Ocean Freight Markets and Spreads

Ocean Freight Comments

The port and terminal labor contract between the International Longshore Association representing labor along the U.S. East and Gulf Coasts and the U.S. Maritime Alliance expires January 15, 2025. Since agreeing to wages in October and otherwise extending the contract at that time, they are negotiating a final contract. The key sticking point is automation at container terminals and the ILA is taking a hard stance to reject further automation on the docks. Each side has been posting their views through their social media outlets. In the meantime, shippers and vessel owners and operators are preparing for a strike by seeking alternative supply chain solutions and contingencies.

The U.S. led military alliance protecting vessel transits through the Red Sea while destroying Houthi’s drone and unmanned equipment has kept activity quiet. The Houthi’s have attempted to attack U.S. flagged vessels while directing efforts directly toward shoreside port assets in Israel. Vessel owners and operators continue to bypass the Red Sea and Arabian Peninsula, opting to use the longer route around the Cape of Good Hope to serve markets in the Middle East and Mediterranean with Asia.

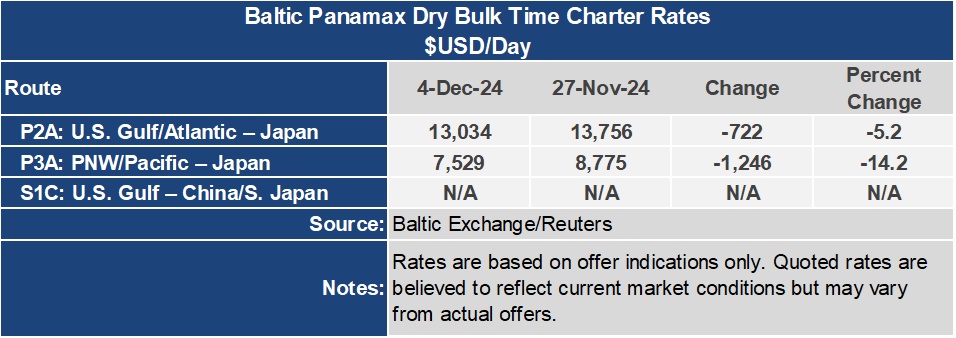

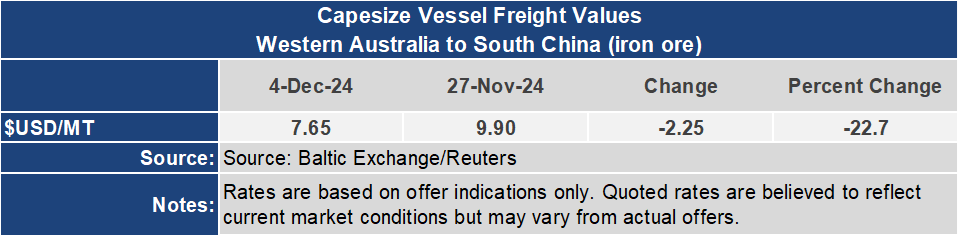

Freight rates have weakened to levels not experienced since August and September of 2023. The Baltic Capesize Index tumbled 37.4% this past week, dropping 960 points to an index of 1,609, its lowest level since September 2023. The weakness of the BCI has pulled down the Baltic Dry Index that lost 21.8% for the week, shedding 329 points to an index of 1,180, its lowest reading since September 2023. The Baltic Panamax Index lost a mere 2.9% or 30 points for the week to an index of 1,014 and about its lowest since August 2023. The Baltic Supramax Index was nearly unchanged for the week at an index of 651 and is at its lowest level since August 2023.

