Chicago Board of Trade Market News

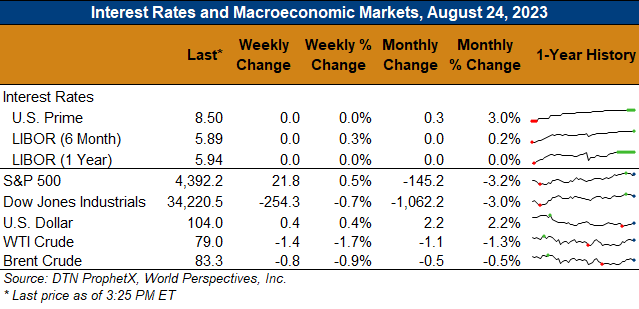

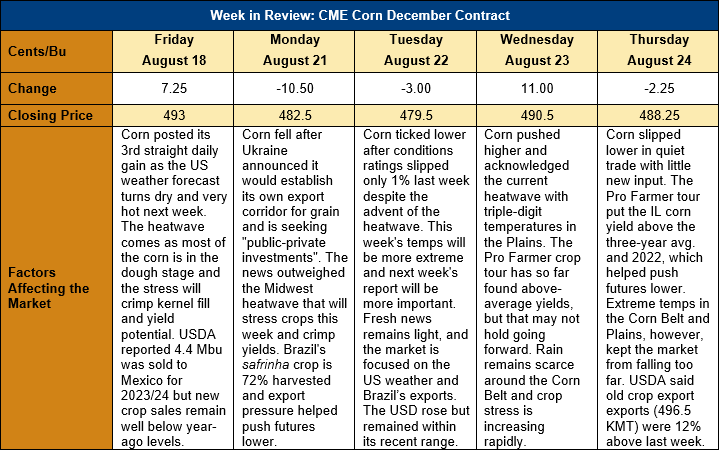

Outlook: Corn futures are 4 ¾ cents (1.0 percent) lower this week after volatile trade developed with little in the way of a fresh direction. Corn markets have found support from this week’s blistering heatwave in the Midwest where extreme temperatures will create crop stress during kernel filling. Conversely, bearish information came from Ukraine’s plans to develop its own “humanitarian corridor” through which grain shipments might proceed along the western edge of the Black Sea. While doubts still exist about the potential for such a corridor to become viable (obtaining insurance remains a hurdle), the idea of Ukraine securing its own export route has pressured grain markets.

The U.S. weather has featured hot, dry conditions for most of the corn-growing region this past week with any rains isolated to the Great Lakes states and parts of the Eastern Corn Belt. The Plains and Western Corn Belt have seen the worst of the extreme temperatures, which were above 37C (100F) this week. Soil moisture reserves are being quickly drained as the corn and soybean crops try to fill ears and pods, respectively. The 3-day forecast offers chances for more rain in the central Plains and Corn Belt, but the 6-8 and 8-14-day forecasts show a return of above-average temperature and dry conditions. Fortunately, the corn crop has passed through most of the key yield-defining stages already. Notably, the Pro Farmer tour has found yields above the respective three-year averages in Ohio, Indiana, Illinois, Nebraska and South Dakota so far.

Conditions ratings for the U.S. 2023 grain crops fell last week with the advent of hot, dry conditions in the center of the country. Corn ratings fell 1 percent to 58 percent good/excellent (G/E) while sorghum ratings declined 3 percent to 51 percent G/E. Barley ratings fell the most of the major grain crops with 49 percent rated G/E, down 5 percentage points from the prior week.

In terms of crop maturity, 78 percent of the corn crop is in the dough stages, in-line with the five-year average while 35 percent has dented (up slightly from the average pace). USDA said 4 percent of the national crop is mature, with Texas and North Carolina leading the nation in maturity development. The U.S. 2023 barley crop is 49 percent harvested through last Sunday, up 21 percentage points from the prior week and slightly below the five-year average pace of 52 percent. Finally, 18 percent of the U.S. sorghum crop is mature as of USDA’s last Crop Progress report, with Texas’ crop making being the most advanced. The U.S.-average figure is slightly behind the five-year average maturity rating of 21 percent. The latest data from USDA show that there are few concerns in terms of crop development stages, though the current heatwave will be a major threat to corn kernel filling.

Technically, December corn is trending sideways in a choppy, volatile range. Long-term bearish trends persist but support near $4.75 has rejected two recent attempts to break below that point. Similarly, Monday’s early rally above $5.00 quickly attracted selling pressure and that point seems to offer increased resistance going forward. Funds are still net short corn futures heading into the harvest, but the recent heatwave has made them more cautious about expanding or carrying that position forward.