Chicago Board of Trade Market News

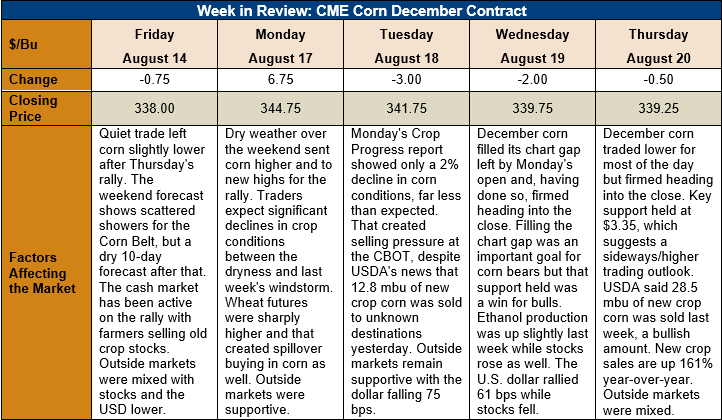

Outlook: December corn futures are up 1.25 cents (0.4 percent) this week as the market walked back to fill an existing chart gap and test new support levels. Concerns about hot/dry weather across the Corn Belt last weekend were assuaged by Monday’ Crop Progress report that showed a modest decline in conditions ratings. New crop corn demand has been robust so far, which has helped keep prices supported.

Monday’s Crop Progress report showed a 2 percent decline in the good/excellent rating for the U.S. corn crop, despite dry weekend weather and drought across parts of the Midwest. Ratings in Iowa fell sharply, however, as the impact of drought in the western part of the state and last week’s derecho hurt conditions. The report continued to show that the crop remains advanced in its maturity, which is helping fend off any impacts of the recent hot/dry weather trend.

Crop tours are making their way across the Midwest this week, and initial yield forecasts have been reassuring. Record high yields have been predicted for South Dakota and forecasts for Illinois, Indiana, and Nebraska are above year-ago levels. Early results from Iowa suggest yields could be down 10-15 bushels/acre this year and the market is awaiting the final state-wide estimate. Of course, USDA’s September projections will be the most influential for determining market direction.

Producers have been aggressive sellers on the recent rally, selling both any lingering old crop stocks as well as making new crop sales. Despite the increase in farm sales, basis has remained largely steady or higher as strong export demand has left exporters and grain elevators needing to buy grain. Cash corn prices are slightly higher this week at $119.50/MT for spot delivery.

The weekly Export Sales report featured net old-crop corn sales of 61,600 MT and net new-crop sales of 0.723 MMT. Weekly exports were down 10 percent from the prior week at 1.197 MMT and were sufficient to put 2019/20 YTD bookings at 44.221 MMT – down 12 percent from the prior year and in-line with USDA’s forecast. Notably, new crop outstanding sales currently total 12.204 MMT, up 161 percent from the prior year.

From a technical standpoint, December futures have been consolidating from last week’s rally. The market pushed to a new high for the move on Monday, gapping higher at the open. For the rest of the week, the market has slowly ground lower as commercials and managed money funds emerged as sellers. The market tested support at $3.35, which held, and moved higher Thursday afternoon, closing above the 100-day moving average. With Iowa yield still uncertain and likely to remain so until the September WASDE, it looks like bears will have a tough time pushing the market below $3.35. Consequently, the outlook is for mostly sideways or higher trade to develop heading into September.