Ocean Freight Markets and Spreads

Ocean Freight Comments

The Canadian railroads (Canadian National and Canadian Pacific Kansas City) and the teamsters union were issued a 13-day cooling off period last Friday by the National Labor Tribunal. The two railroads immediately responded they are prepared to lock out the Teamsters on August 22. The union has said it would give 72 hours of advanced notice before it strikes. The railroads and the union have been at an impasse in their contract negotiations. While the lock out or labor strike directly impacts rail movements in Canada, it will be impact traffic flows with the U.S. The domino effect will filter through the system. Unless a work stoppage continues for an extended period U.S. grain exports will not be greatly impacted. Movements of railed grain mostly move to the Pacific Northwest on the BNSF and Union Pacific railroads. Containerized grain exports move on intermodal trains to Southern California, the Pacific Northwest and U.S. East Coast.

The International Longshore Association contract with shippers, ports, terminals and others through the U.S. Maritime Alliance expires at midnight on September 30, 2024. The contract extends along the U.S. East Coast and Gulf Coast ports that includes 36 ports. Negotiations have stalled with no discussions since at least June. The ILA issued a 60-day notice to strike. The ILA opposes forced work speedup, increased working hours, a decline in safety measures and automation, while demanding higher wages and improved benefits. The impact will directly impact container terminals and vessels, liner service and certain other vessels. The impact on grain exports through the Center Gulf will be minimal since non-union labor is used to load vessels. There is a concern that the West Coast International Longshore and Warehouse Union in solidarity will initiate work slowdowns, sickouts or labor action. Action by the ILWU could impact grain exports through the West Coast.

The U.S. led alliance in the Red Sea and around the Arabian Sea continues to strike down Houthi drones and vessels. The terrorist led organization claims it fired upon on container ship and two U.S. destroyers this week, there were no reported hits or damage. Container vessel owners and operators continue to avoid transiting the Red Sea with a couple carriers announcing this week they do so through the end of calendar year 2024.

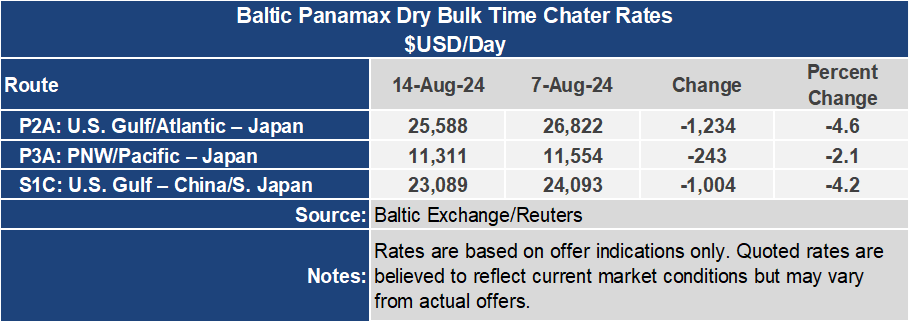

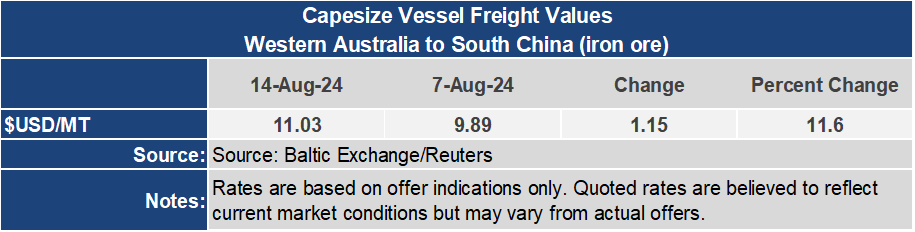

The Baltic Dry Index firmed nearly 2% for the week to an index of 1,728, which is 30 points higher for the week. The Baltic Capesize Index exerted itself as the market leader, gaining 7.2% or 177 points for the week to 2,650 points. The smaller vessel classes continue to soften with the Baltic Panamax down 5.5% or 91 points to an index of 1,560 and the Baltic Supramax Index down nearly 1% or 12 points to an index of 1,297 for the week. The smaller vessel classes are languishing trying to find cargo for the number of vessels looking. With the U.S. about six weeks away from its peak harvest window and Brazil selling slow, demand for vessels has been muted.

