Chicago Board of Trade Market News

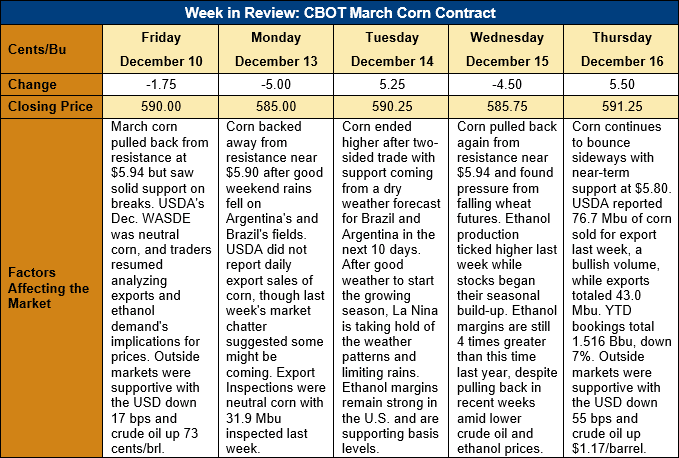

Outlook: March corn futures are 1.25 cents (0.2 percent) higher this week as choppy, sideways, pre-holiday trade has dominated the market since the December WASDE. USDA’s report last week failed to offer either bulls or bears much directional influence, and corn has traded steadily sideways with neither rallies nor breaks finding sustaining trade. Wheat futures and the soy complex have been volatile this past week and have held conflicting influences for corn, further solidifying corn futures’ sideways pattern. Heading into the new year, both technical and fundamental factors point to continued range-bound trade for the yellow feed grain.

Corn export sales and exports were strong for the week ending 9 December, with USDA reporting 1.948 MMT of net sales and 1.093 MMT of exports. Net sales were up 72 percent from the prior week and shipments climbed 21 percent. YTD exports total 11.64 MMT, down 3 percent, while YTD bookings are down 7 percent at 38.5 MMT. USDA also reported 0.331 MMT of sorghum net sales (up 5 percent from last week) and 0.118 MMT of exports (down one-third from the prior week).

Ethanol margins have pulled back from recent, multi-year highs, but USDA’s latest estimate shows Iowa ethanol plants received a gross margin (the difference between the value of ethanol and DDGS and the cost of corn) of $3.72/bushel. That’s down from $4.70/bushel the prior week but well above $0.97/bushel recorded this time last year. The surging value of ethanol and ethanol margins has been one of the major supporting factors for corn markets in the 2021/22 marketing year so far.

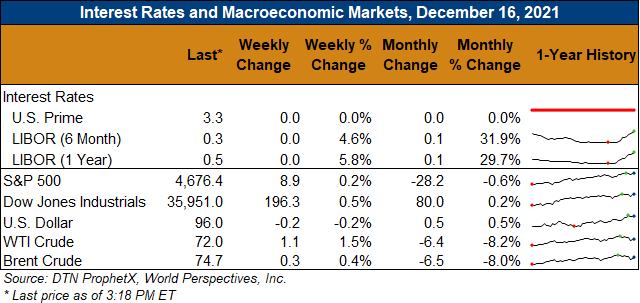

On Wednesday, the U.S. Federal Reserve said it will keep interest rates unchanged and near-zero for now but that the central bank expects to raise interest rates three times next year. Market expectations currently suggest the first two rate increases will come in April and July 2022, with September being a likely month for the third increase.

This may have two important implications for corn and broader commodity markets. First, inflationary pressures are likely to continue into at least Q2 2022, and inflation often prompts fund managers and investors to seek real asset exposure. Consequently, investment in commodities, including crude oil and agriculture, could increase further in early 2022. Second, low interest rates are generally favorable for U.S. economic and stock market growth, which means diminished risks of corn and other commodity markets suffering from macro-market selloffs. While the Fed’s latest comments are not directly bullish corn markets, they provide a supportive background heading into the new year.

March corn futures remain range-bound with support developing this week near $5.80 and long-term support lying near $5.60. The market continues to find stiff resistance at and above $5.94, which still forms the trading range high for now. A strong close above that point could create a rally to $6.00 or $6.25, but follow-through buying has been limited on any strength above that point so far. With many traders taking time off for the holidays these next two weeks, trading volume and follow-through trading interest will likely be further diminished. That will continue to favor choppy, range-bound trading heading into 2022.