Chicago Board of Trade Market News

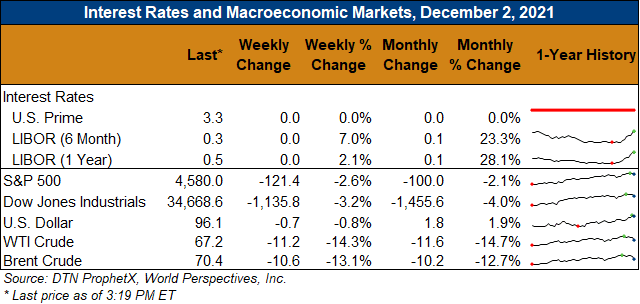

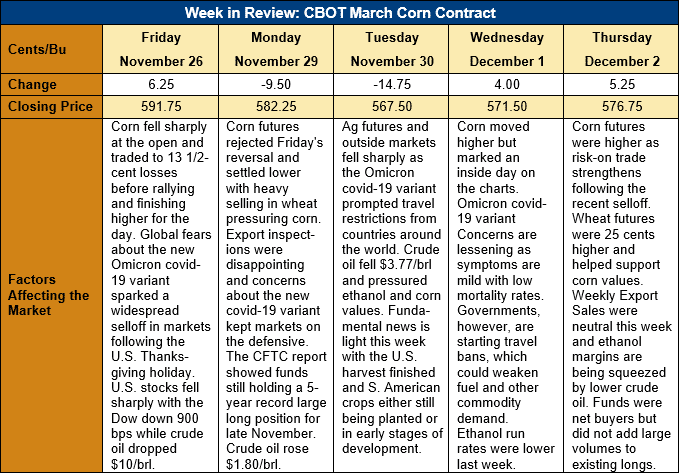

Outlook: March corn futures are 9 ¾ cents (1.7 percent) lower this week as concerns about the new Omicron variant of the covid-19 virus sparked significant volatility in global markets. Crude oil and other energy markets have borne the brunt of the selling, but equities, currencies, and ag markets have also seen volatile trade. Corn futures have also been pulled higher and lower by even more pronounced volatility in wheat futures, though the fundamental outlook for corn has changed little in the past two weeks.

The U.S. corn harvest is essentially completed with USDA reporting 95 percent of fields were harvested as of Monday’s Crop Progress report. That pace is above the five-year average of 87 percent and the quick harvest completion has allowed basis to strengthen earlier than normal this year.

Cash basis levels are steady with last week at -11Z (11 cents under December futures) but are above the -17Z recorded this time last year. Strong ethanol margins and increased production from that industry have supported basis, with most regions of the Corn Belt seeing stronger-than-average basis. Farmers have also been focused on harvest and fall fieldwork rather than marketing grain, which has further prompted elevators and end-users to increase bids to secure physical supplies. This year’s basis strength continues to support futures values and is enabling U.S. and international end-users to remain aggressive on breaks in the market.

The weekly USDA Export Sales report featured 1.02 MMT of net corn sales and 0.938 MMT of exports. Exports were up 1 percent from the prior week and were in-line with pre-report expectations. The week’s activity put YTD bookings (exports plus unshipped sales) at 35.4 MMT, down 7 percent from 2020. Three months into the 2021/22 corn marketing year, YTD bookings account for 50.7 percent of USDA’s projected total.

March corn futures have maintained a sideways trading pattern despite the volatility and weakness in other ag and outside markets these past two weeks. Rallies above $5.90 continue to see selling pressure and profit taking while Tuesday’s selloff found solid support at $5.62. March corn seems to be trading a range from $5.60 to $5.90 with additional support lying at $5.57 (the 9 November daily low) and the 100-day moving average ($5.55 ½). Funds still hold a five-year record large long position in corn futures, which is a supportive factor for the market. The fact corn futures did not selloff more sharply during the Omicon variant volatility points to solid underlying support for the market. Seasonally, corn futures tend to strengthen from harvest into the following spring, and, so far, that trend seems to be holding true this year.