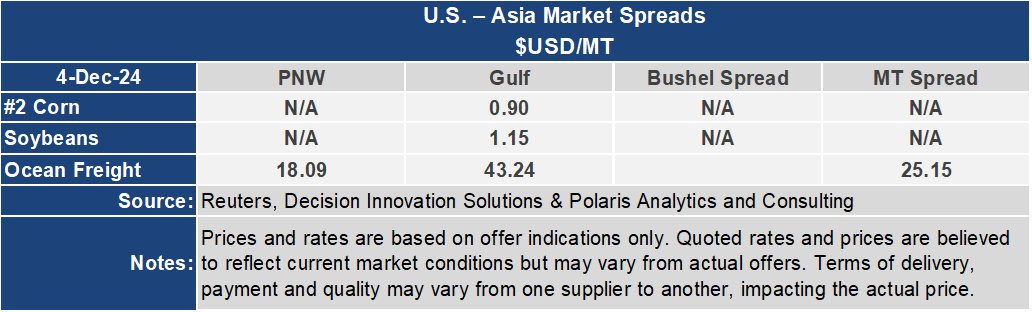

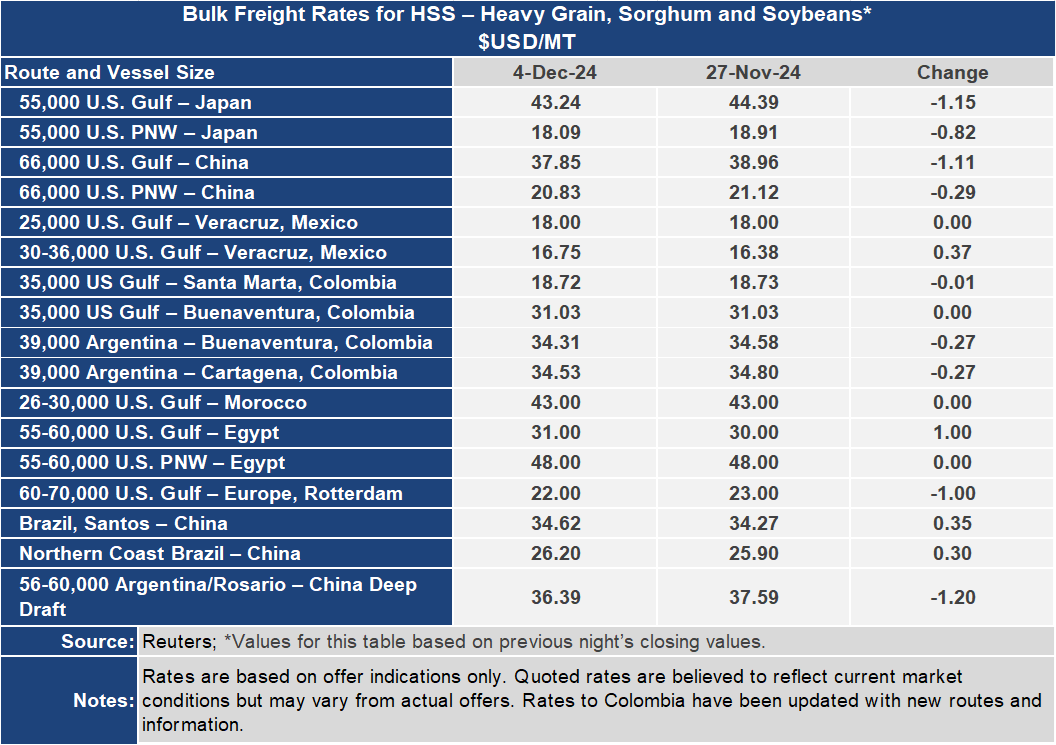

The voyage rates are essentially lower on all routes. To Japan from the U.S. Gulf, the rate ended the week down $1.15 per metric ton or 2.6% lower to $43.24 per metric ton and is essentially the lowest level since January 2021. From the Pacific Northwest to Japan the rate was down 4.3% or $0.82 per metric ton to $18.09 per metric ton. This rate is the lowest in over two years. The spread on these venerable routes narrowed $0.33 per metric ton or 1.3% to $25.15 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf ended the week 2.8% or $1.11 per metric ton lower to $37.84. From the PNW the rate to China was down 1.4% or $0.29 per metric ton to $20.83. The spread on this route narrowed by 4.6% or $0.82 per metric ton to $17.02 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.

Container rates from the U.S. to the Far East are displaying mixed results. From the U.S. West Coast the rate is down 7% from one year ago while maintaining a rangebound trend since early October. From the U.S. East Coast the rate is up 24% from one year ago, jumping higher in late June ahead of the International Longshore Association labor action against the U.S. Maritime Alliance. Despite resolving wages and extending the previous contract in October, the ILA is poised to strike once again on January 15, 2025. The key negotiating issue is container terminal automation that the ILA is opposed to.