USDA made few changes to the 2019/20 sorghum and barley outlooks, boosting food, seed, and industrial sorghum use by 0.127 MMT (5 million bushels). That translated to an equal reduction in ending stocks and USDA lowered its price outlook by 5 cents/bushel. The agency increased the 2019/20 barely export forecast by 1 MMT and lowered ending stocks equally while leaving the price forecast unchanged at $4.60/bushel.

Outside the U.S., the biggest feature of the February WASDE was that USDA left its forecasts of Brazilian and Argentine corn production unchanged at 101 and 50 MMT, respectively. USDA lowered its estimate for Brazil’s 2019/20 ending stocks to 4.28 MMT, the lowest level since 2011. The estimate for world corn production was increased 0.75 MMT while ending stocks were lowered 0.97 MMT due to higher trade forecasts. USDA left China’s 2019/20 corn balance sheet unchanged.

The weekly Export Sales featured 1.007 MMT of gross sales of corn while exports totaled 782,800 MT, up 31 percent from the prior week. YTD exports now stand at 11.89 MMT, down 38 percent from the prior year. Other report highlights include 84,300 MT of sorghum exports and 1,000 MT of barley shipments. YTD exports for sorghum and barley are up 149 and 20 percent, respectively.

Cash corn prices are mostly steady this week with the national average price reaching $144.98/MT. Basis has strengthened slightly and now averages 9 cents under March futures. Barge CIF NOLA prices are steady this week while FOB NOLA offers are down fractionally at $176.50/MT. U.S. corn remains among the cheapest available origins globally, which should continue to support U.S. exports.

From a technical standpoint, March corn is range-bound and trending sideways until some fundamental news creates a breakout. With the deadline for China’s implementation of the Phase One trade deal agreement around the corner, funds are hesitant to remain short with exports potentially picking up very soon. This is helping create support for the futures market, as are firmer basis levels around the U.S. Corn prices tend to grind higher during this time of year but the 2019/20 crop has been full of anomalies, leaving seasonal indications less reliable than usual. With the February WASDE behind, the market is now looking for early estimates of 2020 crop acres as well as any signs of stronger exports.