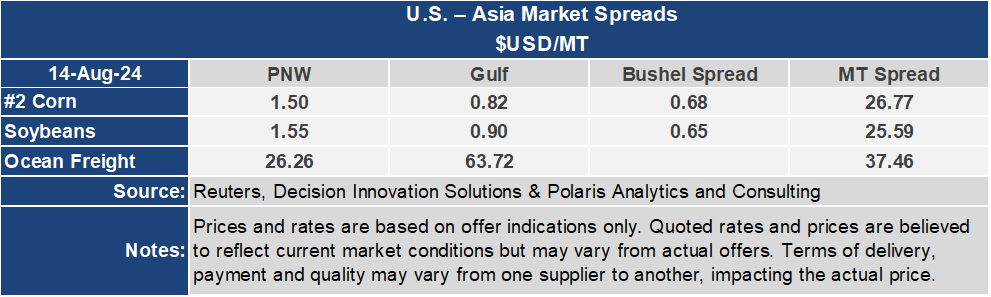

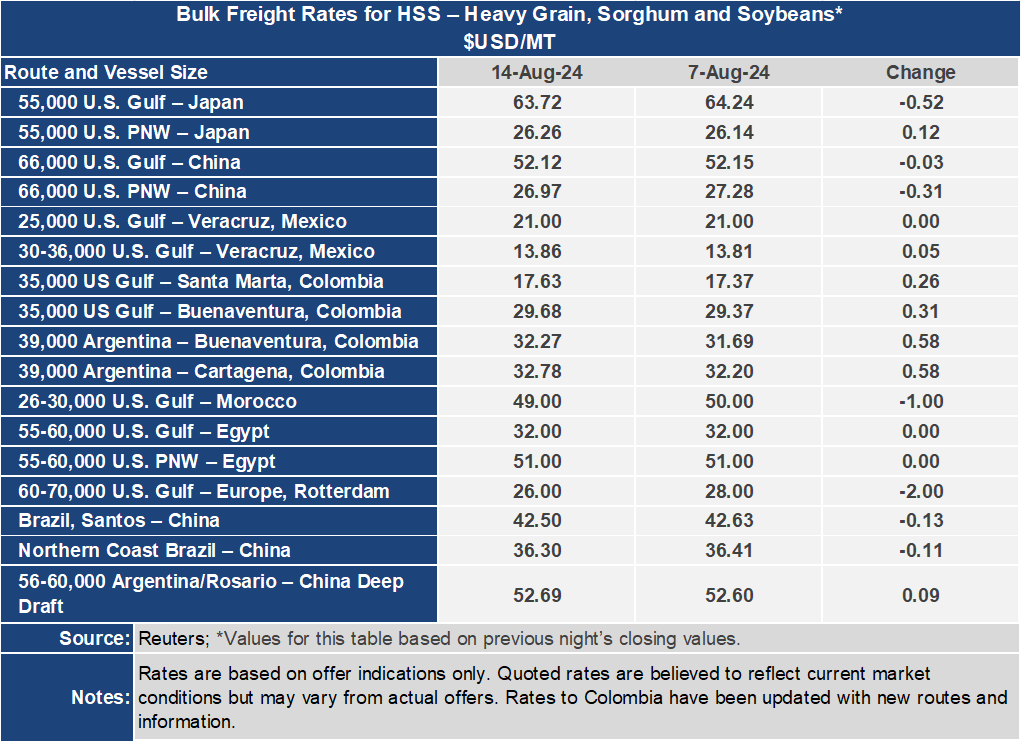

The U.S. Gulf to Japan route was lower this week, down $0.52 per metric ton to $63.72 per metric ton. From the Pacific Northwest the rate was $0.12 per metric ton higher at $26.26 per metric ton. The spread between these venerable routes narrowed $0.645 per metric ton to $37.46 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $52.12 per metric ton for the week, down slightly on the week. From the PNW the rate shed $0.31 per metric ton to $26.97 per metric ton. The spread on this route widened $02.8 per metric ton to $25.15 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.