Chicago Board of Trade Market News

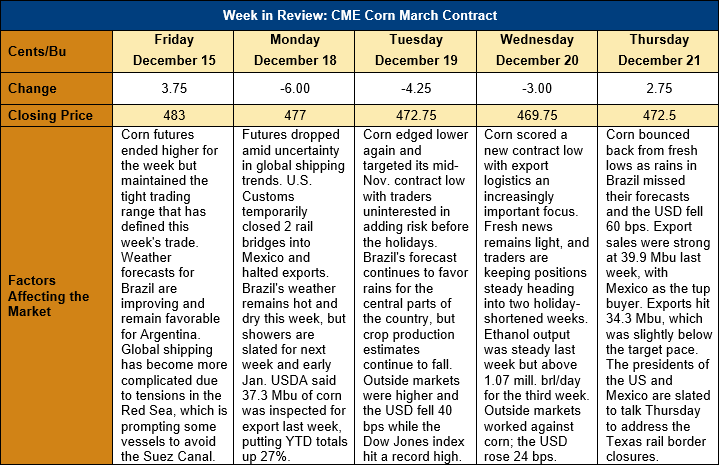

Outlook: March corn futures are 10 ½ cents (2.2 percent) lower this week after they scored a new contract low on Wednesday. Complications in ocean freight and logistics – primarily from the restrictions in the Panama Canal and tensions in the Red Sea causing some vessels to avoid the Suez Canal – exerted pressure on commodity markets this week. Earlier in the week, more favorable forecasts for Brazil’s weather helped push the market lower, but actual precipitation so far has been disappointing and led futures to rebound on Thursday.

Despite shipping challenges, U.S. corn exports rose 2 percent last week to 870.9 KMT with gross sales of 1.15 MMT. The week’s activity put YTD exports at 10.429 MMT (up 27 percent) and YTD bookings (exports plus unshipped sales) at 28.179 MMT (up 37 percent). Corn bookings now account for 52.8 percent of USDA’s 53.34-MMT December WASDE export forecast and shipments total 20 percent of the agency’s projection.

Demand for U.S. sorghum remains strong and export sales rallied sharply last week to 243 KMT with net sales of 237.2 KMT (up 204 percent). Exports were slightly lower than the prior week at 252.1 KMT but YTD exports now total 1.627 MMT (up 823 percent) while YTD bookings total 3.9 MMT (up 981 percent).

Midwest basis levels are strengthening on the heels of strong domestic and export demand. Ethanol production was essentially steady last week and posted its third straight week above 1.07 million barrels/day. The weekly corn grind totaled an estimated 2.754 MMT (108.4 million bushels), which was 191 KMT (7.5 million bushels) more than needed to keep pace with USDA’s 2023/24 use forecast. That, combined with the recent strength in exports helped pull the aveage Midwest basis higher this week to -31H (31 cents below March futures).

Technically, March corn futures are drifting lower and looking for support, which will likely not be far away with values near the psychologically important $4.70 level and U.S. export offers among the cheapest in the world. Corn futures posted a higher day Thursday after they scored new contract lows the prior day, which indicates additional downside potential may be limited.