Ocean Freight Markets and Spreads

Ocean Freight Comments

The dry bulk ocean freight market has been a yo-yo. Much like the toy with a string wrapped around an axis, when released, gravity takes over and as the string reaches its maximum it reverses course and winds itself back up. That has been the pattern with dry bulk ocean freight rates during the first month of 2024. The closely watched Baltic Dry Index for example, started 2024 where it left off with 2023, with gravity pulling it lower. But it seemed it found a bottom and tried to wind back up before losing ground as gravity pulled it lower, ending January down by more than one-third for the month to an index of 1,398. Admittedly, the index is more than double where it was one year ago.

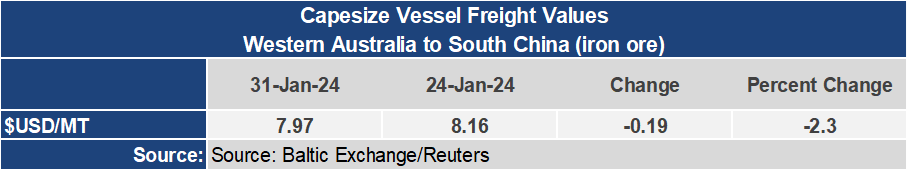

Despite the terrorist attacks on vessels plying the Red Sea, leading vessel owners and operators to use alternative longer routes such as sailing around the Cape of Good Hope, dry bulk ocean freight rates are responding more to weakened demand. And news out of China is not encouraging with manufacturing marking its fourth monthly contraction while housing is in disarray. China is experiencing deflationary pressures and weakened demand for its products and goods that need to be shipped, ergo, less raw ingredients to manufacture such products. And China will be celebrating its New Year starting February 10 through February 20, historically a slower period for vessel demand, which will further exacerbate the situation.

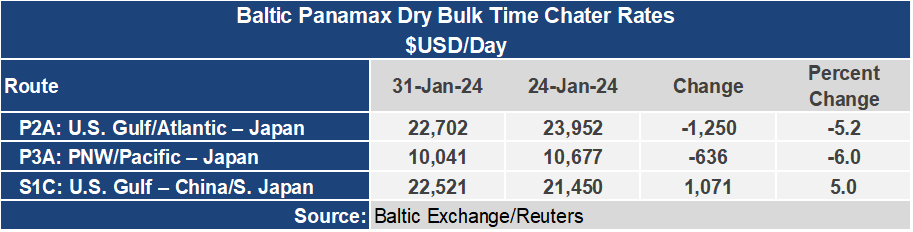

This week the Forward Freight Agreements (FFAs) for Panamax and Supramax vessels lost momentum. Panamax time charters for February peaked at over $14,000 per day one week ago, falling nearly $1,700 for the week to $12,300. A similar pattern is playing out for March with the current FFA pointing to $14,800 per day. The Supramax market is reflecting a similar tendency, with rates for March having peaked at $15,300 per day about ten days ago and have fallen to $14,500.

The water level of Gatun Lake in Panama was slightly lower for the week to 81.2 feet, about six feet below normal for this time of year. Rain is being forecast over the next ten days that will provide some relief, but it will not be enough to recharge Gatun Lake that is an important reservoir used to flush ships through the Panama Canal system of locks. The freshwater surcharge is 2.11% this week, up from 2.01% last week. Daily vessel transits are limited to 24, down from 36 during normal navigation conditions. This is Panama’s dry season that runs through May.

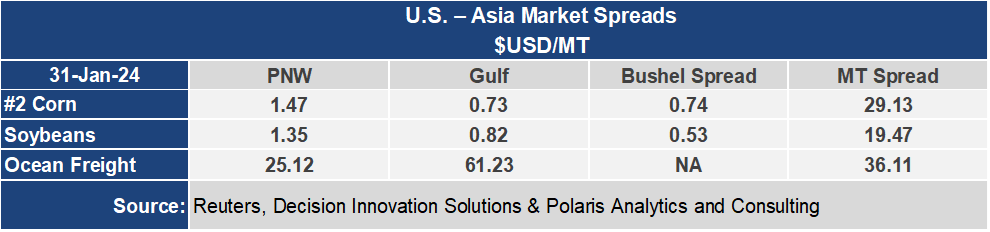

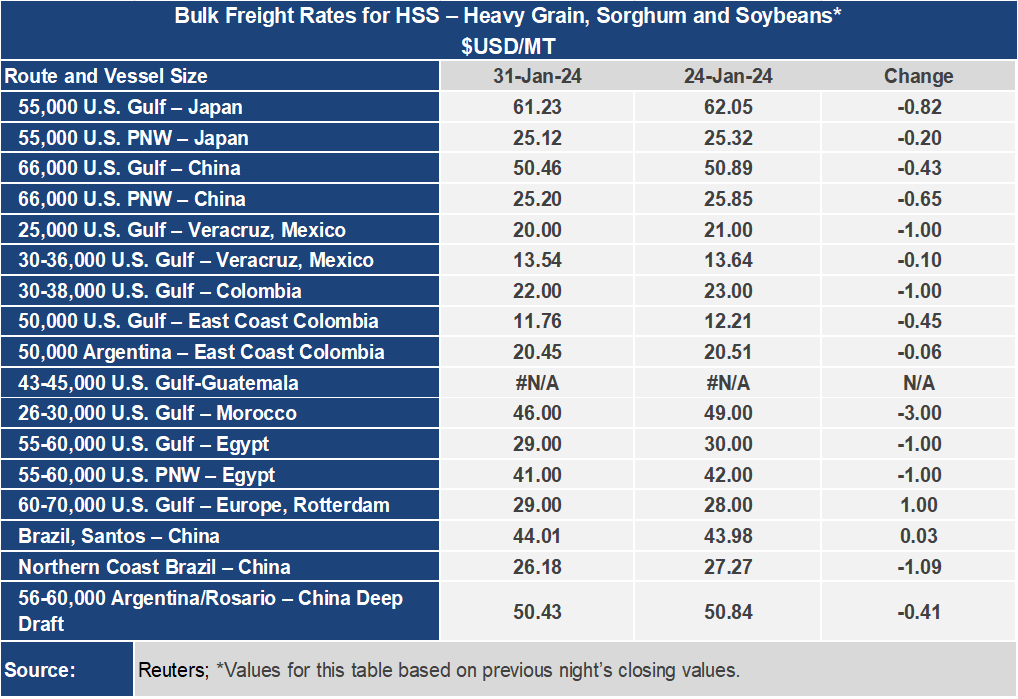

With weakness in the dry bulk sector, voyage rates fell commensurately this week. The U.S. Gulf to China route was down $0.43 per metric ton or 0.8% to $50.46 per metric ton this week. For the month of January, this route was down nearly 4%. Out of the Pacific Northwest the rate to China ended the week at $25.20 per metric ton, down 2.5% or $0.65 per metric ton. And for the month of January, this rate was down 6%.