Ocean Freight Markets and Spreads

Ocean Freight Comments

The Canada Industrial Relations Board ordered the Canadian railroads (Canadian National and Canadian Pacific Kansas City) and the Teamsters Union to resume operations last Thursday. The order came late in the day after the two railroads locked out the Teamsters earlier in the day. The railroads indicated they will appeal the decision to have the union negotiate a new labor contract.

The Houthi terrorist organization continues to disrupt vessel transits through the Red Sea and around the Arabian Peninsula. Because of their actions attacking vessels and threatening crews and cargo, vessel owners and operators are avoiding the Red Sea and Arabian Peninsula. Instead they are using the longer route around the Cape of Good Hope between Asia, Europe and the Mediterranean Sea. Vessel owners and operators are planning to use the longer route indefinitely.

It is late summer across the Northern Hemisphere and low water in various river systems are disrupting inland logistics. The Mississippi River has seen its water levels on the upper reaches fall and could lead to light loadings and slower transits. Barge rates are already surging higher in navigation concerns, improved demand and a relatively small fleet of barges. Conditions in the Rhine River are causing barge operators to light load and restrict barge transits. Not to be left out, an on-going drought across northwest Brazil, Bolivia, Colombia and inland Peru has led to low water conditions. Barge traffic is limited with light loadings and inaccessibility to various reaches of the rivers. This is making it more costly to barge corn to export positions across the Northern Arch.

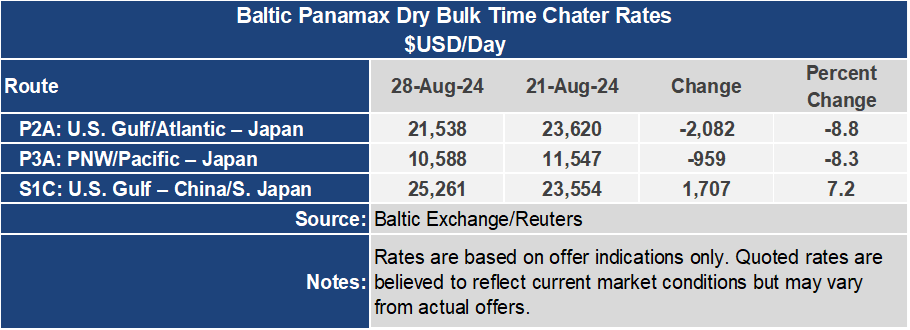

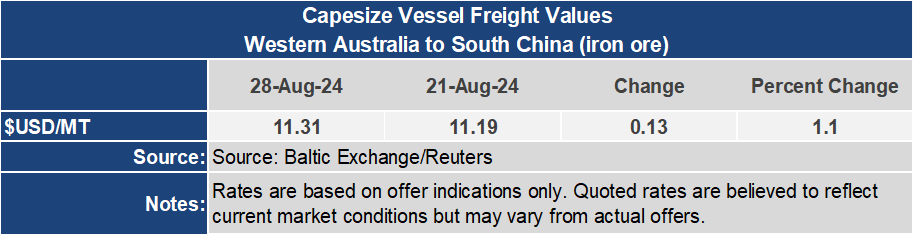

The Baltic Dry Index was mostly unchanged this week, down 4 points to an index of 1,755 and is 60.4% higher than one year ago. The Baltic Capesize Index held the BDI together, gaining 95 points or 3.4% for the week to 2,883 points. BCI is 156.7% higher than it was one year ago. The Baltic Panamax Index pulled the BDI lower, dropping 9.2% for the week to an index of 1,350. The Baltic Supramax Index was nominally higher to 1,316 for the week.

