Ocean Freight Comments

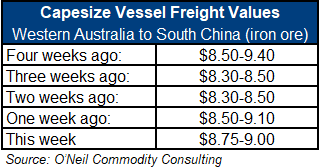

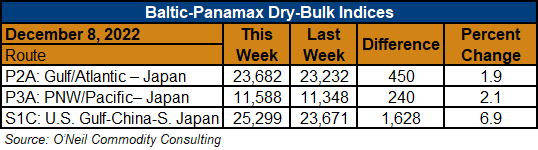

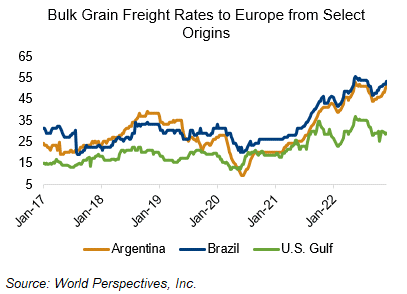

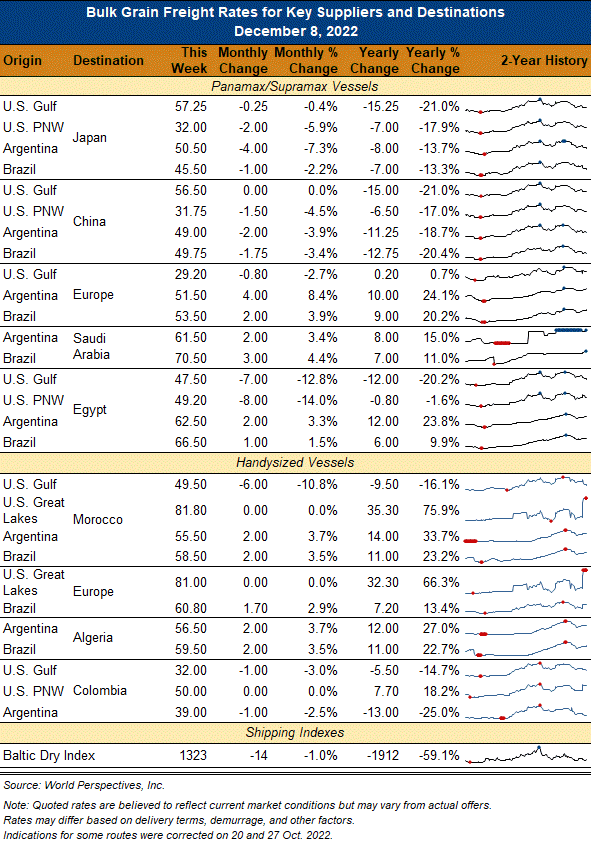

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: For some months now, dry-bulk markets have been an up and down affair with the overall direction moving lower. For most freight traders, these have been dull markets and the outlook for the next few weeks is not promising much change. As has been mentioned many times before, much depends on China. Vessel owners are pinning hopes on a relaxation of Chinese covid-19 restrictions and a reopening of their economy.

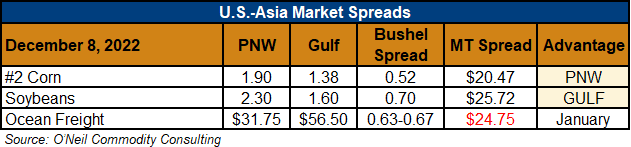

If China makes such policy moves, it will be the big story of 2023. The market must first, however, get past the Lunar New Year celebrations that arrive on 22 January. The decrease in dry-bulk freight rates and the high cost of fuel is causing some owners to shy away from blasting to South American unless they have firm cargo business. This should provide better vessel availability in the U.S. PNW and Gulf.

The low water situation on the Mississippi River improved this week and barges are now loading to 9.0-9.6-foot drafts. Mother Nature will determine how much more rain comes to improve this situation.

The ILWU union container port contract negotiations are continuing without resolution and talks are expected to go into early 2023. The rail strike threat has been resolved but the slow service situation has not.