Ocean Freight Comments

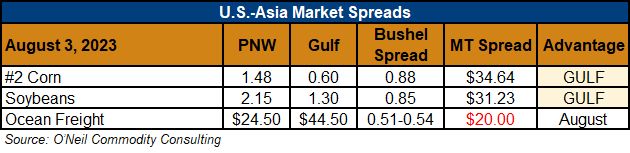

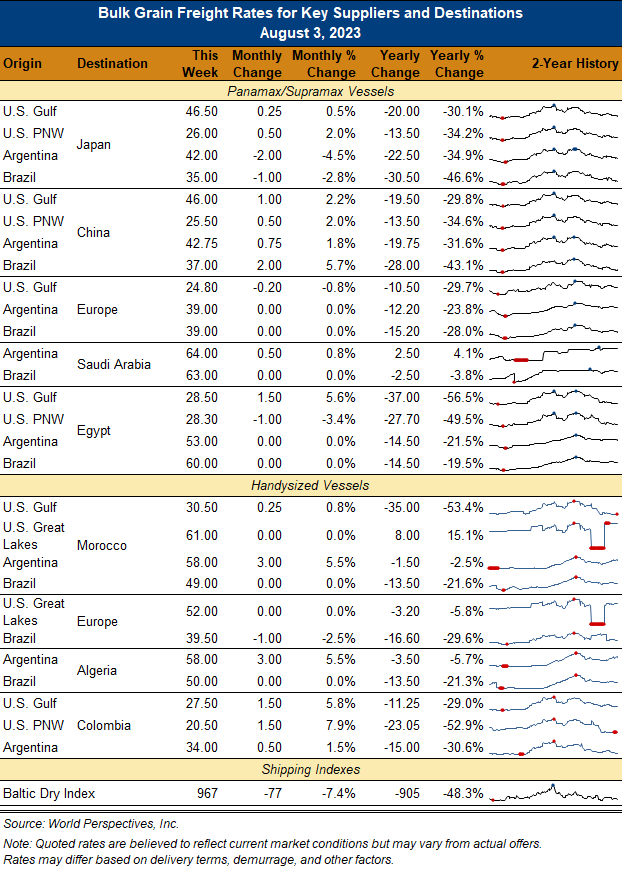

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk ocean freight markets were mixed this week with the Capesize and Panamax sectors getting a bump and the Supramax-Handymax sectors still looking sluggish. Markets were supported by news of a typhoon heading towards China’s ports, increases in the cost of Chinese domestic steel, and China’s port Iron Ore stocks dropping to back to 2020 levels. This provided FFA paper traders with hope that Chinese import demand for raw materials may increase, and with it freight demand. Q3 FFA Panamax markets moved up 2,900 points to $11,500/day while Q4 is trading flat at $11,525/day, and CY 2024 at $10,850/day.

Panama Canal drafts remain restricted due to drought conditions, and the Canadian port strike remains an open issue. The Ukraine Black Sea Grain Corridor remains largely closed by Russia and Ukraine grain export volumes are very questionable.