Chicago Board of Trade Market News

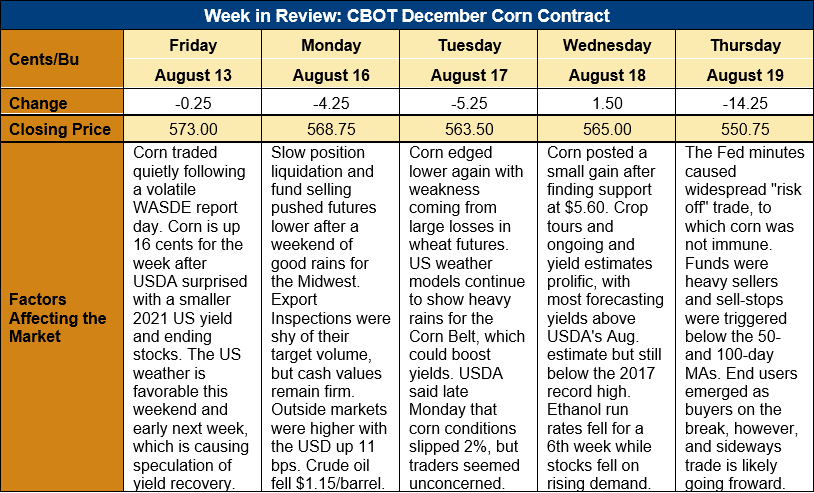

Outlook: December corn futures are 22 ¼ cents (3.9 percent) lower this week after the market gradually retreated following the August WASDE until significant fund selling developed on Thursday. The August WASDE was bullish but the U.S. weather since then has been favorable for yields, and therefore bearish. CBOT corn (and other grain/oilseed markets) held their own until Thursday, when weak technical conditions sparked significant selling from managed money traders. Minutes from the U.S. Federal Reserve’s latest meeting also sparked concerns about the possible impact of rising interest rates on the U.S. economy, which prompted “risk off’ trade on Thursday.

Since last week’s WASDE, there has been little fresh fundamental news, which means the markets have returned to trading the U.S. (and other Northern Hemisphere countries’) weather forecasts. The weather this week has been hotter than normal across the U.S. Plains and Corn Belt but meaningful precipitation fell across the same region. The current 2-week forecasts suggests continued rainfall across the major corn-growing states, with heavy rains for drought-impacted Iowa and Minnesota. Rains will also fall across the Dakotas, but they may be too late to offer much help for the region’s crops.

Despite the favorable shift in the U.S. weather, USDA’s weekly assessment found declining corn conditions. The U.S.-average corn rating was 62 percent good/excellent, down 2 percent from the prior week. The ratings were also down from last year (71 percent) and the five-year average of 66 percent good/excellent. USDA also reported a decline in sorghum conditions due to recent hot weather in the Plains, with the good/excellent rating falling 3 percent from last week to 60 percent. Finally, the barley crop, which has been suffering extreme drought in the northern U.S., was rated just 23 percent good/excellent, down 1 percent from the prior week.

The weekly Export Sales report saw the expected seasonal decline in old crop sales, which totaled 216,000 MT. Old crop exports slipped from the prior week as markets were quiet before the August and totaled 829,000 MT. YTD corn exports are up 59 percent at 65.412 MMT while YTD bookings (exports plus unshipped sales) are also up 59 percent at 70.317 MMT.

New crop (2021/22) corn export sales slipped 15 percent from last week but totaled 510,000 MT. Outstanding new crop export sales total 18.5 MMT, up 62 percent YTD.

From a technical standpoint, December corn futures formed a failed upside breakout above trendline resistance last Thursday, which kept the market on the defensive. On Thursday, weakness in U.S. equity markets and crude oil – due to the Federal Reserve’s new plan to end its asset buying program sooner than expected – sparked broad based selling at the CBOT. Managed money funds liquidated long positions and reduced risk exposure, which pushed December corn below key technical levels, including the 50- and 100-day moving averages. The move below these levels triggered sell-stops that sent the market to its daily lows at $5.46 ½.

Technically, the breach of and settlement below the100-day moving average is bearish, but initial support lies at $5.40 with long-term trendline support below that at $5.32. End-users have proven patient and willing buyers on significant breaks at the CBOT, and market chatter suggests they once again emerged as buyers near Thursday’s lows. With end-user buying, technical support nearby, and plenty of uncertainty on the U.S. yield outlook, a sustained selloff in corn futures seems improbable and range-bound, sideways trade is more likely to develop.