Chicago Board of Trade Market News

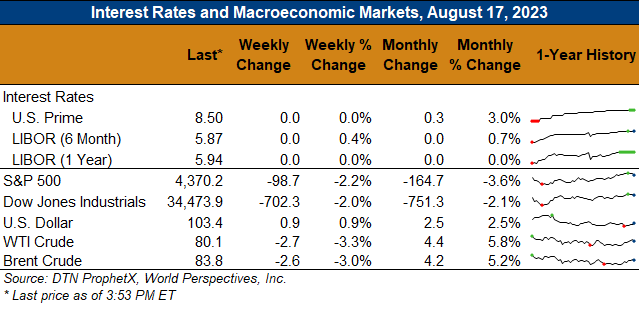

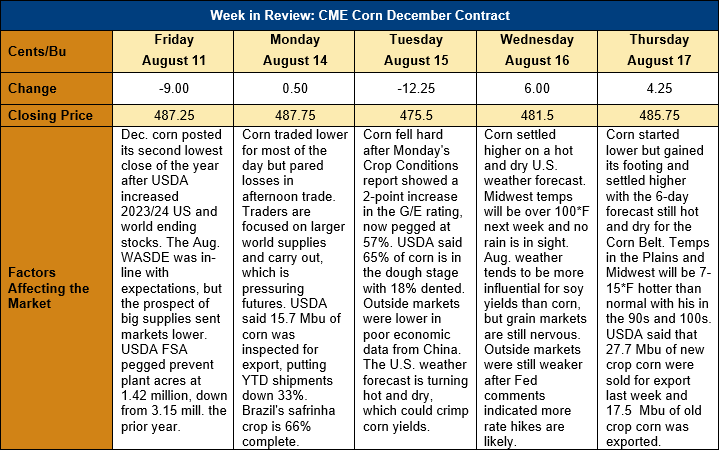

Outlook: Corn futures are 1 ½ cents (0.3 percent) lower this week after the market drifted lower and then sideways following the August WASDE report. The report was in-line with pre-report expectations and helped reassure traders and analysts of this year’s corn yield potential, despite early season dryness. With increases in U.S. and world corn ending stocks for 2023/24 futures dropped below $4.90 but a recent, threatening shift in the U.S. weather is supporting values once again.

The major headlines from the August WASDE were the yield forecast (10.99 MT/ha or 175.1 BPA) and production estimates (383.84 MMT or 15.111 billion bushels), both of which were down from the July report but in-line with analysts’ expectations. USDA increased ending stocks for the 2022/23 marketing year, which helped offset some of the month-over-month production cuts and left total 2023/24 U.S. supplies down 0.9 percent from July but up 9.6 percent from 2022/24.

USDA made a few revisions to the demand side of the U.S. balance sheet and lowered fed and residual use based on the smaller crop and cut food and industrial use 0.3 percent on lower food use. Exports were lowered 1.27 MMT (50 million bushels), which meant that total use fell 0.7 percent from the July estimates but is up 5.2 percent from 2022/23. New crop (2023/24) ending stocks were forecast at 53.93 MMT (2.202 billion bushels), which implied a 15.3 percent ending stocks-to-use ratio. USDA raised its forecast of the U.S. average farm price to $192.90/MT ($4.90/bushel).

Outside the U.S., the Brazilian 2022/23 corn crop was raised 2 MMT to 135 MMT based on higher yields, but exports were left unchanged at 56 MMT. For the 2023/24 South American crops, USDA left the production estimates for Brazil, Argentina, and Paraguay unchanged at 129 MMT, 54 MMT, and 4.7 MMT, respectively. USDA lowered production estimates for the EU (down 3.7 MMT to 59.7 MMT) due to area and yield reductions due to poor weather in Germany, Romania, Hungary, and Italy. USDA also lowered its forecast of Chinese and Russian wheat while increasing Ukraine’s corn crop forecast 2.5 MMT to 27.5 MMT. In total, world 2023/24 production was revied 10.9 MMT lower to 1,213 MMT, which when combined with reductions in feed use and total trade, left ending stocks down 3.07 MMT at 311.05 from the July forecast but up 4.4 percent from the prior year.

After bleak conditions in early July, the U.S. weather forecast turned very favorable for the corn and soybean crops in late July and early August. That forecast, however, has changed again with the current two-week outlook featuring very hot temperatures for the Plains and Midwest with limited rain in the coming week. The forecast has revived concerns about yield potential in U.S. crops, though August conditions are typically more influential for soybeans than corn. The hot, dry outlook is a major reason why December corn futures have started to edge back towards the $4.90-5.00 level this week.

U.S. grain crop conditions ratings moved in different directions last week with corn and barley benefiting from more favorable weather while sorghum struggled. The good/excellent (G/E) rating for the U.S. sorghum crop fell 3 percentage points last week to 54 percent, which is well above last year’s poor rating and 2 points above the five-year average. Barley’s G/E ratings rose 4 percentage points last week to 54 percent while the corn rating rose 2 percentage points to 59 percent G/E. Also of note is the fact that the U.S. corn crop is advancing in-line with its normal pace with 65 percent of the crop in the dough stage while 18 percent is dented. Both figures are in-line with the five-year average and show little concern for the crop’s overall development. The next two weeks’ reports will be closely watched to see what, if any, impact the coming dry weather will make.