Chicago Board of Trade Market News

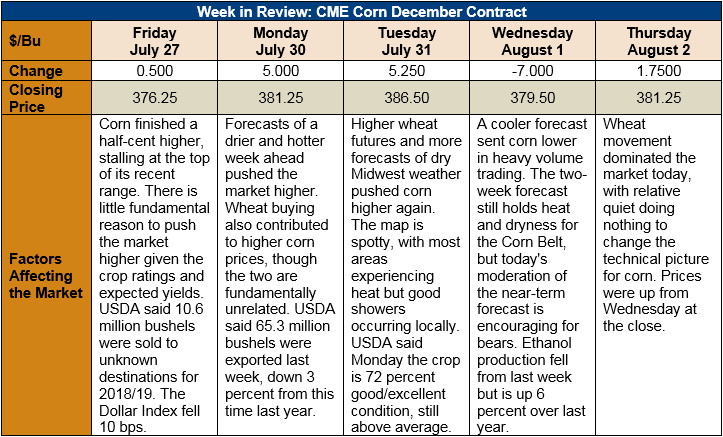

Outlook: December corn futures continue to rally, posting a 1.5 percent gain since last Thursday. Wheat futures have been supportive, providing spillover buying, while U.S. weather forecasts also helped the corn market high. Both influences may be waning, however, especially as the latest weather forecasts include more moisture and modest temperatures for the Corn Belt.

The U.S. corn crop remains in excellent condition with 72 percent rated as good or excellent condition, two percentage points above the five-year average for this time of year. Moreover, 81 percent of the crop is silking (above the five-year average of 62 percent) and doing so under the present cool temperatures will be helpful for yields. The weather forecast turns hotter/drier towards the end of the next two weeks and excessive August heat could still limit the crop’s yield potential. Additionally, reports of spotty conditions around the Corn Belt, with some fields “too dry” and others suffering from mild flooding, will likely reduce the overall yield potential of the U.S. crop as well.

USDA pegged the U.S. corn crop as 72 percent good or excellent condition, up from the five-year average of 69 percent. The crop is one of the best-rated in history and has analysts looking for large yields. Some caution is warranted as conditions ratings often corelate poorly with final yields. Additionally, the spotty weather conditions across the U.S. mean record-breaking yields for multiple states and/or the national average is unlikely as record-breaking yields typically require consistently above-average weather for most of the U.S.

Beyond being in good condition, the corn crop is 8-10 days ahead of its typical maturity. USDA said 91 percent of the corn was silking as of Monday, up from the five-year average of 82 percent. USDA also noted 38 percent of corn is in the dough stage, up from 20 percent on average. There remains uncertainty as to whether the crop’s advance maturity will protect it from any hot/dry August weather or increase any adverse effects. Fortunately, the weather forecast is turning cooler and the crop may be able to avoid the question entirely.

USDA said corn export sales hit 1,624,600 MT last week, bringing YTD bookings (exports plus unshipped sales) to 59,367 MMT, up 5 percent from last year. YTD exports total 50,762.4 MMT. USDA also said sorghum and barley bookings are up 4 percent and 35 percent, respectively.

From a technical standpoint, the December contract is likely to begin a sideways trading pattern between the 40- and 200-day moving averages. The market realizes $3.50 was “too cheap” relative to the fundamentals and adjusted accordingly. As of yet, however, there is no big “story” to justify prices over $3.93 (the 200-day moving average). Funds are paring back corn shorts and adding length to their position – but not aggressively. The corn markets’ near-term direction will likely depend on the August weather forecasts and export performance.