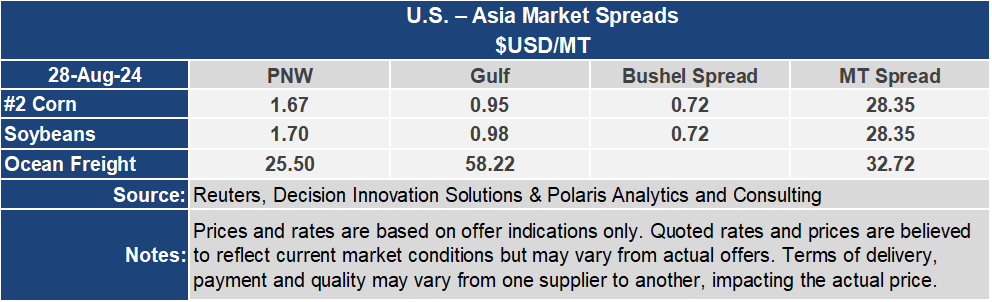

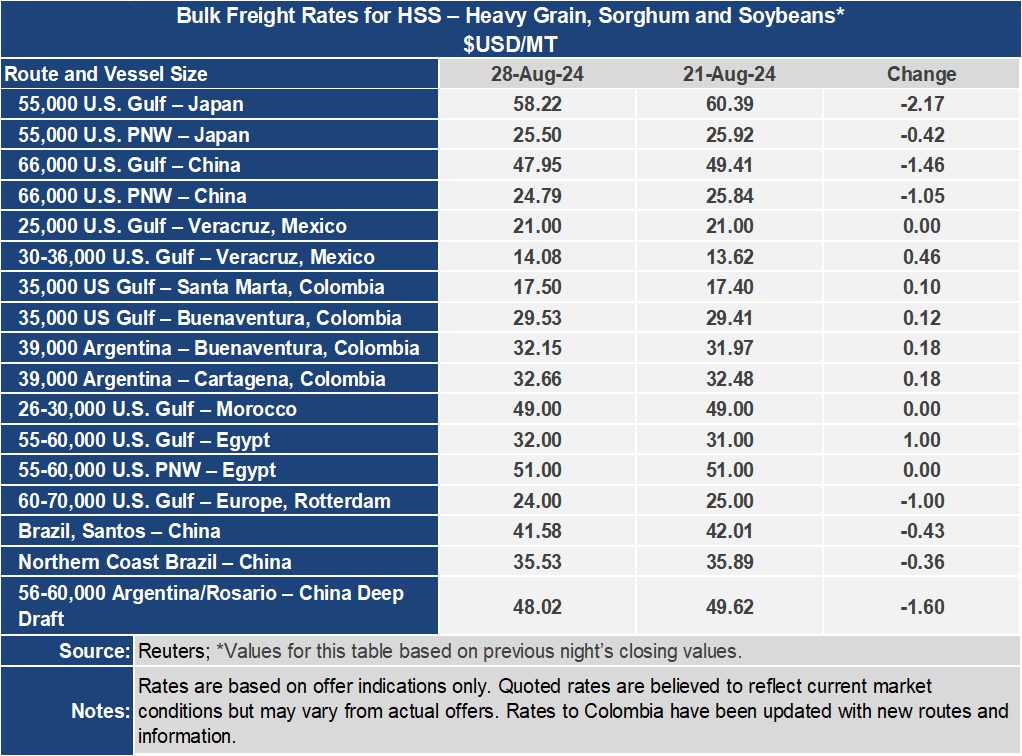

The U.S. Gulf to Japan route lost $2.17 per metric ton or 3.6% for the week to $58.22 per metric ton. This is the first time it has dropped below $60 since early June. From the Pacific Northwest the rate shed 1.6% or $0.42 per metric ton for the week to $25.50 per metric ton. The spread between these key grain routes narrowed 5.1% or $1.75 per metric ton to $32.72 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $47.95 per metric ton for the week, down $1.46 per metric ton or 3.0%. From the PNW the rate was $1.05 per metric ton or 4.1% lower to $24.79 per metric ton this week. The spread on this route narrowed 6.3% or $1.58 per metric ton to $23.16 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.