Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values are steady to $3/MT lower this week amid quiet trade and weaker corn and soymeal values. Soymeal futures and cash basis levels have weakened this week and limited upside potential in the DDGS market. Doemstic end users have reportedly booked most of their near term needs and are waiting before moving on deferred positions.

The FOB ethanol plant DDGS/cash corn price ratio fell to 1.07 this week, up from 1.06 last week and above the three-year average of 1.06. The DDGS/Kansas City soymeal ratio rose this week and hit 0.54, up from last week’s value of 0.53 and still above the five-year average of 0.50.

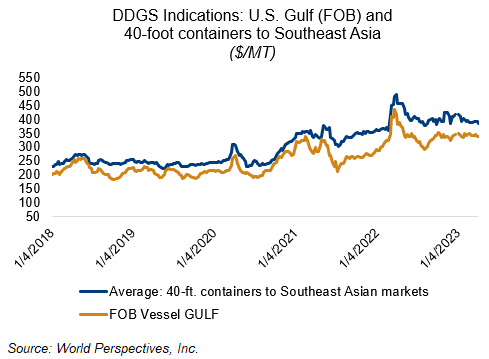

Brokers report that supply pipelines to the river and export markets remain “stretched” this week with slower barge movement. Barge CIF NOLA offers are $7-8/MT higher for Q2 positions – erasing all of last week’s losses – as the market works to pull additional product down to the Gulf. FOB NOLA offers are $2/MT higher for April shipment and $2-3/MT lower for May/June shipment with spot offers averaging $340/MT. Offers for 40-foot containers to Southeast Asia are $4-5/MT lower for Q2 shipment despite this week’s uptick in ocean freight rates.