Chicago Board of Trade Market News

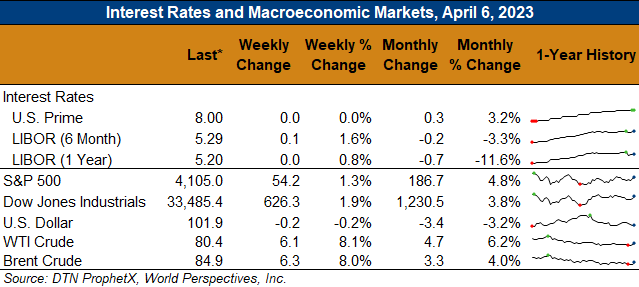

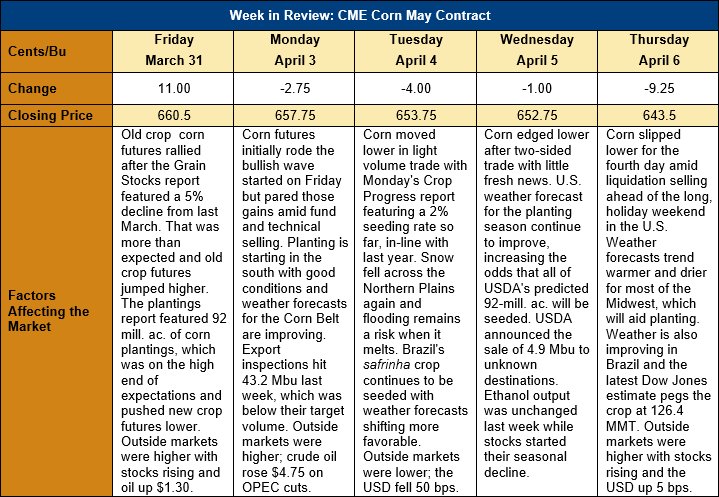

Outlook: May corn futures are 17 cents (2.6 percent) lower this week under mixed influences from a bullish Grain Stocks report but a bearish planting outlook and increasingly favorable U.S. weather forecast. Futures rallied heading into last Friday’s fundamental reports with China’s eager buying buoying markets but have since moved lower under pressure from technical selling and an improved U.S. Corn Belt weather forecast.

The March Grain Stocks report from USDA was bullish corn and with inventories of 187.98 MMT (7.401 million bushels, which was down 5 percent from the prior year and below pre-report expectations. The volume of off-farm stocks was down 10 percent from March 2022, which indicates commercials may have to increase basis bids to originate what’s left of the 2022/23 crop. The stocks report implied December-February corn disappearance of 86.873 MMT (3.42 billion bushels), which was down slightly from the prior year but above expectations.

Also of note is the fact that sorghum stocks fell 47 percent from March 2022 and totaled 2.763 MMT (108.78 million bushels) with off-farm inventories falling to just half of year-ago levels. Barley stocks were up 22 percent from 2022 at 1.93 MMT (88.725 million bushels) and oat stocks were steady with year-ago levels at 660 KMT (42.925 million bushels).

While the Grain Stocks report was bullish old crop futures, the Prospective Plantings report had the opposite implication for new crop markets. USDA’s survey of farmers revealed that they intend to seed 37.232 million hectares (92 million acres) to corn this year. That would be up 3.9 percent from the final planting estimate for the 2022 crop of 35.848 million hectares (88.58 million acres). The agency’s estimate was on the high side of pre-report expectations, which helped elicit a bearish reaction from new crop futures.

The biggest expected corn acreage change is in North Dakota, which is set to expand corn plantings by 323,000 hectares (800,000 acres), followed by Minnesota (adding 141,000 hectares of 350,000 acres) and Indiana (up 101,000 hectares or 250,000 acres). The only major producing state to see corn acres fall from 2022 is Nebraska, where area seeded could fall 40,500 hectares (100,000 acres). Of course, the final planted area will depend on spring planting conditions with cool, wet weather often prompting producers to switch some acres to soybeans, but for now, the 2023 U.S. corn crop looks set to increase substantially on larger planted area.

U.S. corn exports continue to see their seasonal increase with 1.377 MMT of gross sales booked last week (up 20 percent) and exports rising 70 percent to 1.136 MMT. YTD exports now total 20.379 MMT (down 40 percent) while YTD bookings (exports plus unshipped sales) stand at 37.211 MMT (down 32 percent). With roughly six months left in the 2022/23 marketing year, corn bookings now account for 79.2 percent of USDA’s projected export forecast.

From a technical perspective, May corn is pulling back from post-Grain Stocks report highs recorded on Monday. Profit taking and some producer/commercial selling has helped push futures lower, as has a shift for a more favorable weather outlook for the U.S. planting season. Recent weather predictions shifted away from a cooler, wetter pattern initially forecast for the Northern Plains, Upper Midwest, and Western Corn Belt. Now, model runs predict warmer than average temperatures, although moisture will be above average as well. There are some flood concerns for the Northern Plains as recent heavy snowfalls melt, but the central Corn Belt looks to enter planting season with nearly ideal weather. While the improved weather outlook could keep new crop rallies contained, tighter old crop stocks and the seasonal increase in U.S. exports should support old crop futures after this technical pullback ends.