Ocean Freight Comments

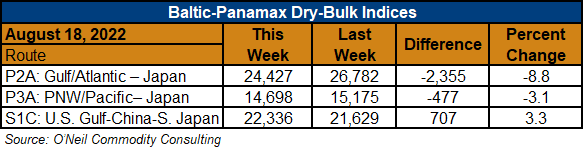

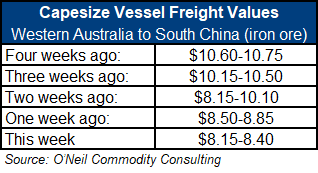

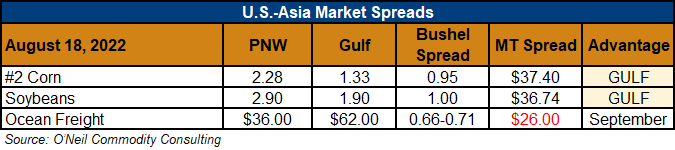

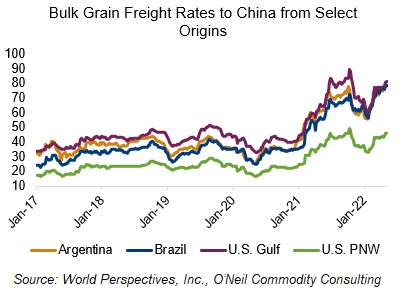

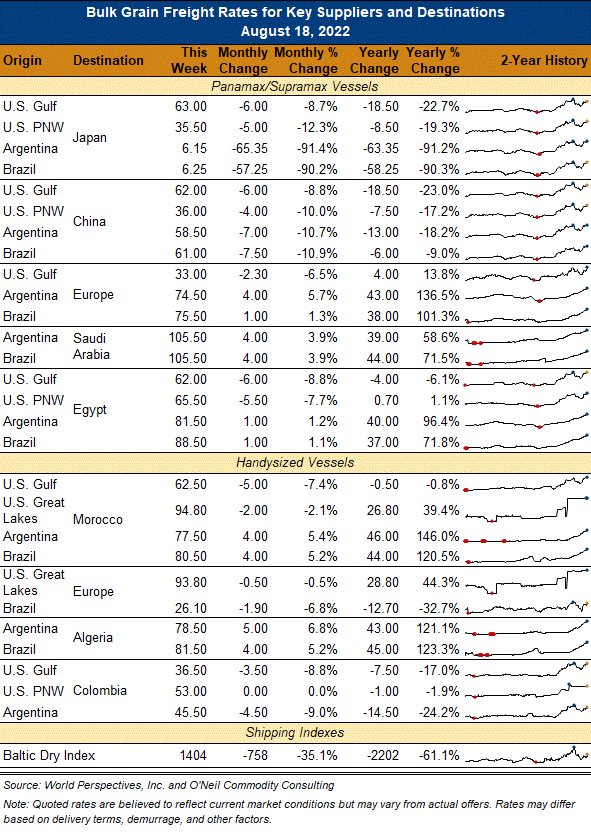

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was another rough week for vessel owners. Freight markets have been very concerned over the outlook for the Chinese economy and this has greatly contributed to the recent selloff. The Capesize sector has been particularly hard hit with nearby Pacific daily hire rates below $10,000/day and now below operating cost. The Q4 Panamax index is at its lowest level since 2011. So, the question remains; have we hit the bottom yet? Will the Chinese government stimulus program provide for better imports of coal, iron ore and minor bulks? It is hard to believe freight markets can retreat much further.

Container markets continue to show better availability of empty containers for reload. Grain exports by container have jumped more than 50 percent over the last month.

The ILWU-West Coast Port labor contract negotiations continue as the big issue of port automation remains unresolved. Moreover, the market may be just 30 days away from a rail strike in the western U.S. if negotiations do not improve by September 16, which is the last day of the cooling-off period. The union wants a pay raise of 31 percent over 5 years, but railroads are offering a 17 percent pay hike. Maybe they will meet in the middle?