Chicago Board of Trade Market News

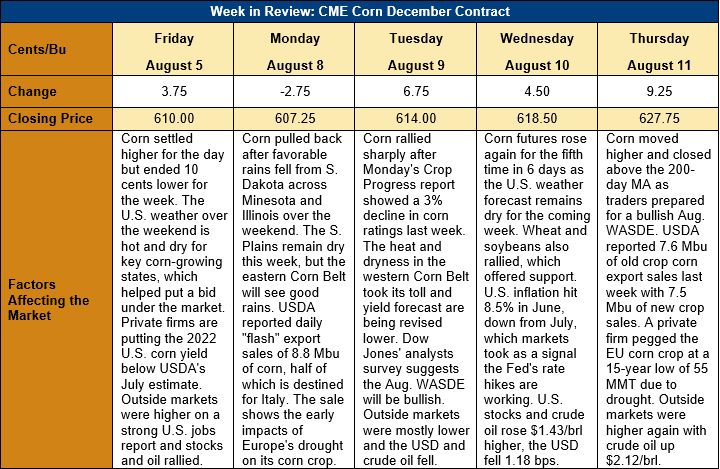

Outlook: December corn futures are up 17 ¾ cents (2.9 percent) this week as a surprise decrease in crop conditions ratings and expectations for a bullish WASDE supported values. Corn futures posted their sixth higher day of the past seven trading days on Thursday as traders finished the final adjustments before USDA’s August WASDE report that will be issued on 12 August. Fresh fundamental news remains light and analysts are increasingly focused on the hot, dry weather in the U.S. southern Plains and Europe that could disrupt corn yield potential in both regions.

The monthly pre-WASDE survey of grain industry analysts shows broad expectations for USDA to cut the U.S. corn yield forecast in the coming report. The average pre-report estimate put the 2022 corn yield at to 11.04 MT/ha (175.8 BPA), which would be 0.7 percent below the July estimate. Analysts are looking for total corn production of 365.347 MMT (14.383 Bbu), which would be 4.8 percent below the 2021 crop. Expectations are for modest increases in 2022/23 corn use, which is forecast to pare ending stocks for the coming year to 35.13 MMT (1.383 Bbu). That ending stocks level would be below both USDA’s July estimate of the 2022/23 crop and the latest estimates of the 2021/22 crop.

The heat and dry conditions that blanketed much of the Midwest in the past two weeks took a mild toll on the U.S. corn conditions ratings. On Monday afternoon, USDA said 58 percent of the crop was rated good/excellent, down 3 percent from the prior week and below the 5-year average of 65 percent. Most of the crop has passed through pollination (90 percent of the crop is silking) and 45 percent has entered the dough stage. Corn in the southern U.S. is entering the final stages of maturity with 6 percent having entered the dent stage.

U.S. old crop corn export sales rose 231 percent last week to 0.191 MMT while exports fell 31 percent to 0.705 MMT. The latest data puts YTD bookings at 60.85 MMT, just even with USDA’s July WASDE projections. YTD exports lag USDA’s forecast by 6 percent with three weeks left in the marketing year. If this week’s export pace continues, however, the final export total will be very close to USDA’s expected 61-MMT export program. Notably, new crop export sales fell 25 percent from the prior week at 139,000 MT, which puts outstanding sales for the 2022/23 marketing year at 8.048 MMT, which is down from last year but in-line with the five-year average.

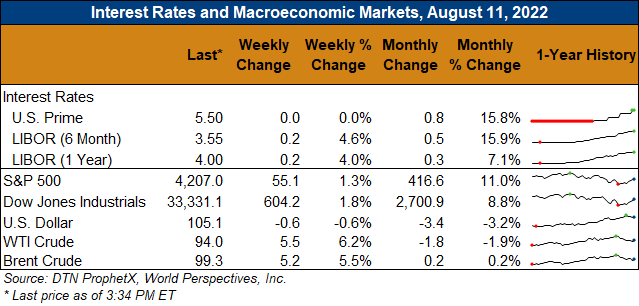

From a technical standpoint, December corn futures are rebounding from what could be a seasonal low set during late July. The contract has climbed 60 cents from its late-July lows and overcome psychological resistance at the $6.00 market as well as the 200-day moving average. Trading volume has been consistently above average on the recent rally, which is often a signal of an emerging bullish trend. Should USDA’s August WASDE prove to be on the bullish side, the next upside target for December corn futures would be the 50-day moving average ($6.40 ¾), followed by the 100-day moving average at $6.80 ¼.